The Canadian GDP for March is predicted to decrease by 9.0% monthly and by 10.0% annualized. Forex traders can compare this to the Canadian GDP for February, which was reported flat at 0.0% monthly, and which increased by 0.3% annualized. The Canadian Industrial Product Price Index for April is predicted to decrease by 1.7% monthly, and the Canadian Raw Materials Price Index is predicted to decrease by 13.6% monthly. Forex traders can compare this to the Canadian Industrial Product Price Index for March, which decreased by 0.9% monthly and to the Canadian Raw Materials Price Index, which decreased by 15.6% monthly.

US Personal Income for April is predicted to decrease by 6.5% monthly, and Personal Spending is predicted to decrease by 12.6% monthly. Forex traders can compare this to Personal Income for March, which decreased by 2.0% monthly and to Personal Spending, which decreased by 7.5% monthly. The PCE Core Deflator for April is predicted to decrease by 0.3% monthly, and to increase by 1.1% annualized. Forex traders can compare this to the PCE Core Deflator for March, which decreased by 0.1% monthly, and which increased by 1.7% annualized. The US Chicago PMI for May is predicted at 40.0. Forex traders can compare this to the US Chicago PMI for April, which was reported at 35.4.

Final US Michigan Consumer Sentiment for May is predicted at 74.0. Forex traders can compare this to previous US Michigan Consumer Confidence for May, which was reported at 73.7. Final Current Conditions for May are predicted at 83.0, and Final Expectations are predicted at 67.7. Forex traders can compare this to previous Current Conditions for May, which were reported at 83.0 and to Expectations, which were reported at 67.7.

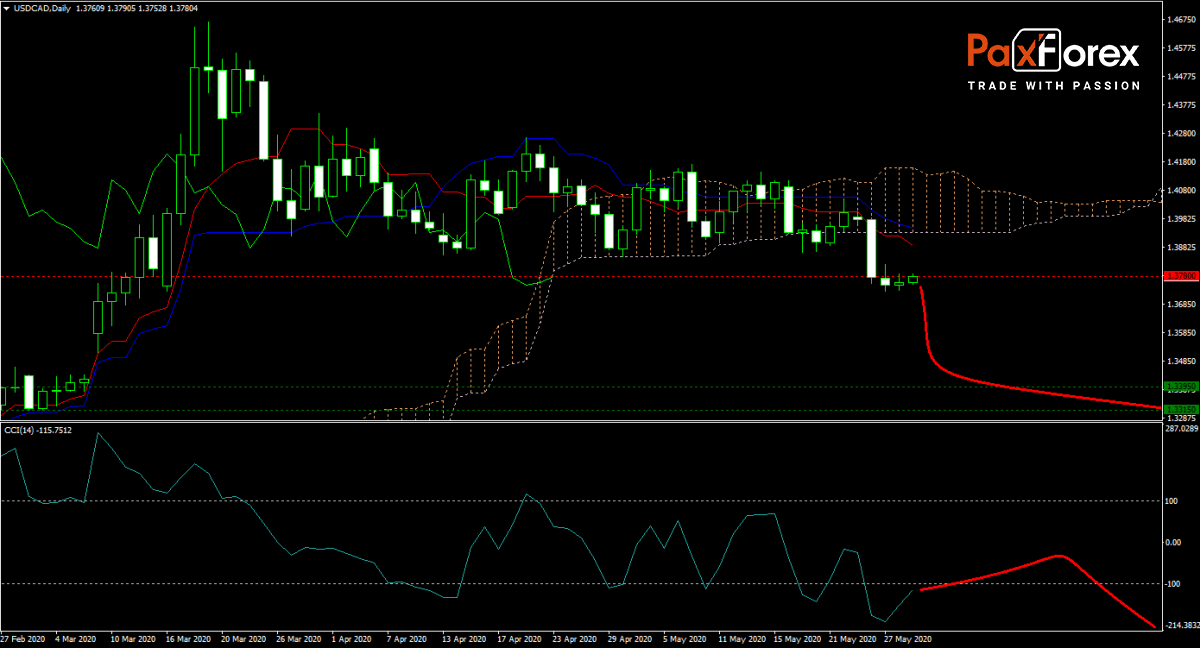

The USD/CAD forecast remains bearish after this currency pair moved below its Ichimoku Kinko Hyo cloud. US weekly initial jobless claims came in higher than expected yesterday, while total claims decreased. This currency pair may attempt a move higher, but the Tenkan-sen and Kijun-sen provide a profound resistance level. Today’s US income and spending data may give bears the next downward catalyst. Will price collapse heading into the weekend? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/CAD remain inside the or breakdown below the 1.3730 to 1.3820 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3780

- Take Profit Zone: 1.3315– 1.3395

- Stop Loss Level: 1.3865

Should price action for the USD/CAD breakout above 1.3820 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3865

- Take Profit Zone: 1.3920 – 1.3960

- Stop Loss Level: 1.3780

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.