The Japanese Trade Balance for March was reported at ¥4.9B. Economists predicted a figure of ¥459.9B. Forex traders can compare this to the Japanese Trade Balance for February, which was reported at -¥1,108.8B. The Japanese Adjusted Trade Balance for March was reported at -¥190.0B. Economists predicted a figure of -¥115.0B. Forex traders can compare this to the Japanese Adjusted Trade Balance for February, which was reported at ¥492.2B. Exports for March decreased by 11.7% annualized and Imports decreased by 5.0% annualized. Economists predicted a decrease of 9.4 and 8.7%. Forex traders can compare this to Exports for February, which decreased by 1.0% annualized, and to Imports which decreased by 13.9% annualized. The US Chicago Fed National Activity Index for March is predicted at -3.00. Forex traders can compare this to the US Chicago Fed National Activity Index for February, which was reported at 0.16.

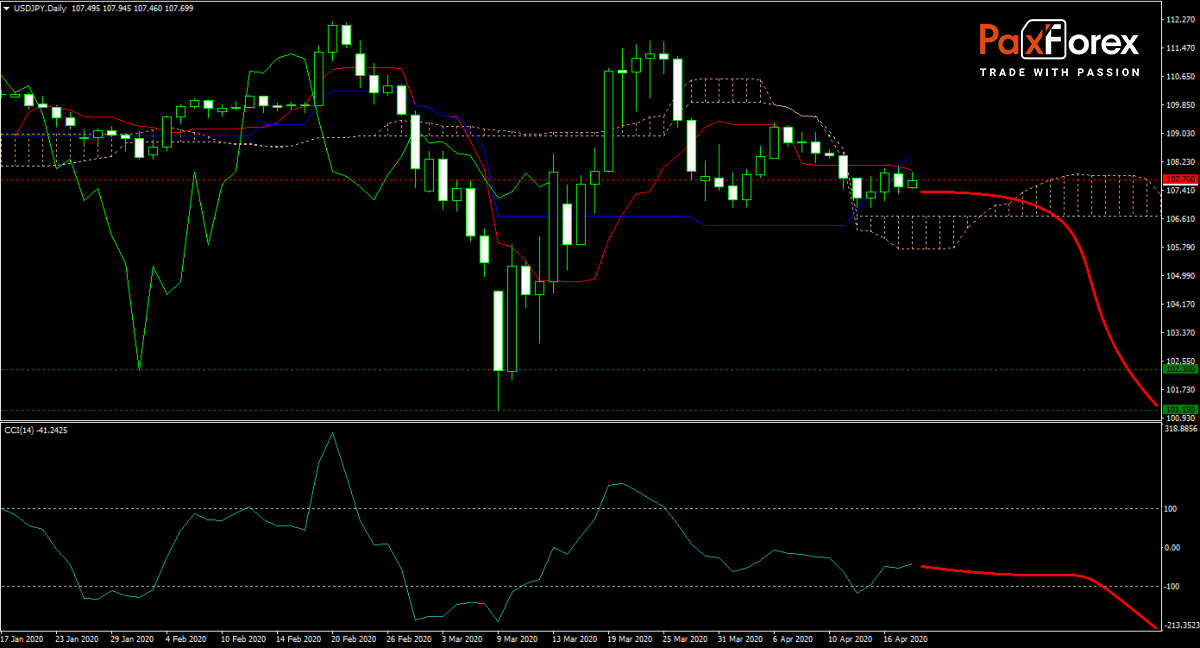

The USD/JPY forecast remains bearish with price action below the Tenkan-sen. A bearish chart pattern is forming and expected to provide downside momentum for this currency pair to accelerate below its Senkou Span A and B. The Covid-19 virus continues to dominate headlines, as it keeps the global economy hostage. Will bears receive enough data to keep the correction going? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/JPY remain inside the or breakdown below the 107.000 to 108.000 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 107.700

- Take Profit Zone: 101.150 – 102.300

- Stop Loss Level: 108.500

Should price action for the USD/JPY breakout above 108.000 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 108.500

- Take Profit Zone: 109.500 – 110.000

- Stop Loss Level: 108.000

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.