Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Final Japanese Leading Index for December was reported at 95.3, and the Final Japanese Coincident Index was reported at 88.3. Economists predicted a figure of 94.9 and 87.8. Forex traders can compare this to the Japanese Leading Index for November, reported at 96.1, and to the Japanese Coincident Index, reported at 89.0.

US Initial Jobless Claims for the week of February 20th are predicted at 838K, and US Continuing Claims for the week of February 13th are predicted at 4,467K. Forex traders can compare this to US Initial Jobless Claims for the week of February 13th, reported at 861K, and to US Continuing Claims for the week of February 6th, reported at 4,494K. US Pending Home Sales for January are predicted to decrease by 0.2% monthly. Forex traders can compare this to US Pending Home Sales for December, which decreased by 0.3% monthly.

US Preliminary Durable Goods Orders for January are predicted to increase by 1.1% monthly, and Durables Excluding Transportation are predicted to increase by 0.7% monthly. Forex traders can compare this to US Durable Goods Orders for December, which increased by 0.5% monthly, and to Durables Excluding Transportation, which increased by 1.1% monthly. Capital Goods Orders Non-Defense Excluding Aircraft for January are predicted to increase by 0.7% monthly. Forex traders can compare this to Capital Goods Orders Non-Defense Excluding Aircraft for December, which increased by 0.7% monthly.

The Advanced US GDP for the fourth quarter is predicted to increase by 4.2% annualized. Forex traders can compare this to the third-quarter GDP, which increased by 33.4% annualized. The GDP Price Index for the fourth quarter is predicted to increase by 2.0% annualized. Forex traders can compare this to the third quarter GDP Price Index, which increased by 1.9% annualized. The Core PCE for the fourth quarter is predicted to increase by 1.4% annualized. Forex traders can compare this to the third quarter Core PCE, which increased by 1.4% annualized.

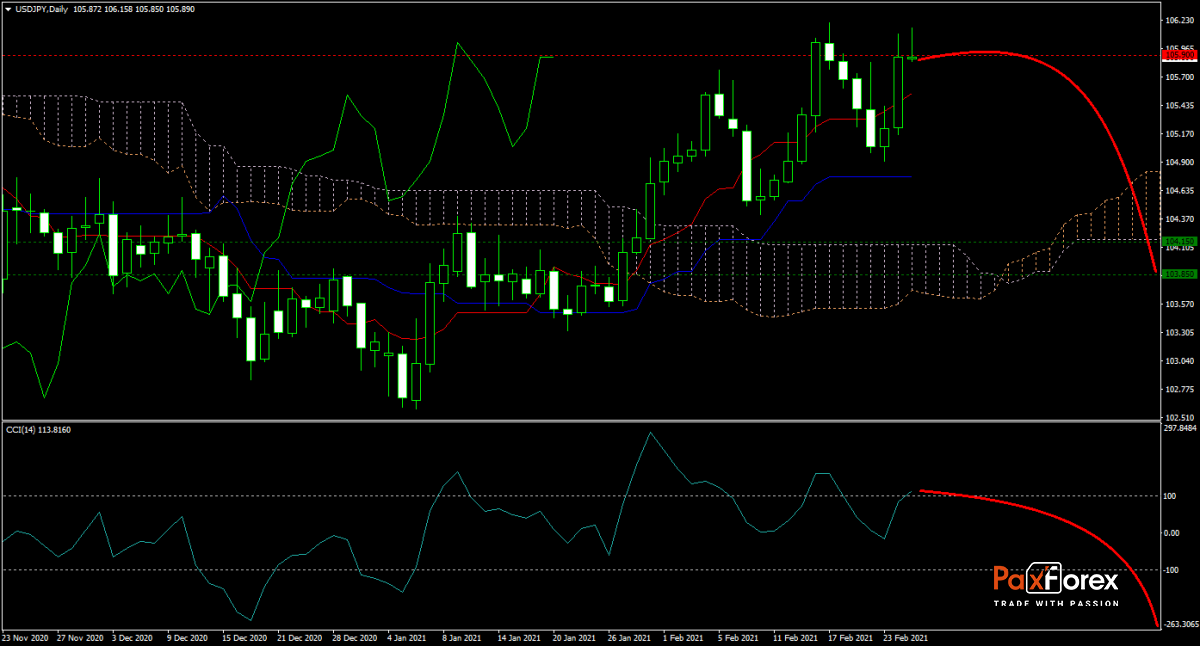

The forecast for the USD/JPY turned bearish as the risk-on sentiment continues to accelerate and markets ignore the red flags. This currency pair began to form a topping pattern, and volatility could increase before a sell-off. After the Kijun-sen flattened, the Tenkan-sen is expected to follow suit as the Ichimoku Kinko Hyo Cloud shows a momentum loss. The CCI confirms the rise of bearish pressures after a negative divergence formed from where more downside can follow. Will bears capitalize on recent developments and force the USD/JPY into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 105.750 to 106.200 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 105.900

- Take Profit Zone: 103.850 – 104.150

- Stop Loss Level: 106.550

Should price action for the USDJPY breakout above 106.200 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 106.550

- Take Profit Zone: 107.200 – 107.400

- Stop Loss Level: 106.200

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.