Source: PaxForex Premium Analytics Portal, Fundamental Insight

Concerns about Tesla electric car sales in China have recently intensified, raising some concerns about the high valuation of the rising stock. For example, GLJ Research analyst Gordon Johnson believes that monthly deliveries of Tesla vehicles in the important car market have peaked at around 20,000 units.

But one analyst remains adamant about Tesla stock: Wedbush analyst Daniel Ives.

While Ives admits that Tesla's second-quarter may not have gotten off to a good start in China, he believes that things will level out over time, as the market opportunity is very large. He predicts that electric car sales as a percentage of total annual car sales in that market will grow from 5% to 10% over the next 10 years.

In addition, the analyst notes that recently released data from the China Passenger Car Association (CPCA) indicates a 29% jump in monthly Tesla car sales in May compared to April - although 11,527 of the 33,463 vehicles were exported. Still, with the reported 33,463 deliveries, the company's Chinese production appears to be a significant contributor to Tesla's overall sales. By comparison, Tesla delivered about 185,000 electric cars worldwide in the first quarter of 2021.

Tesla is actively investing in the Chinese market, having built a large plant in Shanghai. Indeed, the Chinese market currently has enough equipment installed to produce 450,000 cars a year, although Tesla may need time to ramp up production to reach that capacity.

Ives set a 12-month price target on Tesla stock at $1,000, which represents a 67% increase over how the stock trades today.

The analyst set a $1,000 price target for the company's stock after Tesla announced first-quarter deliveries that exceeded analysts' forecasts. While raising the price target, the analyst said he believes Tesla's shipments this year could exceed 850,000 units, a huge jump from about 500,000 units last year.

While these analyst opinions may be informative, investors should pay less attention to month-over-month and quarter-over-quarter deliveries and more to Tesla's year-over-year results.

It's hard to gauge the company's sales momentum or expansion over months or quarters.

By the end of 2020, there were 10 million electric cars worldwide, up from 17,000 some ten years ago. This rapid growth in popularity has been boosted by several factors: enhancements in battery technology, lower costs, government subsidization of purchases, and a growing interest in reducing carbon emissions.

More importantly, this trend is foreseen to proceed. According to Allied Market Research, the global electric car market will grow nearly 23 percent a year through 2027 to reach $803 billion. And Tesla is at the vanguard of this trend.

As of March 2021, the company had 16 percent of the electric car market, while its closest competitor had only 9 percent. It puts Tesla in an advantageous position - but that's not all.

Since October 2016, all Tesla cars have come with the latest autopilot equipment. And with more than 1 million cars on the road, Tesla has access to far more real-world driving data than any of its competitors. In fact, as of February 2020, its fleet had more than 3 billion miles on autopilot. It gives Tesla a vital advantage in the race to create a fully autonomous car.

Distinctly, Tesla intends to launch an autonomous driving network in the future. And, according to analysts, this market could bring more than $1 trillion in profits by 2030.

To increase production capacity, Tesla is building a Gigafactory in Berlin, where the Model Y will be produced, and a Gigafactory in Texas, where both the Model Y and Cybertruck will be produced. Once these factories are up and running, Tesla believes it will be able to increase deliveries by 50 percent a year over the next few years.

It's good news for investors. According to Grand View Research, the total number of EV units will grow 42% per year through 2027. If Tesla can outpace industry-wide growth, it will gain market share in the coming years.

Tesla's stock has a market value of $575 billion. For perspective, that means the company is worth more than Toyota, Volkswagen, Daimler, and General Motors combined. But that wasn't always the case. Just 12 months ago, Tesla had a market value of $150 billion -- in other words, its value has risen 280 percent in the past year.

Not surprisingly, Tesla stock looks very expensive. In fact, at 18 times sales and 597 times earnings, to say that the company's stock trades at a very high value would be an understatement. The vast majority of automakers don't come close to such multiples. So investors should ask themselves the important question - can Tesla justify that price over the long term?

Let's broaden the range and see what happens over the full year. The automaker's total deliveries in China in 2021 compared to its total market deliveries in 2020 and 2019 will likely be more indicative of the company's long-term sales trajectory in the market.

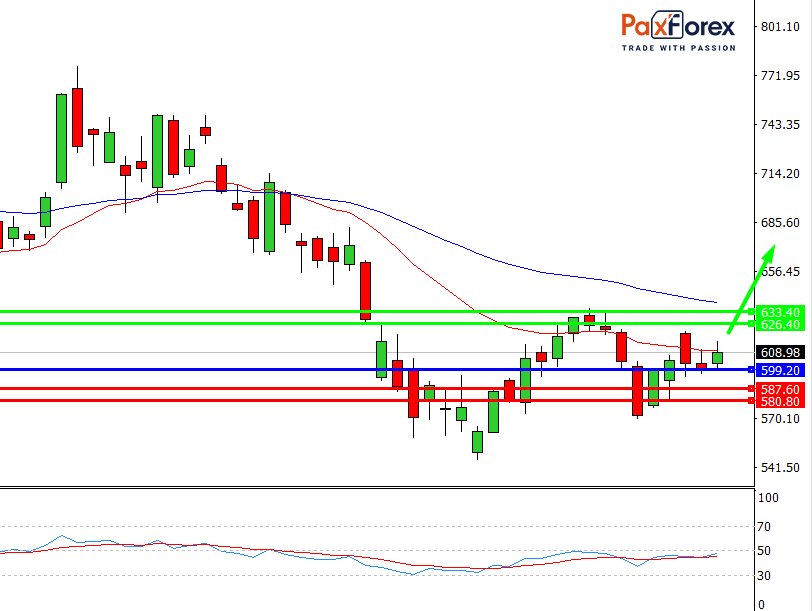

While the price is above 599.20, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 608.87

- Take Profit 1: 626.40

- Take Profit 2: 633.40

Alternative scenario:

If the level 599.20 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 599.20

- Take Profit 1: 587.60

- Take Profit 2: 580.80