Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Swiss KOF Leading Indicator for January is predicted at 102.0. Forex traders can compare this to the Swiss KOF Leading Indicator for December, reported at 104.3. The US Employment Cost Index for the fourth quarter is predicted to increase by 0.5% quarterly. Forex traders can compare this to the US Employment Cost Index for the third quarter, which increased by 0.5% quarterly. The US Chicago PMI for January is predicted at 58.5. Forex traders can compare this to the US Chicago PMI for December, reported at 58.7.

US Personal Income for December is predicted to increase by 0.1% monthly, and Personal Spending is predicted to decrease by 0.4% monthly. Forex traders can compare this to Personal Income for November, which decreased by 1.1% monthly, and to Personal Spending, which decreased by 0.4% monthly. The PCE Core Deflator for December is predicted to increase by 0.1% monthly and 1.3% annualized. Forex traders can compare this to the PCE Core Deflator for November, which increased by 0.2% monthly and by 1.4% annualized.

US Pending Home Sales for December are predicted to decrease by 0.1% monthly. Forex traders can compare this to US Pending Home Sales for November, which decreased by 2.6% monthly. The final US Michigan Consumer Sentiment for January is predicted at 79.2. Forex traders can compare this to US Michigan Consumer Confidence for December, reported at 80.7.

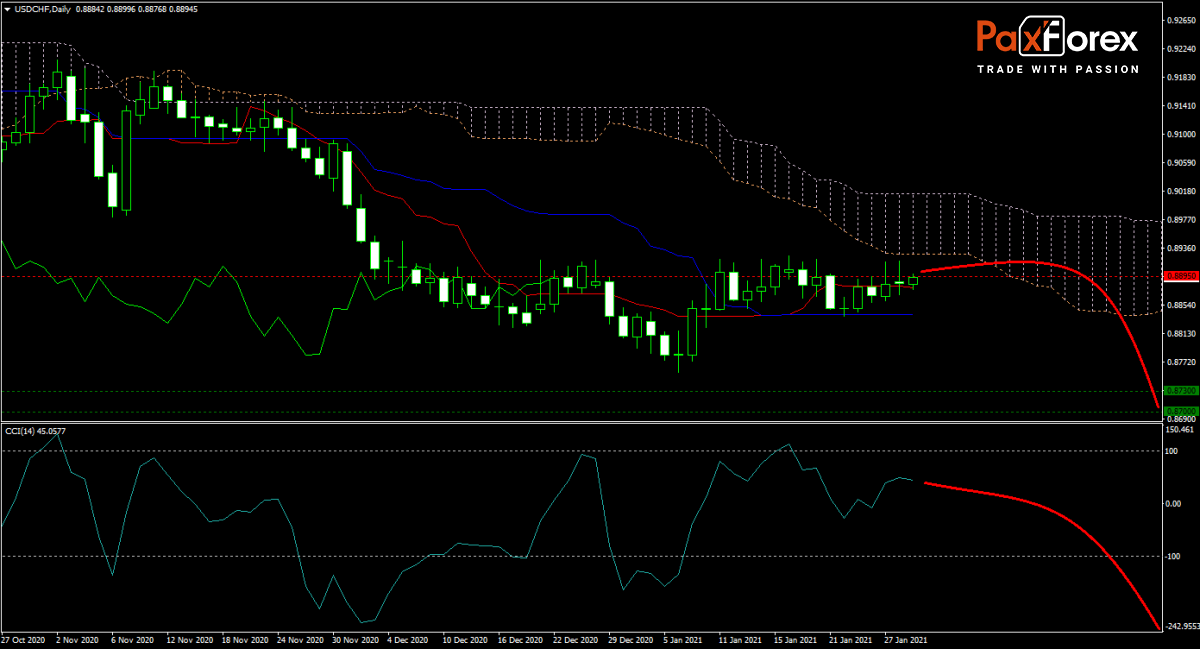

The forecast for the USD/CHF remains bearish as the US Dollar is under pressure from a dovish central bank, unsustainable debt, and a weak economy. Price action drifted into its descending Ichimoku Kinko Hyo Cloud, and the Tenkan-sen started to move lower. A crossover below its flat Kijun-sen can add to more selling pressure. The CCI moved out of extreme overbought territory and below 100. Will bears take advantage of recent developments and force the USD/CHF into its next horizontal support area, using safe-haven demand as a catalyst? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/CHF remain inside the or breakdown below the 0.8875 to 0.8925 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.8895

- Take Profit Zone: 0.8670 – 0.8730

- Stop Loss Level: 0.8880

Should price action for the USD/CHF breakout above 0.8925 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.8880

- Take Profit Zone: 0.8930 – 0.8960

- Stop Loss Level: 0.8925

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.