Source: PaxForex Premium Analytics Portal, Fundamental Insight

Foreign Buying of Japanese Bonds for the period ending April 10th was reported at ¥1,714.4B and Foreigners Buying of Japanese Stocks was reported at ¥640.9B. Forex traders can compare this to Foreign Buying of Japanese Bonds for the period ending April 3rd, reported at ¥375.1B, and to Foreigners Buying of Japanese Stocks, reported at ¥977.6B.

US Initial Jobless Claims for the week of April 10th are predicted at 700K, and US Continuing Claims for the week of April 3rd are predicted at 3,700K. Forex traders can compare this to US Initial Jobless Claims for the week of April 3rd, reported at 744K, and to US Continuing Claims for the week of March 27th, reported at 3,734K. The Philadelphia Fed Manufacturing Index for April is predicted at 42.0. Forex traders can compare this to the Philadelphia Fed Manufacturing Index for March, reported at 51.8. The US Empire Manufacturing Index for April is predicted at 19.5. Forex traders can compare this to the US Empire Manufacturing Index for March, reported at 17.4.

US Advanced Retail Sales for March are predicted to increase by 5.9% monthly, and Retail Sales Less Autos are predicted to increase by 5.0% monthly. Forex traders can compare this to US Advanced Retail Sales for February, which decreased by 3.0% monthly, and to Retail Sales Less Autos, which decreased by 2.7% monthly. Retail Sales in the Control Group for March are predicted to increase by 6.3% monthly. Forex traders can compare this to Retail Sales in the Control Group for February, which decreased by 3.5% monthly.

US Industrial Production for March is predicted to increase by 2.8% monthly, and Manufacturing Production is predicted to increase by 4.0% monthly. Forex traders can compare this to US Industrial Production for February, which decreased by 2.2% monthly, and to Manufacturing Production, which decreased by 3.1% monthly. Capacity Utilization for March is predicted at 75.7%. Forex traders can compare this to Capacity Utilization for February, reported at 73.8%.

US Business Inventories for February are predicted to increase by 0.5% monthly. Forex traders can compare this to US Business Inventories for March, which increased by 0.3% monthly. The US NAHB Housing Market Index for April is predicted at 83. Forex traders can compare this to the US NAHB Housing Market Index for March, reported at 82.

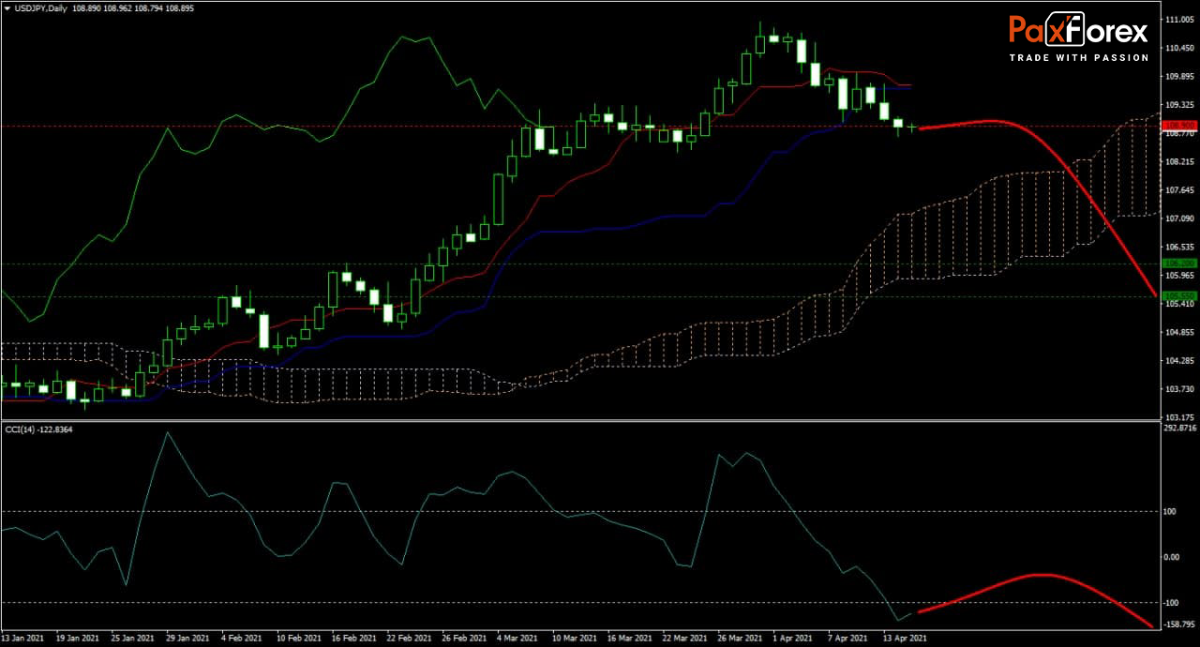

The forecast for the USD/JPY remains bearish following its most recent correction. While risk aversion continues, so does the worsening of underlying economic conditions related to the accelerating Covid-19 pandemic. While the Ichimoku Kinko Hyo Cloud maintains its uptrend, price action is close to moving through it. The Kijun-sen and the Tenkan-sen flatlined, with a pending crossover that could result in more selling pressure. After the CCI dipped into extreme oversold territory, traders should wait for a reversal before selling into an advance. Can bears extend the sell-off in the USD/JPY into its horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 108.400 to 109.350 zone, the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 108.900

- Take Profit Zone: 105.550 – 106.200

- Stop Loss Level: 109.750

Should price action for the USDJPY breakout above 109.350, the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 109.750

- Take Profit Zone: 110.300 – 110.950

- Stop Loss Level: 109.350

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.