The Preliminary Japanese Leading Index for March was reported at 83.8, and the Preliminary Japanese Coincident Index was reported at 90.5. Forex traders can compare this to the Japanese Leading Index for February, which was reported at 91.9 and to the Japanese Coincident Index, which was reported at 95.4. The US CPI for April is predicted to decrease by 0.7% monthly, and to increase by 0.4% annualized. Forex traders can compare this to the US CPI for March, which decreased by 0.4% monthly, and which increased by 1.5% annualized. The US Core CPI for April is predicted to decrease by 0.2% monthly, and to increase by 1.7% annualized. Forex traders can compare this to the US Core CPI for March, which decreased by 0.1% monthly, and which increased by 2.1% annualized.

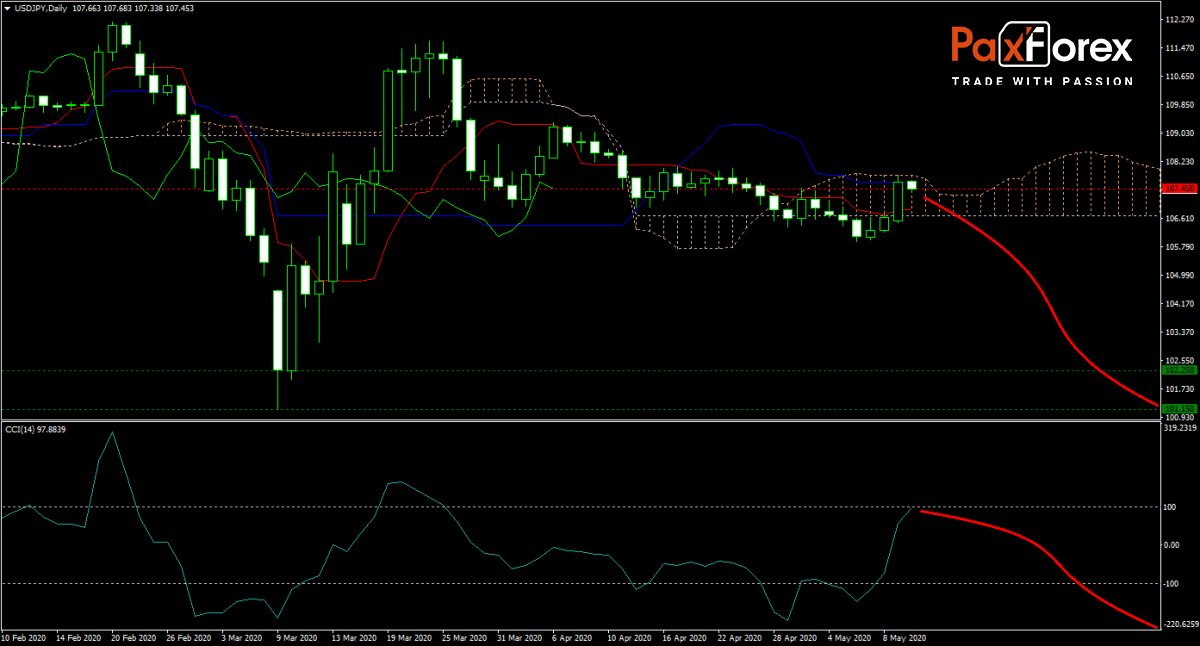

The USD/JPY forecast is bearish as the US is risking to rush into reopening its economy. The Covid-19 virus is spreading in the White House, with several people in quarantine. Economic data remains dismal, out of Japan and the US alike, while the Japanese Yen enjoys its status as a safe-haven currency. Price action moved below the Kijun-sen, and this currency pair is inside of the Ichimoku Kinko Hyo cloud. Will bears succeed in forcing a sell-off, or can bulls start a rally? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 106.700 to 107.850 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 107.450

- Take Profit Zone: 101.150 – 102.250

- Stop Loss Level: 108.150

Should price action for the USDJPY breakout above 107.850 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 108.150

- Take Profit Zone: 109.000 – 109.300

- Stop Loss Level: 107.850

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.