Canadian Housing Starts for April are predicted at 110.0K. Forex traders can compare this to Canadian Housing Starts for March, which were reported at 195.2K. Canadian Building Permits for March are predicted to decrease by 20.0% monthly. Forex traders can compare this to Canadian Building Permits for February, which decreased by 7.3% monthly. The Canadian Employment Report for April is predicted to show the loss of 4,000.0K jobs and an Unemployment Rate of 18.0%. Forex traders can compare this to the Canadian Employment Report for March, which showed the loss of 1,010.7K jobs and an Unemployment Rate of 7.8%. The Participation Rate for April is predicted at 65.1%. Forex traders can compare this to the Participation Rate for March, which was reported at 63.5%.

The US NFP Report for April is predicted to show 22,000K job losses and an unemployment rate of 16.0%. Forex traders can compare this to the US NFP Report for March, which showed 701K job additions and an unemployment rate of 4.4%. Private Payrolls for April are predicted to show 21,050K job losses and Manufacturing Payrolls 2,500K job losses. Forex traders can compare this to Private Payrolls for March, which showed 713K job losses and to Manufacturing Payrolls, which showed 18K job losses. The Average Work Week for April is predicted at 33.7 hours. Forex traders can compare this to the Average Work Week for March, which was reported at 34.2 hours. Average Hourly Earnings for April are predicted to increase by 0.4% monthly and by 3.3% annualized. Forex traders can compare this to Average Hourly Earnings for March, which increased by 0.4% monthly and by 3.1% annualized. The Labor Force Participation Rate for April is predicted at 62.3%. Forex traders can compare this to the Labor Force Participation Rate for March, which was reported at 62.7%.

US Preliminary Wholesale Inventories for March are predicted to decrease by 1.0% monthly. Forex traders can compare this to US Wholesale Inventories for February, which decreased by 0.7% monthly.

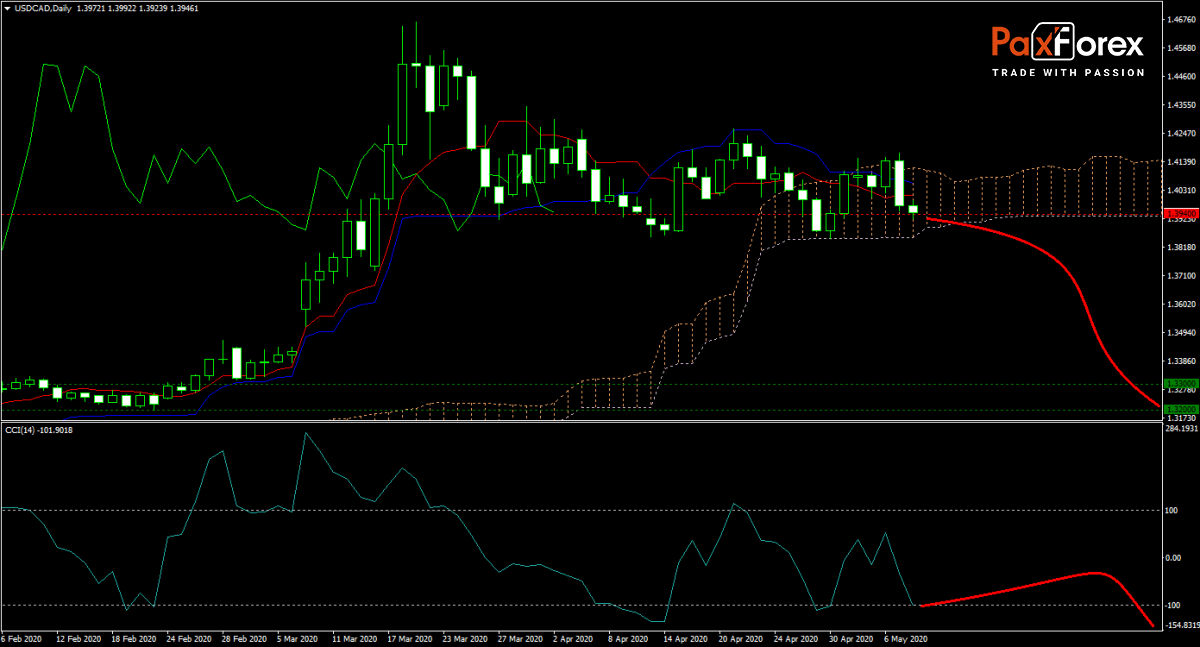

The USD/CAD forecast continues its bearish trajectory with US data disappointing. Today’s NFP report is expected to show the worst employment report in history, with over 22 million job losses. The Canadian labor situation is equally at all-time lows due to the Covid-19 pandemic, but the overall US fundamental condition is more worrisome. Price action moved into the Ichimoku Kinko Hyo cloud from where more selling is likely following this afternoon’s US and Canadian employment reports. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/CAD remain inside the or breakdown below the 1.3900 to 1.4000 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3940

- Take Profit Zone: 1.3200 – 1.3300

- Stop Loss Level: 1.4055

Should price action for the USD/CAD breakout above 1.4000 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.4055

- Take Profit Zone: 1.4200 – 1.4260

- Stop Loss Level: 1.4000

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.