Source: PaxForex Premium Analytics Portal, Fundamental Insight

For decades, Amazon has invested heavily in its growth, evolving from a small book retailer into the global store it is today. Several large retailers that no longer exist today can partly blame Amazon for their failure.

Walmart, however, does not take Amazon lightly. The largest retailer in the world, judging by its annual sales volume, is adjusting to Amazon's attempts to encroach on its business. In fact, Walmart is taking some of the techniques from Amazon's arsenal. Next, we'll talk about how Walmart is fighting back.

One of the biggest changes Walmart is making begins with capital investment. Back in 2015, Walmart was spending 60% of its capital investment budget on new stores. Walmart is now within 10 miles of 90% of America's population. Now Walmart is shifting its investment spending to process improvements and efficiencies.

And much of that spending will go into the supply chain. Walmart's e-commerce business is about twice as big today as it was a year ago. To support this growth, the company is building fulfillment centers equipped with the latest technology. Greater efficiency can increase profits in the long run as the company finds ways to automate where it can and increase worker productivity in jobs that can't be automated. In a sense, Walmart may have a secondary advantage here, as it learns from Amazon what works and what doesn't.

In the fiscal year 2021, which ended in January of this year, Walmart's revenue grew 7% to $559.2 billion. Comparable-store sales were up 8.6% at Walmart U.S., with e-commerce up 79% and Sam's Club up 11.8%. Walmart International sales, which are not reported on a comparable-store basis, were up 1%, with Mexico, Canada, and Flipkart accounting for most of the growth.

Adjusted earnings per share rose 11% and free cash flow (FCF) rose 77% to $25.8 billion, with the company spending $8.7 billion of that amount on stock repurchases and dividends.

In the first quarter of fiscal 2022, Walmart's revenue grew 3% year over year to $138.3 billion. Walmart U.S. sales were up 6%, with e-commerce up 37% and Sam's Club sales up 7.2%. International sales were down 8%, mostly due to several divestitures. Adjusted earnings per share were up 43%.

Analysts expect Walmart's full-year revenue to decline 1% amid tough comparisons to the previous year due to the pandemic. But they do expect adjusted earnings -- thanks to buybacks -- to grow 9%.

Another area in which Walmart is adopting Amazon's expertise is food delivery. Walmart has its eye on this service and considers it an important part of its customer service. Certainly, Walmart's physical presence near 90% of America's population makes grocery delivery an area in which the company can compete and have a good chance of maintaining market share.

Most interestingly, Walmart believes it can become an industry leader in an area currently dominated by Amazon. Last year, sales of third-party products on Walmart's site tripled in a few quarters. Given the amount of traffic Walmart attracts to its site, the company believes it is in a natural position to lead the market. If it succeeds in pulling off the coup, it will have a miraculous effect on Walmart's profit margins.

Walmart has announced that it is increasing capital spending by 40 percent to $14 billion from $10 billion the previous year. However, this is nothing compared to the more than $45 billion Amazon has spent in the past 12 months. It is important to note, however, that Walmart's spending will be more focused on retail. Meanwhile, Amazon has many categories in which it is investing, including but not limited to, retail, media content, and cloud services.

One could argue that since Amazon's web services segment generates the bulk of its operating income, that's where Amazon has focused its efforts. It may well be that Walmart's focus means that it does not need to spend as much money to create a protective moat around its business. Whatever the case, however, the battle between these two industry giants will be interesting for investors to follow.

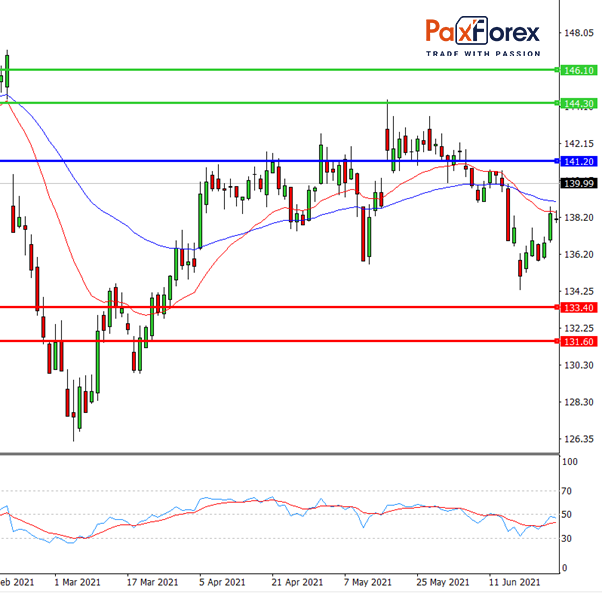

While the price is below 141.2, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 138.53

- Take Profit 1: 133.40

- Take Profit 2: 131.60

Alternative scenario:

If the level 141.2 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 141.2

- Take Profit 1: 144.3

- Take Profit 2: 146.1