Source: PaxForex Premium Analytics Portal, Fundamental Insight

In recent months, Tesla has caused a flood of press coverage, much of it focused on its problems in China. But at the same time, another story has been developing about the company's chase of self-driving cars.

Both of these cases could have a tremendous impact on the company's stock. Here are two things you should know about Tesla.

- Troubles in China

At the beginning of 2019, Tesla began building the Gigafactory Shanghai, becoming the first foreign automaker to own a 100 percent plant in China, the world's largest electric vehicle (EV) market if we talk about the number of cars on the road.

Things have been going very well for several years. Tesla delivered its first Model 3 made in China in late 2019. And notwithstanding the COVID-19, the company ramped up Model 3 production and last year began producing the Model Y in Shanghai. But problems arose in April 2021, when a protest by angry customers over Tesla's quality and safety problems at the Auto Shanghai show went viral.

It triggered a backlash from consumers in China, with people taking to social media, expressing displeasure over Tesla's constant haughtiness and quality issues. Soon after, the company issued a public apology, pledging to set up a customer service unit in the region.

Then, in June, Tesla faced another obstacle. After an investigation, a Chinese regulator claimed that the cruise control system in Tesla cars could be accidentally activated, provoking sudden acceleration. To fix the problem, affected customers had to update the cruise control software remotely (i.e., without a trip to the dealership). In total, more than 285,000 vehicles were affected.

That's bad news for Tesla, especially after the recent consumer backlash. But there is a silver lining: After a dip in April, demand for Tesla cars in China has rebounded, as evidenced by an increase in sales compared to the previous month.

China is currently Tesla's second-largest market after the U.S., but CEO Elon Musk believes it will eventually become the largest. It makes sense, considering that this country currently accounts for almost half of the global electric car market.

Between January and May 2021, Tesla gained 12 percent of the electric car market in China, ranking third behind SAIC-GM-Wuling Automobile and BYD Auto. Investors should keep an eye on these numbers - if Tesla wants to become a long-term global leader, it needs to be a major player in China.

- Full self-driving software

Starting in early 2019, all Tesla cars are equipped with hardware 3.0, a third-generation supercomputer that powers autopilot and full-self-driving (FSD) software. Remarkably, the computer chip used in this hardware is 1000% more powerful than the previous one, and Musk called it " the best chip in the world."

Of course, Musk has never been shy about making bold statements. In fact, during the company's Battery Day event last September, he told investors, "In about three years, we believe we can create a very attractive $25,000 electric car that's also fully autonomous."

In early July, Tesla got a little closer to that goal by releasing version 9.0 of its FSD beta testing software. In April, Musk announced it on Twitter, saying: "FSD Beta V9.0 will blow your mind." Musk also said that the software achieves higher safety scores using pure vision rather than vision plus radar, citing the company's decision to rely solely on cameras for the inputs used by its self-driving cars.

That's what makes the debut so significant - FSD 9.0 is the first version of the software that no longer uses input from radar sensors. This strategy stands in stark contrast to that of competitors like General Motor's Cruise, Intel's Mobileye, and Alphabet's Waymo, which use radar and lidar to build maps with centimeter-level accuracy.

However, Tesla believes this map-based approach is flawed, citing its lack of scalability. For example, self-driving cars based on mapping technology will only operate safely on roads that have been carefully mapped. And even then, the slightest change (such as road debris) can cause chaos. By comparison, if Tesla's vision-based approach works, it could theoretically be instantly scalable.

Investors should watch carefully how well (or poorly) FSD version 9.0 will be adopted. It could be a turning point in Tesla's quest for autonomy - one way or another.

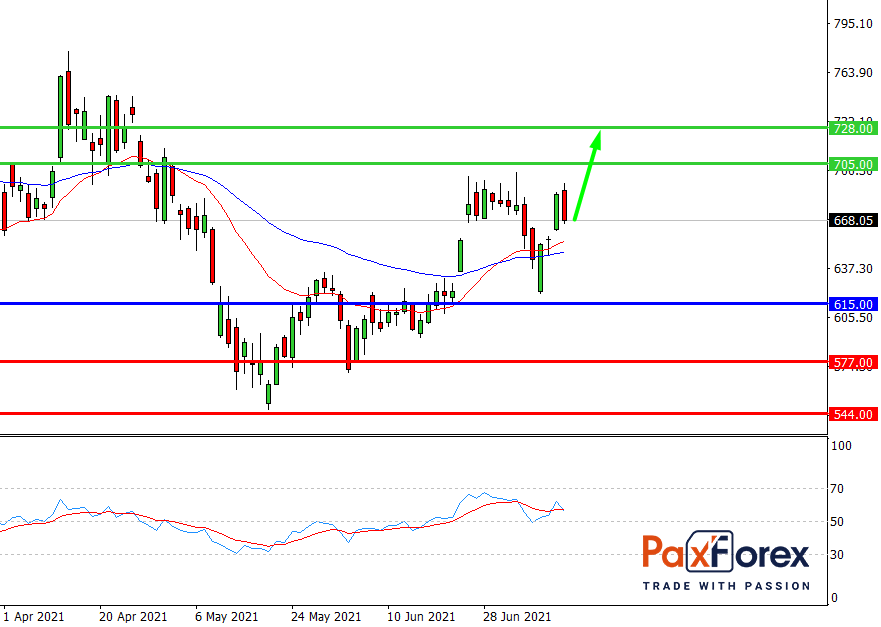

Provided that the company is traded above 615.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 656.00

- Take Profit 1: 705.00

- Take Profit 2: 728.00

Alternative scenario:

In case of breakdown of the level 615.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 615.00

- Take Profit 1: 577.00

- Take Profit 2: 554.00