Source: PaxForex Premium Analytics Portal, Fundamental Insight

If you cast even a fleeting glance at Walmart, you will see that the current company is more or less the same as Walmart of yore. The stores are still huge warehouses, offering just about anything you might need at any given time, and their prices are usually lower than the competition. It's the formula that made the brick-and-mortar retailer the giant it is today.

However, if you look at the company more closely and with a philosophical eye, you will see that Walmart is not just evolving as a seller of low-cost goods. The company's latest initiatives look at how people think, shop, and live, with the ultimate goal of establishing a deeper relationship with consumers. In five years, Walmart will complete its quest to become something of a "lifestyle brand."

Given the next five years, is Walmart stock worth buying now?

Being a lifestyle brand is not a term often thrown around, but you may be more familiar with the concept than you think.

For example, Amazon is a prime example of a lifestyle brand. Its customers love that their favorite place to shop online integrates with the smart speaker in their room and that the free shipping offered by Prime subscriptions also includes access to an on-demand video package. Grocery items are also quickly becoming an important part of the mix. Amazon shoppers love how easy it is to use any of the company's services while supporting causes they believe in.

Other lifestyle-oriented brands include Ikea, Apple, and, to a lesser extent, Nike. All three companies make products that not only meet customers' basic needs but also fit seamlessly into their lives and lifestyles.

But what about Walmart?

Of course, it is not able to recreate the kind of brand love that a company like Apple has. But in areas where it can cultivate deeper relationships, it succeeds.

Take health care, for example: For years, the company was content with just a pharmacy. Now Walmart operates about a dozen conventional medical clinics not directly affiliated with any of its stores. It also acts as an agent for Medicare health insurance.

Health care may be an unusual field for a retailer. But given the current situation, Walmart's move is a smart one. Health care has become not only overly complicated but also overly expensive. Walmart is helping in both ways by running its new clinics and insurance chains just as much as it is running its stores.

The world's largest retailer is also responding to the ongoing consumer expectations shaped by the temporary COVID-19 pandemic by launching Walmart+ last September.

Walmart+ is the company's answer to Amazon Prime. For a monthly fee of $12.95, or $98 a year, members enjoy similar amenities, such as unlimited free shipping for online orders, use of the quick Scan & Go app when shopping in-store, and discounts on fuel at partnered gas stations.

It doesn't quite match Amazon Prime; noticeably absent is a huge library of on-demand videos. Still, free shipping - often from a nearby store - resonates with busy consumers who may not have time to shop at Walmart. According to a recent PYMNTS consumer survey, just over 60 million U.S. consumers are Walmart+ subscribers. That's still far less than the 200 million Prime users worldwide. Keep in mind, however, that Walmart+ has only been around for a few months, while Prime has been around for several years.

Among other nice little things to boost business, Walmart shoppers are surprised to find high-end alcoholic beverages, a genuine interest in supporting and expanding the number of third-party sellers on Walmart.com, and an experiment with home installation services. The company is even trying its hand at creating self-driving cars. None of these ideas would have even been considered just a few years ago.

However, not all of Walmart's attempts to become a lifestyle-oriented company end well. For example, the retailer acquired online women's clothing store ModCloth in 2017 and got rid of it in 2019. This digital-based brand never had much success in stores and even struggled online with some of its customers because it was owned by a mega-retailer.

However, all of these initiatives seem to be working rather than not, positioning the company as something it has never been before - a retailer that is more than just a place to buy basic necessities. It is a brand that now offers access to higher-end consumer goods.

It's hard to imagine that any of these unlikely moves is a huge growth factor. But they are, and that's one reason why long-term investors can count on the more sustainable progress of the world's largest retailer. It will take another five years for all this work to fully manifest itself.

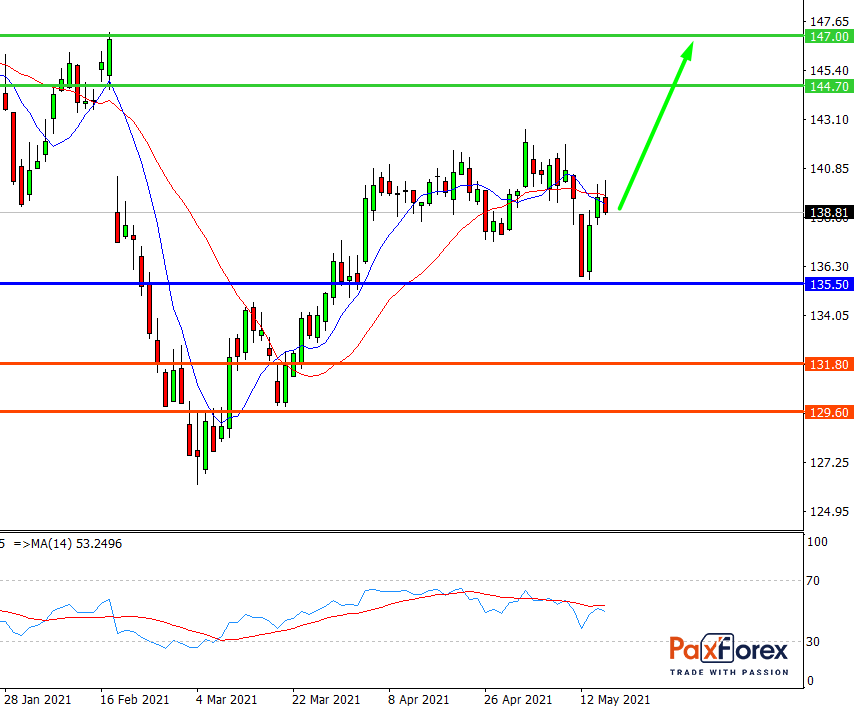

While the price is above 135.50, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 139.00

- Take Profit 1: 144.70

- Take Profit 2: 147.00

Alternative scenario:

If the level 135.50 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 135.50

- Take Profit 1: 131.80

- Take Profit 2: 129.60