Source: PaxForex Premium Analytics Portal, Fundamental Insight

In April 2021, Twitter shares fell by more than 13%. At the same time from the beginning of the year to the beginning of May the shares lost 1%, and over the past 12 months they rose 90%. Let's look into the main reasons for the decline and consider the company's prospects.

On April 9, the company published financial results for Q1 2021. Revenues were up 28% YoY, exceeding $1 billion. The number of daily active users bringing monetization was up 20% YoY, to 199 million. Net income of $68 million was generated, versus a loss of $8 million last year.

The results are good. However, the company forecasts to earn $0.98 billion to $1.08 billion in Q2 2021, the midpoint of this range below Wall Street expectations of $1.05 billion. The market doesn't like this, and advertising competitors such as Google, Facebook and Snap are showing better revenue trends.

In addition, the company plans to increase spending by 25 percent this year. After such statements, some analysts reported downward revisions to their ratings and targeting.

One reason was the mixed Q2 estimate, which should have been higher given Twitter's management's announcement of a recovery in advertising revenue. Some analysts focused on slowing user growth and questioned whether users would use the app in the post-pandemic period.

Twitter previously held an Investor Day, voicing a goal of 315 million daily users by 2023, up from 192 million at the end of 2020. Moreover, Twitter continues to look for ways to broaden its appeal by adding new options.

Shares of Twitter gained 11.6% last week, leading social media stocks over the period. Snap Inc. was the only other company whose stock rose more than 5 percent over the same period, though the rest of the company had a better week than the S&P 500.

Twitter's stock gains over the past week were mostly due to positive news about its efforts to increase monetization, both for its top users and for the company itself.

There have been rumors for some time that Twitter was planning to introduce a number of features that - finally - would help it monetize its user base to make money. And we've seen a few of these recently come to fruition, including Twitter Spaces and, more recently, Twitter Blue, a subscription service the company has already rolled out in several international markets that adds some extra features for users willing to pay.

But now the next group is on the horizon, and it makes investors feel more optimistic: Super Follows and Ticketed Spaces. In short, the Twitter bulls have high hopes that the addition of features that Twitter users will pay for, and the ability to host paid events at Twitter Spaces, will unlock more economic value for Twitter users, as the company will get a cut of what its users pay for Ticketed Spaces and Super Follows.

The plans for these two new offerings have been in development for months and shouldn't come as a surprise to anyone who follows Twitter. But the point is that they will finally appear in the real world and start generating revenue for the company. Twitter stock trades at about 14 times sales and less than 49 times operating cash flow, and only Facebook can offer a lower valuation among similar social networks.

If these new revenue-generating offerings turn out to be even moderately successful, Twitter could be a bargain at these prices. All that remains is the hard part: releasing them on the market and finding out if they will make money, or if it will be another failed attempt that fails to justify itself.

Although the company has been upsetting investors more lately, it is trying to set clear goals, identify development options and make the platform attractive to current and new users.

The current financial results cannot be called disastrous. On the contrary, Twitter is trying to be on trend and creating new services to make it more attractive. Stock movements after the publication of the report are usually impulsive and more often speculative in nature without determining a long-term direction. This is probably the case for Twitter. It is worth noting that earnings forecasts have not changed significantly: sales will be in line with expectations.

In the future, investors and analysts will have to evaluate the company's innovations. In the short term, sellers can still create pressure, but for long-term investors, the opportunity to enter a position at interesting levels is open. In general, the analysts` target on the horizon for the year is $75-80.

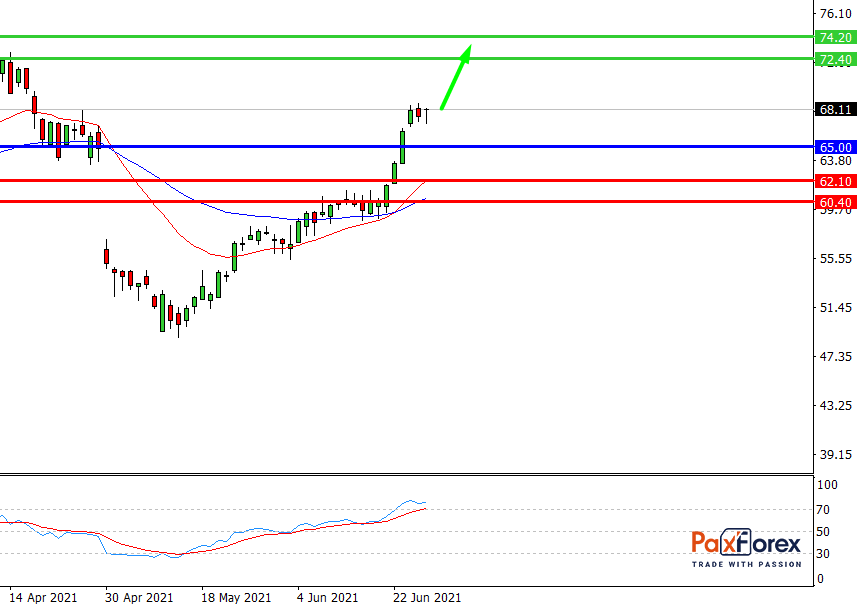

Provided that the company is traded above 65.00 , follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 68.11

- Take Profit 1: 72.40

- Take Profit 2: 74.20

Alternative scenario:

In case of breakdown of the level 65.00 , follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 65.00

- Take Profit 1: 62.10

- Take Profit 2: 60.40