Source: PaxForex Premium Analytics Portal, Fundamental Insight

Shares of Twitter dropped more than 20 percent after the latest earnings report was released as investors reacted to its first-quarter results. Although the company marginally beat analysts' estimates, results in key metrics such as revenue and growth in monetizable daily active users (mDAUs) were not strong.

Earlier this year, Twitter said it plans to double revenues of $3.7 billion in 2020 to $7.5 billion a year by the end of 2023 and increase monetizable users by at least 60 percent. Despite a consistent 19.6% decline in revenue last quarter, the company says those plans remain on track, but investors don't seem to have much faith in it.

Twitter has long been a disappointing stock for shareholders. The company has some competitive advantages and is a unique social media platform, but it has failed to build a thriving business like that of Facebook.

The company's management cannot define the purpose of the platform, its best use cases, or how to provide users, especially new ones, with the best experience. In addition, the company has had difficulty providing relevant advertising, making it difficult to compete with major platforms such as Google, Facebook, and Amazon.

Although Twitter's stock has generally performed well over the past few years, its value is still below the peak it reached in 2014, shortly after its IPO.

It's a fair criticism of the stock and the company, but it doesn't take into account where Twitter is today. The company has made significant strides against harassment on the platform, and the removal of Donald Trump's account did not generate the reaction many expected.

Despite the stock misfortunes, Twitter continues to innovate faster than it has in a long time: it launched Twitter Spaces (an audio platform similar to Clubhouse), acquired Revue to add a subscription business similar to Substack, and introduced Super Follows to allow top contributors to monetize their content, giving the company new ways to grow revenue and increase engagement. In addition, Twitter also said it will give hosts the ability to sell tickets to events on Twitter Spaces.

The company has also expanded the thematic sections to make the platform more relevant and easy to use, as users can get information on topics that interest them. On the advertising side, there has been steady growth in brand advertising and mobile app promotion, and new advertising products such as Curated Categories have been added, giving advertisers the ability to target content and conversations that are only on Twitter.

Basically, Twitter needs to generate about $1.27 billion in revenue per year in 2021, 2022, and 2023 to reach its 2023 revenue goal.

The company's actual past revenue growth hasn't quite matched those lofty expectations, with only $417 million in 2019 and $257 million last year. Not only is this far below what Twitter needs, but growth appears to be slowing.

Moreover, revenue in the first quarter fell to $1.04 billion, down from $1.29 billion in the fourth quarter of 2020, a nearly 20 percent drop. In dollar terms, Twitter is starting the year on the back burner, and it looks unlikely to grow as much as it needs to for its long-term goal - at least this year. However, that figure is 28% higher than last year's quarter, so the door remains open if the company can seriously outperform in the remainder of 2021.

Growth in monetized daily active users was slightly more favorable. That figure was up 4% for the quarter and 20% year over year. However, the 4% sequential growth through the end of 2023 will result in only 306 million users, down from the 315 million the company predicts. That will change if the company maintains its year-over-year growth trajectory, but it will be a very serious setback because of the tough comparisons in 2020 and the ongoing economic recovery.

The results so far suggest that Twitter is falling short of the ambitious promises that were made to investors in February, and this is the main reason for the stock's sharp drop after the report was published. If mDAU growth stops slowing, the company could reach its user target, but any weak reports would end the discussion.

At around $50 a share at the moment of writing, Twitter has a market value of $42 billion. That would make sense if 2019 earnings were $1.87 per share, as the price-to-earnings multiple is about 28. However, the company failed to deliver a similar result in 2020, losing $1.44 per share and leaving investors hoping for the ambitious outlook discussed above.

Twitter is right in the middle between two key social media competitors: Facebook, which trades at about 30 times 2020 earnings while continuing to build on its bottom line, and Snap, which has repeatedly failed to deliver full-year earnings and instead trades at 30 times 2020 earnings.

Twitter is trading at a more reasonable price, at 11 times its 2020 earnings.

Given the effects of the pandemic and Twitter's ability to manage them to deliver revenue and user growth in 2020, investors probably thought the company would carry that momentum into the new year, which was certainly reflected in the stock price. After analyzing its first-quarter results, however, it became clear that Twitter's medium-term goals may have been overstated.

For the company to level out, it needs to maintain user growth and monetize quickly to support the top line expansion needed to double revenues in just a few years. Otherwise, the stock could find itself underperforming the broad market.

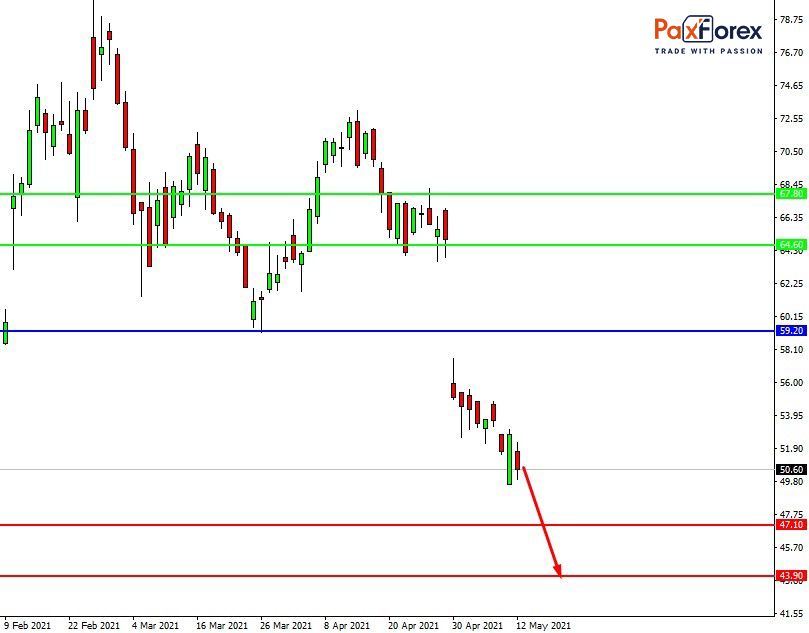

Provided that the company is traded below 59.20, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 53.79

- Take Profit 1: 47.10

- Take Profit 2: 43.90

Alternative scenario:

In case of breakout of the level 59.20, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 59.20

- Take Profit 1: 64.60

- Take Profit 2: 67.80