Source: PaxForex Premium Analytics Portal, Fundamental Insight

The South African Trade Balance for November was reported at $36.72B. Economists predicted a figure of $23.00B. Forex traders can compare this to the South African Trade Balance for October, reported at $34.94B. The US Dallas Fed Manufacturing Index for December was reported at 9.7. Forex traders can compare this to the US Dallas Fed Manufacturing Index for November, reported at 12.0. The US S&P/Case-Shiller Composite 20 for October is predicted to increase by 1.00% monthly and by 6.90% annualized. Forex traders can compare this to the US S&P/Case-Shiller Composite 20 for September, which increased by 1.30% monthly and 6.60% annualized.

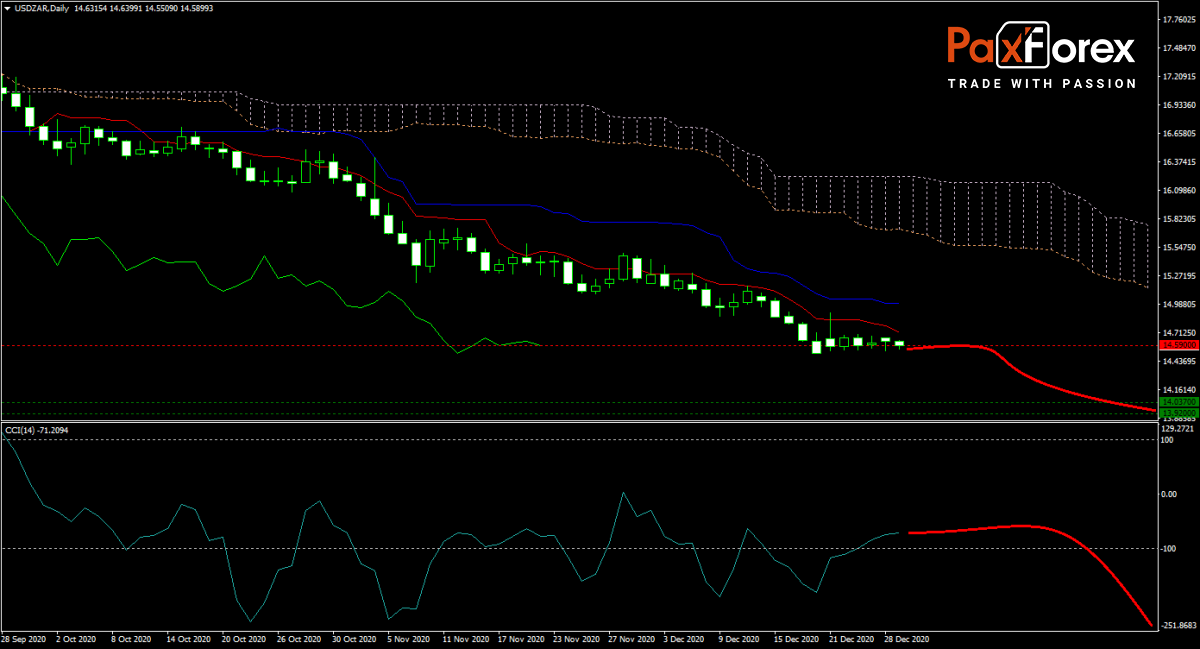

The forecast for the USD/ZAR remains bearish with price action below its descending Tenkan-sen and Kijun-sen. Adding to long-term downside pressures is the descending Ichimoku Kinko Hyo Cloud. The CCI moved out of extreme oversold conditions, but give the selling pressure resulting from US Dollar weakness, more downside is possible. The Covid-19 pandemic keeps the global economy depressed, but South Africa is using it to slowly pass growth reforms. Will bears continue to drive the USD/ZAR towards its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/ZAR remain inside the or breakdown below the 14.5090 to 14.7120 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 14.5900

- Take Profit Zone: 13.9200 – 14.0370

- Stop Loss Level: 14.8360

Should price action for the USD/ZAR breakout above 14.7120 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 14.8360

- Take Profit Zone: 15.0000 – 15.1630

- Stop Loss Level: 14.7120

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.