Source: PaxForex Premium Analytics Portal, Fundamental Insight

Foreign Buying of Japanese Bonds for the period ending March 20th was reported at ¥551.6B, and Foreigners Buying of Japanese Stocks was reported at -¥79.7B. Forex traders can compare this to Foreign Buying of Japanese Bonds for the period ending March 13th, reported at -¥426.2B, and to Foreigners Buying of Japanese Stocks, reported at -¥55.0B.

US Initial Jobless Claims for the week of March 20th are predicted at 730K, and US Continuing Claims for the week of March 13th are predicted at 4,043K. Forex traders can compare this to US Initial Jobless Claims for the week of March 13th, reported at 770K, and to US Continuing Claims for the week of March 6th, reported at 4,124K. The final US GDP for the fourth quarter is predicted to increase by 4.1% annualized. Forex traders can compare this to the third-quarter GDP, which increased by 33.4% annualized. Final GDP Sales for the fourth quarter are predicted to increase by 3.0% annualized. Forex traders can compare this to third-quarter GDP Sales, which increased by 3.0% annualized. The final GDP Price Index for the fourth quarter is predicted to increase by 2.0% annualized. Forex traders can compare this to the third quarter GDP Price Index, which increased by 3.7% annualized. The Final Core PCE for the fourth quarter is predicted to increase by 1.4% annualized. Forex traders can compare this to the third quarter Core PCE, which increased by 1.4% annualized.

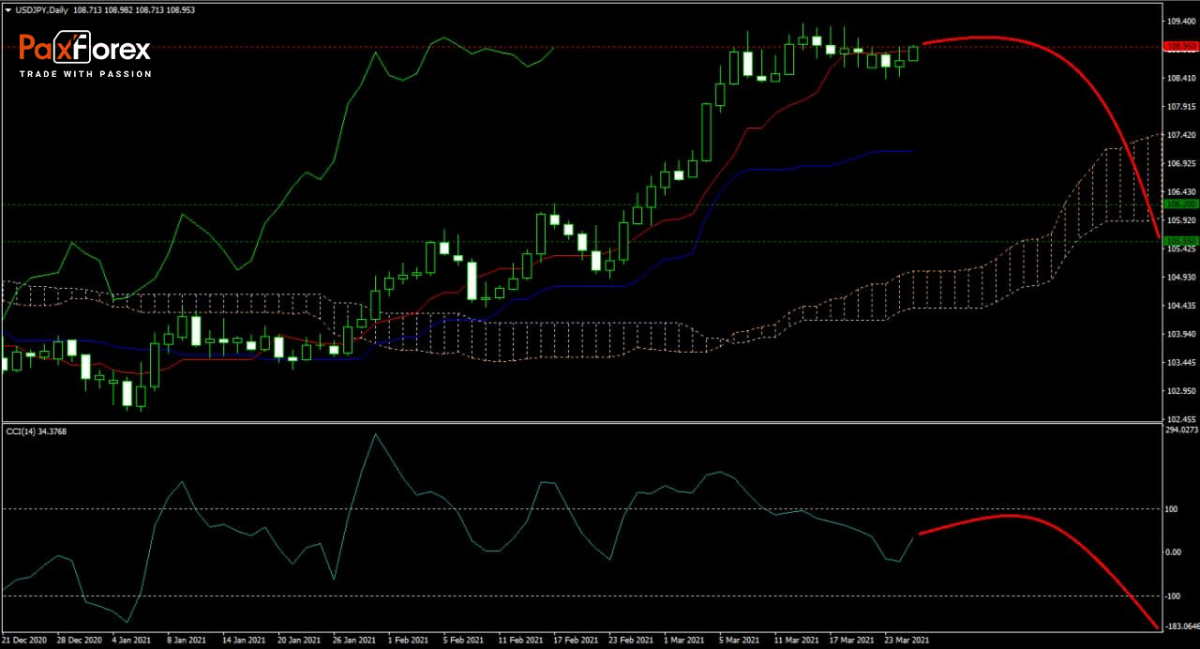

The forecast for the USD/JPY remains bearish, with this currency pair losing steam at a resistance area. Adding to bearish progress is the resurgence of Covid-19 related economic worries, which will benefit the Japanese Yen, a safe-haven currency. The Kijun-sen and Tenkan-sen flatlined, confirming the lack of bullish momentum, but the Ichimoku Kinko Hyo Cloud continues to ascend. The CCI has more upside potential, and price action may attempt another push higher before retreating. Can bears for the USD/JPY into its horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 108.450 to 109.300 zone, the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 108.950

- Take Profit Zone: 105.550 – 106.200

- Stop Loss Level: 110.000

Should price action for the USDJPY breakout above 109.300, the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 110.000

- Take Profit Zone: 110.950 – 111.450

- Stop Loss Level: 109.300

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.