Source: PaxForex Premium Analytics Portal, Fundamental Insight

Foreign Buying of Japanese Bonds for the period ending May 29th was reported at -¥1,090.0B, and Foreigners Buying of Japanese Stocks was reported at -¥181.3B. Forex traders can compare this to Foreign Buying of Japanese Bonds for the period ending May 22nd, reported at -¥550.7B, and to Foreigners Buying of Japanese Stocks, reported at -¥233.2B. The Final Japanese Jibun Bank Services PMI for May was reported at 46.5, and the Final Japanese Jibun Bank Composite PMI at 48.8. Forex traders can compare this to the Japanese Jibun Bank Services PMI for April, reported at 49.5, and to the Japanese Jibun Bank Composite PMI, reported at 51.0.

The US ADP Employment Change for May is predicted at 650K. Forex traders can compare this to the US ADP Employment Change for April, reported at 742K. US Initial Jobless Claims for the week of May 29th are predicted at 390K, and US Continuing Claims for the week of May 22nd are predicted at 3,615K. Forex traders can compare this to US Initial Jobless Claims for the week of May 22nd, reported at 406K, and to US Continuing Claims for the week of May 15th, reported at 3,642K. Final US Non-Farm Productivity for the first quarter is predicted to increase by 5.5% quarterly, and Unit Labor Costs are predicted to decrease by 0.4% quarterly. Forex traders can compare this to US Non-Farm Productivity for the fourth quarter, which decreased by 3.8% quarterly, and to Unit Labor Costs, which increased by 5.6% quarterly.

The US Final Markit Services PMI for May is predicted at 70.1, and the US Final Markit Composite PMI is predicted at 68.1. Forex traders can compare this to the US Markit Services PMI for April, reported at 64.7, and to the US Markit Composite PMI, reported at 63.5. The US ISM Non-Manufacturing PMI for May is predicted at 63.0, and the ISM Non-Manufacturing Business Activity Index at 67.2. Forex traders can compare this to the US ISM Non-Manufacturing PMI for April, reported at 62.7, and to the ISM Non-Manufacturing Business Activity Index, reported at 62.7.

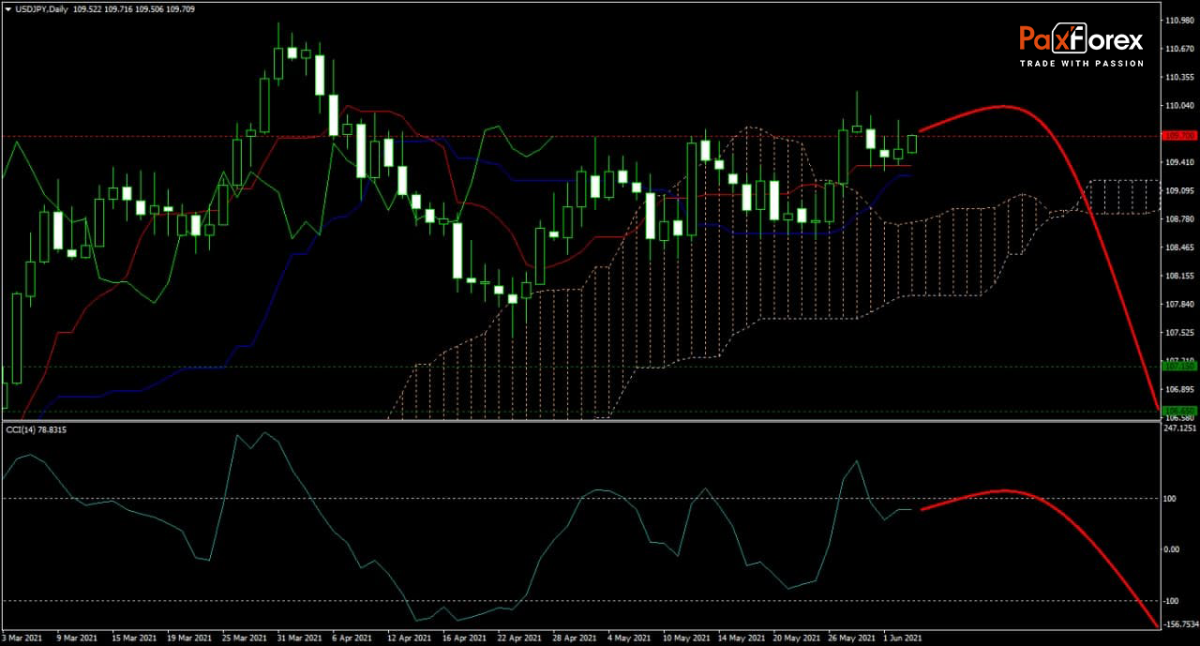

The forecast for the USD/JPY is turning bearish after this currency pair experiences rising selling pressures at resistance. After the Tenkan-sen entered a sideways trend, the Kijun-sen followed, ending its advance that supplied bullish momentum. The Ichimoku Kinko Hyo Cloud also turned sideways, suggesting the next move in price action is a correction that will take this currency pair below the cloud. Following the breakdown in the CCI out of extreme overbought territory, traders should prepare for more downside. Will bears gather enough strength and force the USD/JPY into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 109.350 to 110.200 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 109.700

- Take Profit Zone: 106.650 – 107.150

- Stop Loss Level: 110.550

Should price action for the USDJPY breakout above 110.200, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 110.550

- Take Profit Zone: 110.950 – 111.200

- Stop Loss Level: 110.200

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.