Source: PaxForex Premium Analytics Portal, Fundamental Insight

Singapore Bank Lending for January was reported at S$683.6 billion. Forex traders can compare this to Singapore Bank Lending for December, reported at S$678.7 billion. Singapore Industrial Production for January increased by 4.6% monthly and by 8.6% annualized. Economists predicted an increase of 5.5% and 5.7%. Forex traders can compare this to Singapore Industrial Production for December, which increased by 1.4% monthly and 16.2% annualized.

US Personal Income for January is predicted to increase by 9.5% monthly, and Personal Spending is predicted to increase by 2.5% monthly. Forex traders can compare this to Personal Income for December, which increased by 0.6% monthly, and to Personal Spending, which decreased by 0.2% monthly. The PCE Core Deflator for January is predicted to increase by 0.2% monthly and by 1.4% annualized. Forex traders can compare this to the PCE Core Deflator for December, which increased by 0.3% monthly and by 1.5% annualized.

The US Chicago PMI for February is predicted at 61.1. Forex traders can compare this to the US Chicago PMI for January, reported at 63.8. The Final US Michigan Consumer Sentiment for February is predicted at 76.5. Forex traders can compare this to US Michigan Consumer Confidence for January, reported at 79.0. Final Current Conditions for February are predicted at 86.2, and Final Expectations are predicted at 69.8. Forex traders can compare this to Current Conditions for January, reported at 86.7, and to Expectations, reported at 74.0.

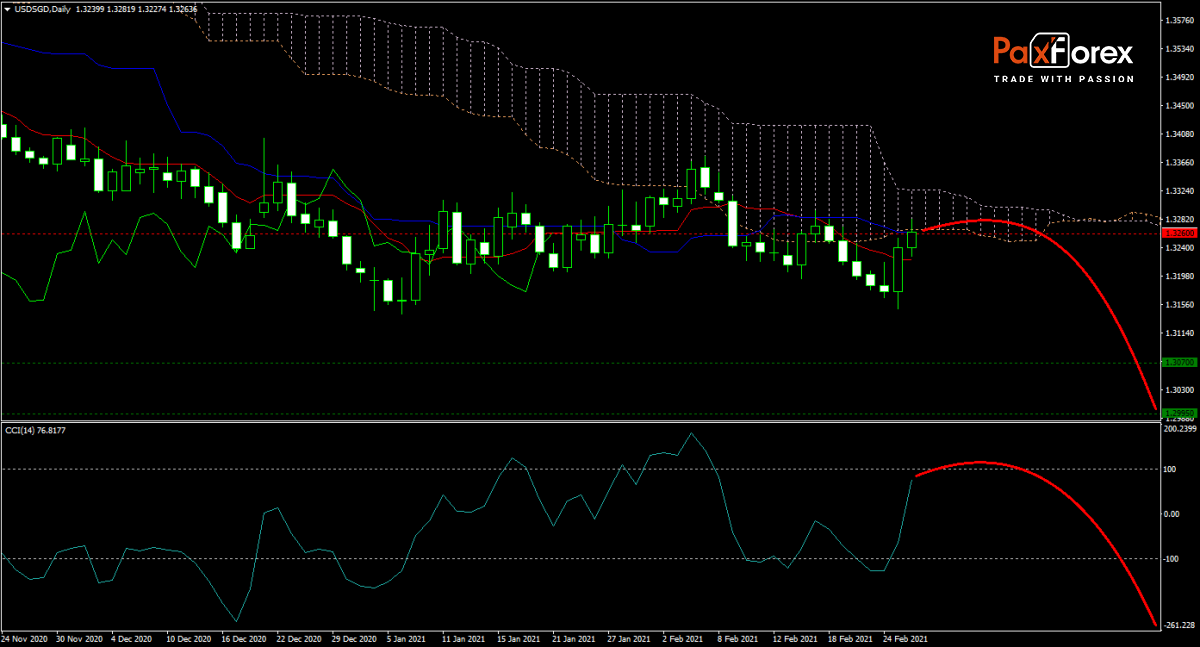

The forecast for the USD/SGD remains bearish after price action advanced into the Senkou Span A of its descending Ichimoku Kinko Hyo Cloud. While the Tenkan-sen and Kijun-sen paused their descend, the trend continues to support more downside. The CCI accelerated out of extreme oversold territory and is likely to decelerate as it races towards extreme overbought conditions. Do bears have enough strength to force the USD/SGD into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/SGD remain inside the or breakdown below the 1.3225 to 1.3285 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3260

- Take Profit Zone: 1.2995 – 1.3070

- Stop Loss Level: 1.3315

Should price action for the USD/SGD breakout above 1.3285 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3315

- Take Profit Zone: 1.3400 – 1.3420

- Stop Loss Level: 1.3285

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.