Source: PaxForex Premium Analytics Portal, Fundamental Insight

Singapore Bank Lending for November was reported at S$676.7 billion. Forex traders can compare this to Singapore Bank Lending for October, reported at S$675.6 billion. US Initial Jobless Claims for the week of December 26th are predicted at 833K, and US Continuing Claims for the week of December 19th are predicted at 5,390K. Forex traders can compare this to US Initial Jobless Claims for the week of December 19th, reported at 803K, and to US Continuing Claims for the week of December 12th, reported at 5,337K.

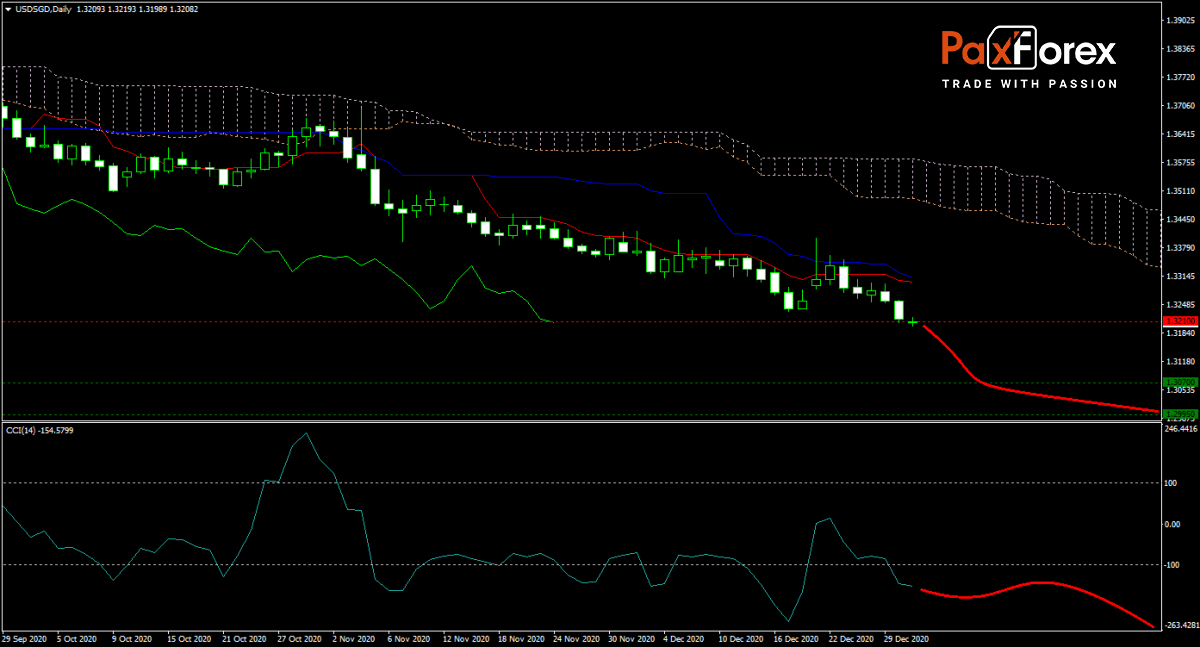

The forecast for the USD/SGD remains bearish, with weakness in the US Dollar dominating this currency pair. Price action moved below its descending Tenkan-sen and Kijun-sen, while the Ichimoku Kinko Hyo Cloud is sloping to the downside. The US is well-below its December Covid-19 vaccination plan, and almost half the population is against inoculation. Given the arrival of the mutated virus in the US, the already strained healthcare system is set to suffer more. The CCI moved into extreme oversold conditions with more downside potential. Will bears force the USD/SGD into its next horizontal support area, including the psychological support of 1.3000? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/SGD remain inside the or breakdown below the 1.3185 to 1.3225 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3210

- Take Profit Zone: 1.2995 – 1.3070

- Stop Loss Level: 1.3260

Should price action for the USD/SGD breakout above 1.3225 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3260

- Take Profit Zone: 1.3355 – 1.3400

- Stop Loss Level: 1.3225

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.