The Canadian Employment Report for March is predicted to show the loss of 500.0K jobs and an Unemployment Rate of 7.4%. Forex traders can compare this to the Canadian Employment Report for February, which showed the addition of 30.3K jobs and an Unemployment Rate of 5.6%. Hourly Earnings for Permanent Employees for March are predicted to increase by 4.4% annualized. Forex traders can compare this to Hourly Earnings for Permanent Employees for February, which increased by 4.3% annualized. The Participation Rate for March is predicted at 65.0%. Forex traders can compare this to the Participation Rate for February, which was reported at 65.5%.

US Initial Jobless Claims for the week of April 4th are predicted at 5,250K, and US Continuing Claims for the week of March 28th are predicted at 8,000K. Forex traders can compare this to US Initial Jobless Claims for the week of March 28th, which were reported at 6,648K and to US Continuing Claims for the week of March 21st, which were reported at 3,029K.

The US PPI for March is predicted to decrease by 0.4% monthly and to increase by 0.5% annualized. Forex traders can compare this to the US PPI for February, which decreased by 0.6% monthly, and which increased by 1.3% annualized. The US Core PPI for March is predicted flat at 0.0% monthly, and to increase by 1.2% annualized. Forex traders can compare this to the US Core PPI for February, which decreased by 0.3% monthly, and which increased by 1.4% annualized. The US Core PPI ex Trade for March is predicted to decrease by 0.1% monthly, and to increase by 1.0% annualized. Forex traders can compare this to the US Core PPI ex Trade for February, which decreased by 0.1% monthly, and which increased by 1.4% annualized.

Preliminary US Michigan Consumer Sentiment for April is predicted at 75.0. Forex traders can compare this to US Michigan Consumer Confidence for March, which was reported at 89.1. Preliminary Current Conditions for April are expected at 112.0, and Preliminary Expectations are predicted at 88.2. Forex traders can compare this to Current Conditions for March, which were reported at 103.7 and to Expectations, which were reported at 79.7. US Final Wholesale Inventories for February are predicted to decrease by 0.5% monthly. Forex traders can compare this to US Wholesale Inventories for January, which decreased 0.4% monthly.

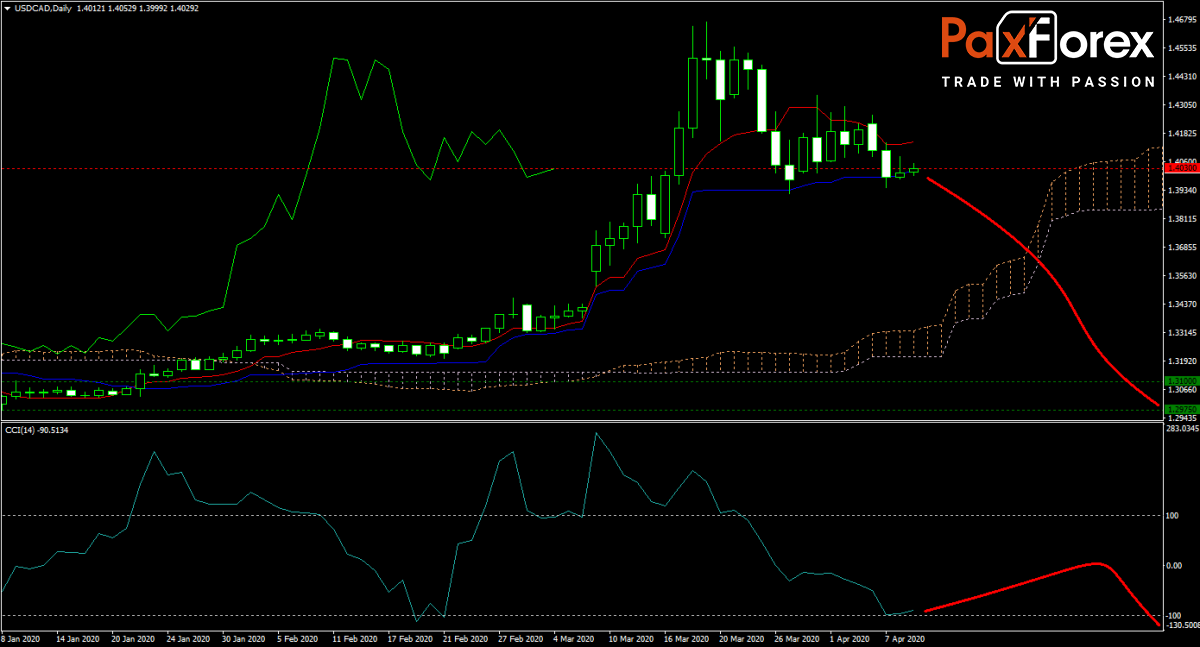

The USD/CAD forecast remains bearish after entering a sell-off from a multi-year high. US initial jobless claim will be in today’s focus after the previous two weeks saw a record amount of filings at 10M, lifting the four-week average to over 3M. The breakdown in this currency pair below the Tenkan-sen added to the bearish outlook. Will today’s initial jobless claims data out of the US force more selling? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/CAD remain inside the or breakdown below the 1.3990 to 1.4080 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.4030

- Take Profit Zone: 1.2975 – 1.3100

- Stop Loss Level: 1.4200

Should price action for the USD/CAD breakout above 1.4080 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.4200

- Take Profit Zone: 1.4500 – 1.4660

- Stop Loss Level: 1.4080

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.