Source: PaxForex Premium Analytics Portal, Fundamental Insight

US Construction Spending for October is predicted to increase by 0.8% monthly. Forex traders can compare this to US Construction Spending for September, which increased by 0.3% monthly. The US ISM Manufacturing Index for November is predicted at 58.0. Forex traders can compare this to the US ISM Manufacturing Index for October, reported at 59.3. ISM Prices Paid for November are predicted at 65.0. Forex traders can compare this to ISM Prices Paid for October, reported at 65.5.

The Canadian GDP for September is predicted to decrease by 0.9% monthly and third-quarter by 47.6% annualized. Forex traders can compare this to the Canadian GDP for August, which increased by 1.2% monthly, and to second-quarter GDP, which decreased by 38.7% annualized.

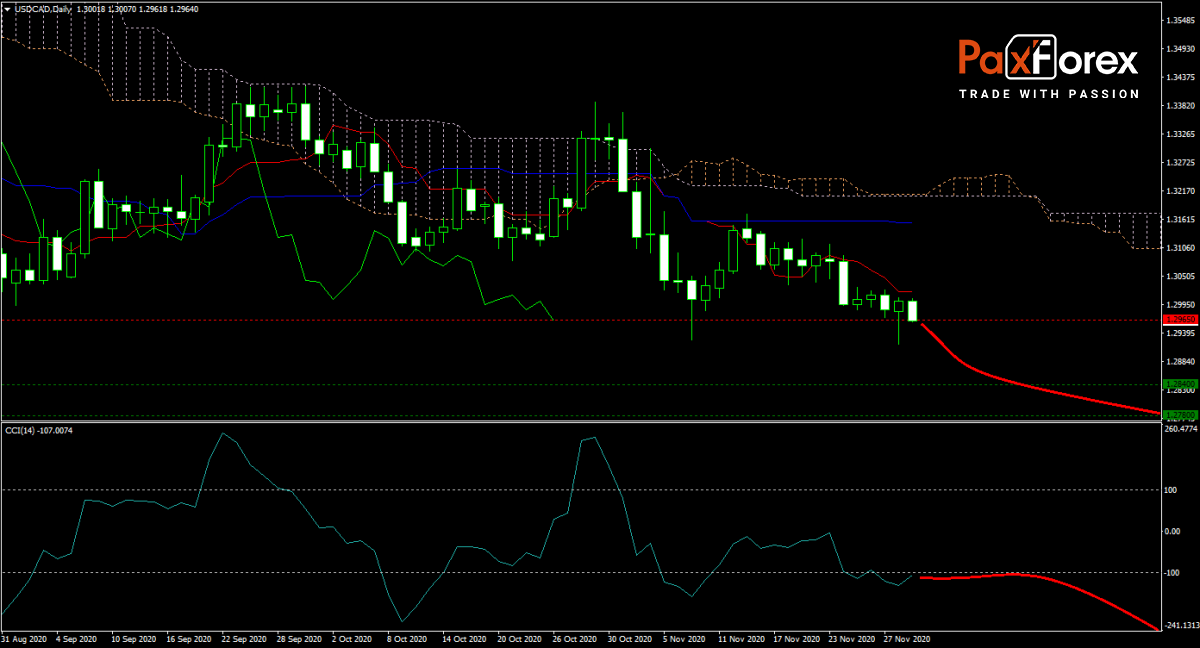

The forecast for the USD/CAD remains bearish after this currency pair moved below its flatlining Tenkan-sen, located below its Kijun-sen. With US economic reports suggesting a slowing recovery, and several states implementing emergency hospital protocols, the outlook continues to weaken for the US Dollar. The Ichimoku Kinko Hyo Cloud sloped downwards and narrowed its band, and the CCI is in extreme oversold territory with more downside potential. Will bears force more downside in the USD/CAD? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/CAD remain inside the or breakdown below the 1.2925 to 1.3000 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.2965

- Take Profit Zone: 1.2780 – 1.2840

- Stop Loss Level: 1.3035

Should price action for the USD/CAD breakout above 1.3000 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3035

- Take Profit Zone: 1.3150 – 1.3175

- Stop Loss Level: 1.3000

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.