Source: PaxForex Premium Analytics Portal, Fundamental Insight

Japanese Household Spending for November decreased by 1.8% monthly and increased by 1.1% annualized. Economists predicted a decrease of 1.3% and 1.5% annualized. Forex traders can compare this to Japanese Household Spending for October, which increased by 2.1% monthly and 1.9% annualized. The Preliminary Japanese Leading Index for November was reported at 96.6, and the Preliminary Japanese Coincident Index was reported at 89.1. Forex traders can compare this to the Japanese Leading Index for October, reported at 94.3, and to the Japanese Coincident Index, reported at 89.4.

The US NFP Report for December is predicted to show 71K job additions and an unemployment rate of 6.8%. Forex traders can compare this to the US NFP Report for November, which showed 245K job additions and an unemployment rate of 6.7%. Private Payrolls for December are predicted to show 98K job additions and Manufacturing Payrolls 20K job additions. Forex traders can compare this to Private Payrolls for November, which showed 344K job additions, and to Manufacturing Payrolls, which showed 27K job additions. The Average Work Week for December is predicted at 34.8 hours. Forex traders can compare this to the Average Work Week for November, reported at 34.8 hours. Average Hourly Earnings for December are predicted to increase by 0.2% monthly and by 4.4% annualized. Forex traders can compare this to Average Hourly Earnings for November, which increased by 0.3% monthly and by 4.4% annualized.

US Preliminary Wholesale Inventories for November are predicted to decrease by 0.1% monthly. Forex traders can compare this to US Wholesale Inventories for October, which increased by 1.2% monthly. US Consumer Credit for November is predicted at $9.00B. Forex traders can compare this to US Consumer Credit for October, reported at $7.23B.

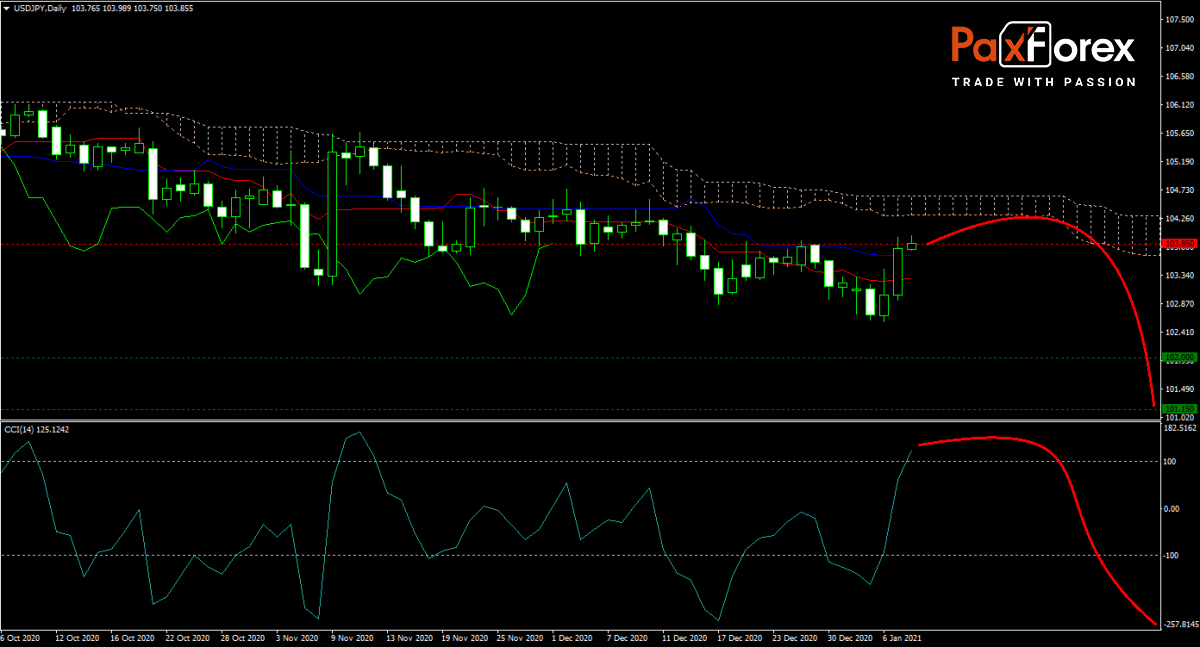

The forecast for the USD/JPY remains bearish with today’s NFP report out of the UD likely a downside catalyst. The ADP report showed 123K job losses for December. Price action spiked above its Tenkan-sen and Kijun-sen, but bullish momentum is easing. The Ichimoku Kinko Hyo Cloud provides significant resistance. The CCI moved into extreme overbought territory, signaling a potential pause in the advance. Can bears spark the next sell-off into the USD/JPY until it reaches its horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 103.650 to 104.300 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 103.850

- Take Profit Zone: 101.150 – 102.000

- Stop Loss Level: 104.600

Should price action for the USDJPY breakout above 104.100 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 104.600

- Take Profit Zone: 105.100 – 105.650

- Stop Loss Level: 104.100

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.