Source: PaxForex Premium Analytics Portal, Fundamental Insight

Foreign Buying of Japanese Bonds for the period ending July 10th was reported at -¥1,217.8B, and Foreigners Buying of Japanese Stocks was reported at -¥10.5B. Forex traders can compare this to Foreign Buying of Japanese Bonds for the period ending July 3rd, reported at -¥191.4B and to Foreigners Buying of Japanese Stocks, reported at -¥310.0B. The Japanese Tertiary Industry Index for May decreased by 2.7% monthly. Forex traders can compare this to the Japanese Tertiary Industry Index for April, which decreased by 0.8% monthly.

US Initial Jobless Claims for the week of July 10th are predicted at 360K, and US Continuing Claims for the week of July 3rd are predicted at 3,313K. Forex traders can compare this to US Initial Jobless Claims for the week of July 3rd, reported at 373K, and to US Continuing Claims for the week of June 26th, reported at 3,339K. The US Import Price Index for June is predicted to increase 1.2% monthly, and the US Export Price Index is predicted to increase 1.2% monthly. It compares to the US Import Price Index for May, which increased 1.1% monthly, and to the US Export Price Index, which increased 2.2% monthly.

The US Empire Manufacturing Index for July is predicted at 18.0. Forex traders can compare this to the US Empire Manufacturing Index for June, reported at 17.4. The Philadelphia Fed Manufacturing Index for July is predicted at 28.0. Forex traders can compare this to the Philadelphia Fed Manufacturing Index for June, reported at 30.7. US Industrial Production for June is predicted to increase 0.6% monthly, and Manufacturing Production is predicted to increase 0.2% monthly. Forex traders can compare this to US Industrial Production for May, which increased 0.8% monthly, and to Manufacturing Production, which increased 0.9% monthly. Capacity Utilization for June is predicted at 75.6%. Forex traders can compare this to Capacity Utilization for May, reported at 75.2%.

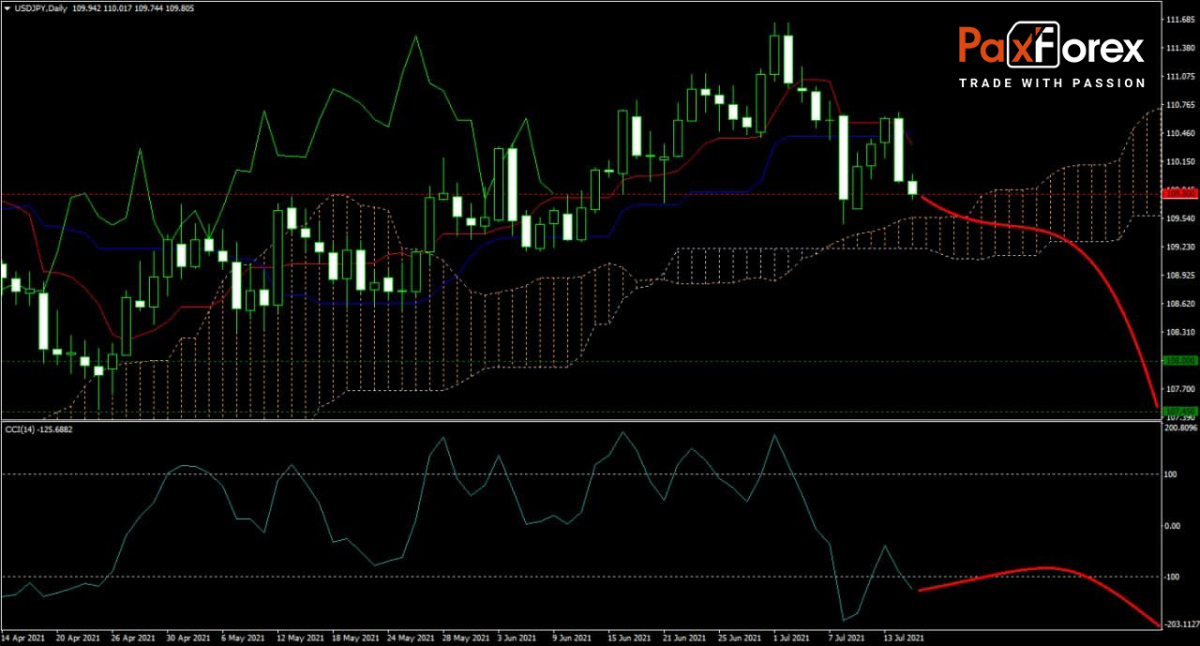

The forecast for the USD/JPY remains bearish as inflationary pressures in the US remain well above expectations. While the Fed continues to believe they are transitory, they pose enough of a threat to the US Dollar. The Tenkan-sen crossed below the Kijun-sen, confirming a rise in bearish momentum, but the Ichimoku Kinko Hyo Cloud resumes its uptrend. Traders should expect more short-term volatility before resuming its sell-off. The CCI moved into extreme oversold territory but has more downside potential. Can bears use rising breakdown pressures to force the USD/JPY into its horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 109.500 to 110.200 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 109.800

- Take Profit Zone: 107.450 – 108.000

- Stop Loss Level: 110.350

Should price action for the USDJPY breakout above 110.200, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 110.350

- Take Profit Zone: 110.950 – 111.200

- Stop Loss Level: 110.200

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.