Source: PaxForex Premium Analytics Portal, Fundamental Insight

Social media companies have had a great year due to the fact that the "stay-at-home" trend has boosted activity and engagement on their platforms. But the situation is changing, and life is slowly returning to normal, so it may well be that the most successful times are behind for some of these technology companies.

Twitter offered incredibly optimistic guidance for early 2021, announcing plans to nearly double its 2020 annual revenue by the end of 2023, but its first-quarter results caused the stock to plummet after a while.

With that in mind, investors may be cautious ahead of the second-quarter results to be released on July 22. With economic revelations sending consumers back into the physical economy, it seems pretentious to anticipate Twitter to revive weak growth in some key metrics.

Valuations are often a source of heated debate for tech companies. Sometimes they are hard to value, especially when their business is making a loss. Few are consistently profitable, like Facebook, which has proven its value to both growth and value-oriented investors. This company trades at 30 times earnings per share and has increased earnings by double digits every year for the past five years -- and investors have been rewarded with a 200% increase in its share price during that time.

Twitter, on the other hand, lost $1.44 per share in 2020 and improved only slightly in the first quarter of 2021, gaining $0.09 - the company was unable to build on a really strong 2019, despite the benefits of quarantine restrictions. That didn't stop the stock price from rising, which rose 26% over the year, valuing the company at $55 billion. But as investors saw after the first-quarter report, such gains quickly evaporate when the company underperforms.

Twitter's goal of $7.5 billion in annual revenue by 2023 seems unlikely, given that in 2020, that figure grew only 7.4% to $3.72 billion. Moreover, growth has slowed each of the last three years, from 24.5% in 2018 to 13.7% in 2019.

In fact, to reach that lofty goal, the company needs to add $1.27 billion in new revenue in each of the next three years - or about $317 million per quarter. The $229 million added in the first quarter fell short of that goal.

As for estimates, analysts on average are forecasting second-quarter earnings of $0.07, which would be a slight decline from the previous quarter. For all of 2021, Twitter's earnings are expected to be $0.79 per share, which means that most of the company's revenue will be in the second half of the year.

The average revenue forecast for the second quarter is $1.06 billion, an increase of just 2.3 percent from the $1.036 billion generated in the first quarter. However, the company itself expects second-quarter revenues to be between $980 million and $1.08 billion, leaving a wide range with no significant upside from the first quarter.

Maybe most distinctly, Twitter forecasts an operating loss in the second quarter of up to $170 million.

The company is experimenting with some new features, including Twitter Spaces, which allows users to have audio conversations in a setting similar to competitors' Clubhouse. It is also changing the traditional platform experience, giving users more control over who can see their tweets and the ability to "unlink" themselves from content. These additions will ultimately drive revenue growth for the company, but probably not in the short term.

User growth is the essence of Twitter's platform - it's one of the few things that can really boost revenue growth and profit potential. In each of the past six quarters, it has grown at an annualized rate of more than 20 percent, although it has been growing consistently at less than 5 percent, indicating a possible slowdown in growth. This is something to keep an eye on because an acceleration in growth would be positive for the company's prospects.

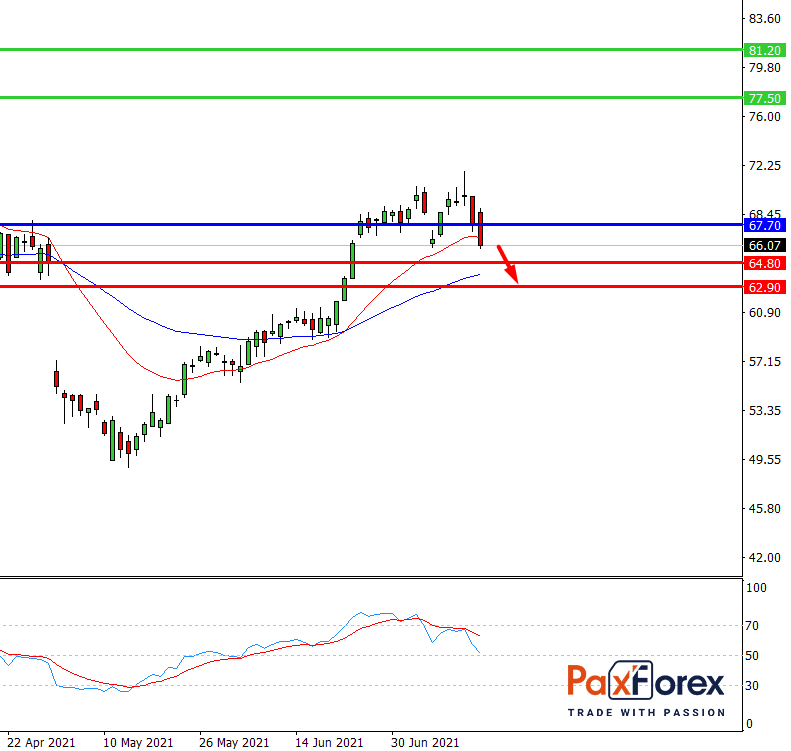

On April 29, Twitter shares were trading at $65. The company then released its first-quarter report, which triggered a 23% drop in the following weeks. The company's stock is about to hit the $70 mark amid a rising market, and investors should be cautious as the upcoming earnings report could do the same.

Overall, with only marginal earnings and financial targets in question, owning Twitter stock ahead of second-quarter results can be quite risky. Investors who like this company may want to wait and add the stock to their portfolio after we see another drop.

While the price is below 67.70, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 66.07

- Take Profit 1: 64.80

- Take Profit 2: 62.90

Alternative scenario:

If the level 67.70 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 67.70

- Take Profit 1: 77.50

- Take Profit 2: 81.20