Japanese Labor Cash Earnings for January increased by 1.5% annualized and Japanese Real Cash Earnings increased by 0.7% annualized. Economists predicted an increase of 0.2% and a decrease of 0.5%. Forex traders can compare this to Japanese Labor Cash Earnings for December, which decreased by 0.2% annualized and to Japanese Real Cash Earnings, which decreased by 1.1% annualized. Japanese Household Spending for January decreased by 1.6% monthly and by 3.9% annualized. Economists predicted an increase of 0.9% and a decrease of 4.0% annualized. Forex traders can compare this to Japanese Household Spending for December, which decreased by 1.7% monthly and by 4.8% annualized.

The Preliminary Japanese Leading Index for January was reported at 90.3, and the Preliminary Japanese Coincident Index was reported at 94.7. Economists predicted a figure of 91.1 and 94.5. Forex traders can compare this to the Japanese Leading Index for December, which was reported at 91.6 and to the Japanese Coincident Index, which was reported at 94.1.

The US NFP Report for February is predicted to show 175K job additions and an unemployment rate of 3.6%. Forex traders can compare this to the US NFP Report for January, which showed 225K job additions and an unemployment rate of 3.6%. Private Payrolls for February are predicted to show 155K job additions and Manufacturing Payrolls 3K job losses. Forex traders can compare this to Private Payrolls for January, which showed 206K job additions and to Manufacturing Payrolls, which showed 12K job losses. The Average Work Week for February is predicted at 34.3 hours. Forex traders can compare this to the Average Work Week for January, which was reported at 34.3 hours. Average Hourly Earnings for February are predicted to increase by 0.3% monthly and by 3.0% annualized. Forex traders can compare this to Average Hourly Earnings for January, which increased by 0.2% monthly and by 3.1% annualized. The Labor Force Participation Rate for February is predicted at 63.4%. Forex traders can compare this to the Labor Force Participation Rate for January, which was reported at 63.4%.

The US Trade Balance for January is predicted at -$47.7B. Forex traders can compare this to the US Trade Balance for December, which was reported at -$48.9B. US Final Wholesale Inventories for January are predicted to decrease by 0.2% monthly. Forex traders can compare this to previous US Wholesale Inventories for January, which decreased by 0.2% monthly. US Wholesale Trade Sales for January are predicted to increase by 0.4% monthly. Forex traders can compare this to US Wholesale Trade Sales for December, which decreased by 0.7% monthly. US Consumer Credit for January is predicted at $17.000B. Forex traders can compare this to US Consumer Credit for December, which was reported at $22.055B.

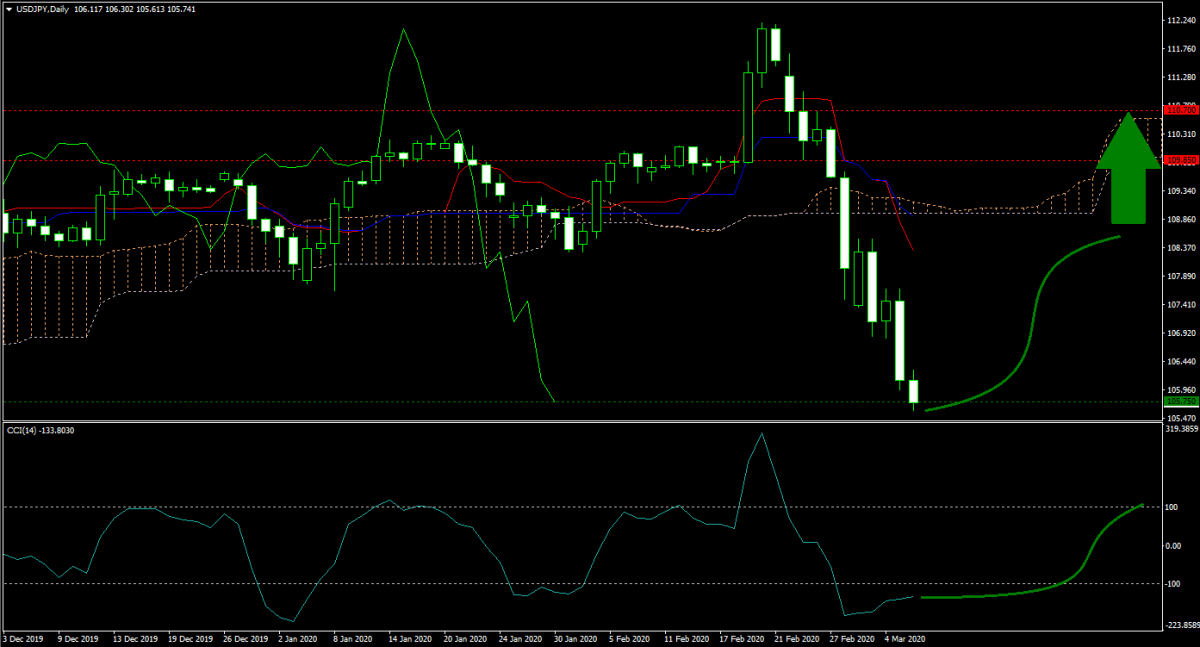

The USD/JPY extended its sell-off as forex traders sought safe-haven assets like the Japanese Yen. The forecast for this currency pair remains bearish as the coronavirus continues to disrupt the global economy. More volatility lies ahead after price action moved into its horizontal support area. Will bears get the date required to force a breakdown, or can bulls pause the sell-off heading into the weekend?

Should price action for the USD/JPY remain inside the or breakout above the 105.500 to 106.300 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 105.750

- Take Profit Zone: 109.850 – 110.700

- Stop Loss Level: 105.000

Should price action for the USD/JPY breakdown below 105.500 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 105.000

- Take Profit Zone: 104.000 – 104.400

- Stop Loss Level: 105.500

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.