Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Singapore Trade Balance for September was reported at $3.100B. Forex traders can compare this to the Singapore Balance for August, reported at $5.800B. Non-Oil Exports for September decreased by 11.3% monthly and increased by 5.9% annualized. Economists predicted a decrease of 3.0% and an increase of 10.8%. Forex traders can compare this to Non-Oil Exports for August, which increased by 10.5% monthly and by 7.7% annualized.

US Advanced Retail Sales for September are predicted to increase by 0.7% monthly, and Core Retail Sales are predicted to increase by 0.5% monthly. Forex traders can compare this to US Advanced Retail Sales for August, which increased by 0.6% monthly, and to Core Retail Sales, which increased by 0.7% monthly. Retail Sales in the Control Group are predicted to increase by 0.2% monthly. Forex traders can compare this to Retail Sales Control Group, which decreased by 0.1% monthly.

US Industrial Production for September is predicted to increase by 0.5% monthly, and Manufacturing Production is predicted to increase by 0.7% monthly. Forex traders can compare this to US Industrial Production for August, which increased by 0.4% monthly, and to Manufacturing Production, which increased by 1.0% monthly. Capacity Utilization for September is predicted at 71.9%. Forex traders can compare this to Capacity Utilization for August, reported at 71.4%.

US Business Inventories for August are predicted to increase by 0.4% monthly. Forex traders can compare this to US Business Inventories for July, which increased by 0.1% monthly. Preliminary US Michigan Consumer Sentiment for October is predicted at 80.5. Forex traders can compare this to US Michigan Consumer Confidence for September, reported at 80.4. Preliminary Current Conditions for October are expected at 88.5, and Preliminary Expectations are predicted at 76.5. Forex traders can compare this to Current Conditions for September, reported at 87.8, and to Expectations, reported at 75.6.

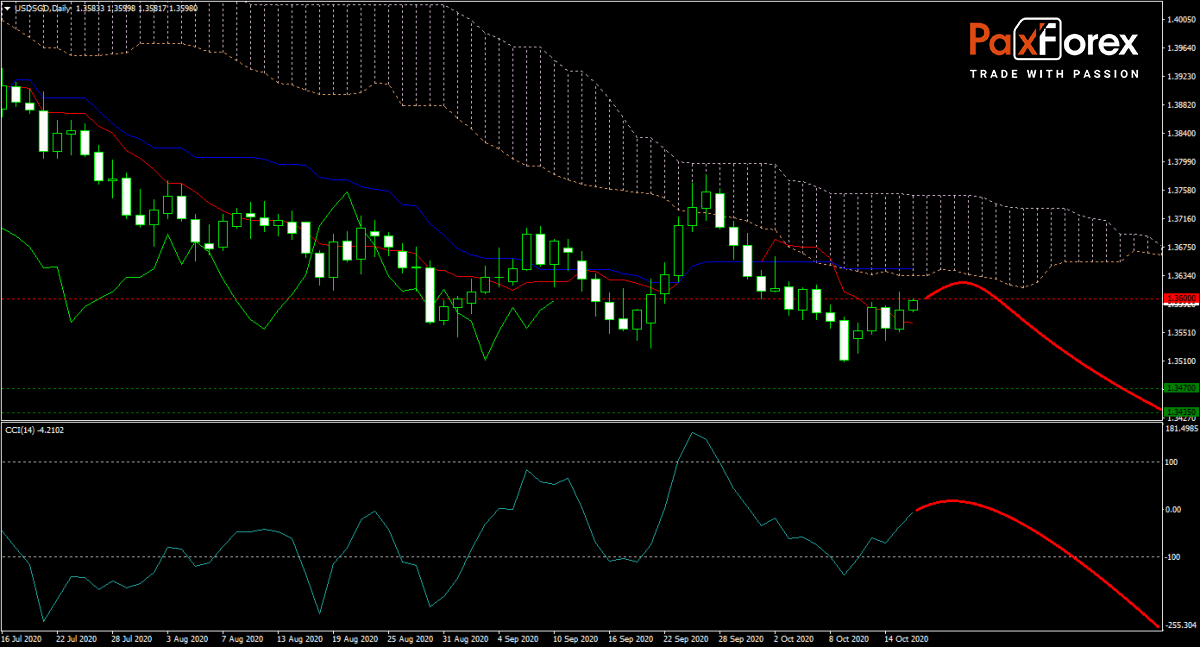

The forecast for the USD/SGD turned bearish with price action between its descending Tenkan-sen and its sideways trending Kijun-sen. While this currency pair may move into the Senkou Span A of its downward sloping Ichimoku Kinko Hyo Cloud, the outlook calls for more downside with Covid-19 cases surging across the US. Yesterday’s initial jobless claims spiked, adding to uncertainty over the holiday shopping season. The CCI moved out of oversold territory but is favored to retreat following a brief advance into positive conditions. Will bears regain strength and force bulls into a retreat? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/SGD remain inside the or breakdown below the 1.3565 to 1.3610 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3600

- Take Profit Zone: 1.3435 – 1.3470

- Stop Loss Level: 1.3650

Should price action for the USD/SGD breakout above 1.3610 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3650

- Take Profit Zone: 1.3720 – 1.3760

- Stop Loss Level: 1.3610

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.