Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Final Japanese Leading Index for October was reported at 94.3, and the Final Japanese Coincident Index was reported at 89.4. Economists predicted a figure of 93.8 and 89.7. Forex traders can compare this to the Japanese Leading Index for September, reported at 93.3, and to the Japanese Coincident Index, reported at 84.8.

US Initial Jobless Claims for the week of December 19th are predicted at 885K, and US Continuing Claims for the week of December 12th are predicted at 5,558K. Forex traders can compare this to US Initial Jobless Claims for the week of December 12th, which were reported at 885K, and to US Continuing Claims for the week of December 5th, which were reported at 5,508K. US Preliminary Durable Goods Orders for November are predicted to increase by 0.6% monthly, and Durables Excluding Transportation are predicted to increase by 0.5% monthly. Forex traders can compare this to US Durable Goods Orders for October, which increased by 1.3% monthly, and to Durables Excluding Transportation, which increased by 1.3% monthly.

US Personal Income for November is predicted to decrease by 0.3% monthly, and Personal Spending is predicted to decrease by 0.2% monthly. Forex traders can compare this to Personal Income for October, which decreased by 0.7% monthly, and to Personal Spending, which increased by 0.5% monthly. The PCE Core Deflator for November is predicted to increase by 0.1% monthly and by 1.5% annualized. Forex traders can compare this to the PCE Core Deflator for October, which increased by 0.2% monthly and by 1.4% annualized.

US New Home Sales for November are predicted to decrease by 0.3% monthly to 995K new homes. Forex traders can compare this to US New Home Sales for October, which decreased by 0.3% monthly to 999K new homes. Final US Michigan Consumer Sentiment for December is predicted at 81.3. Forex traders can compare this to US Michigan Consumer Confidence for November, reported at 76.9. Final Current Conditions for December are predicted at 91.8, and Final Expectations are predicted at 74.7. Forex traders can compare this to Current Conditions for November, which were reported at 87.0, and to Expectations, which were reported at 70.5.

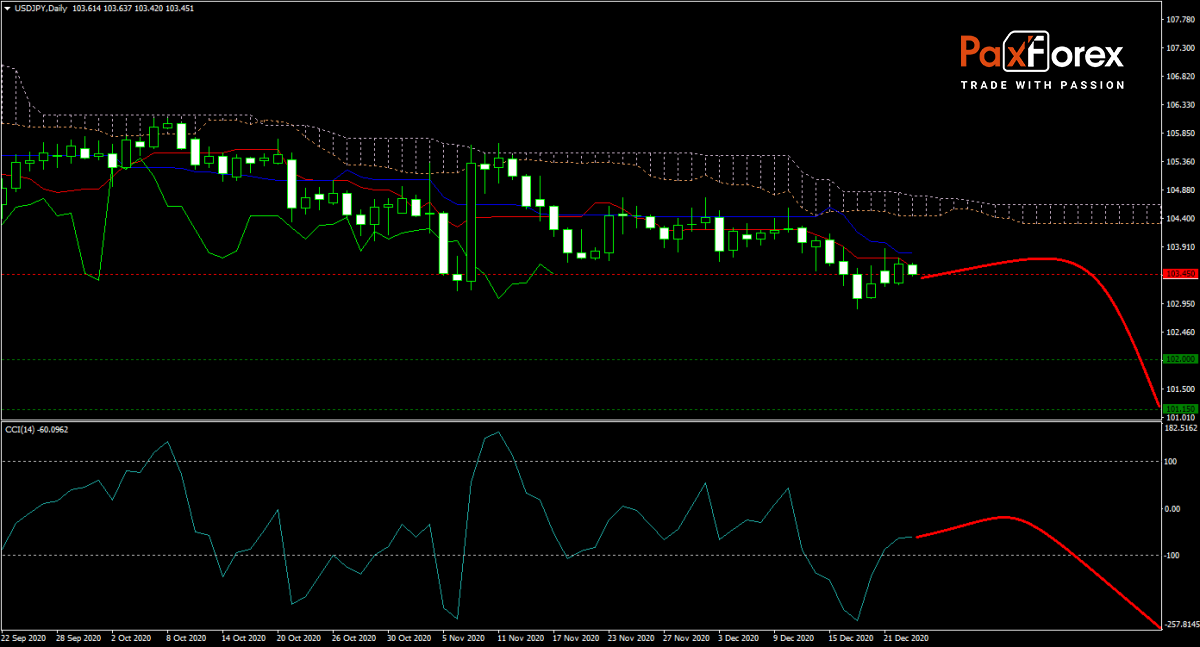

The forecast for the USD/JPY remains bearish, with US Dollar weakness driving price action. The new mutation of the Covid-19 virus resulted in more severe lockdowns, and more countries have to restrict activities. Safe-haven demand for the Japanese Yen adds to more downside potential in this currency pair, which moved below its Kijun-sen and its Tenkan-sen. The Ichimoku Kinko Hyo Cloud is gradually descending, suggesting more medium-to-long-term bearish pressures. The CCI moved out of extreme oversold territory but has more downside potential. Can bears force the USD/JPY into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 103.250 to 103.800 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 103.450

- Take Profit Zone: 101.150 – 102.000

- Stop Loss Level: 104.100

Should price action for the USDJPY breakout above 103.800 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 104.100

- Take Profit Zone: 104.750 – 105.100

- Stop Loss Level: 103.800

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.