Source: PaxForex Premium Analytics Portal, Fundamental Insight

Since the release of its first Roadster in 2008, Tesla has not been looking back. Over the years, the company has proved many of its skeptics wrong. Tesla rightfully deserves praise for its ongoing transformation of the auto industry from internal combustion engine vehicles to electric vehicles. The company is already a threat to the decades-long dominance of legacy car companies. Let's take a look at where Tesla could be in 10 years.

Tesla sold 499,550 electric cars last year. It expects 50% average annual growth in shipments within a few years. The company currently has two plants, one in Fremont, California, and one in Shanghai, China. In addition, the company is building two more plants, one in Berlin and one in Texas. Production at the Berlin plant has been moved from late this year to early next year, while the Texas plant still plans to begin deliveries later this year.

From 2016 to 2020, Tesla has been increasing deliveries by an average of 65 percent. The electric-car maker's annual shipments increased from 76,230 in 2016 to 499,535 in 2020.

Assuming annual deliveries grow by an average of 50% over the next four years, and after that, the growth rate declines to an average of 25%, Tesla could sell about 10 million cars by 2030. By comparison, Toyota sold 9.5 million cars in 2020, the highest of any automaker in the world.

If we were to base this forecast solely on a four-year growth rate, then Tesla's expected growth figures look reasonable. However, past growth was initially based on a lower base.

Boosting production at such a high rate could be a challenge.

Tesla currently has a production capacity of about 1 million cars. With planned plants in Berlin and Texas, it is likely to double that capacity. To reach its goal of 10 million cars, Tesla would need about 16 more plants, assuming an average capacity of 500,000 units. Even if Tesla builds larger plants in the future, increasing capacity may not be feasible. For example, Hyundai Motor's plant in Ulsan, South Korea, one of the largest in the world, has an annual capacity of about 1.5 million units, while Volkswagen's plant in Wolfsburg is designed for more than 800,000 units.

A key constraint on Tesla's production growth could be the availability of batteries. The company plans to produce its own batteries, not just buy them from suppliers, to meet the high demand.

Despite the challenges, Tesla's growth targets are achievable. Tesla has dealt with production problems in the past, and it may well continue to do so. Even if we assume a few more delays and declining performance, Tesla can still be one of the top five automakers in the world by 2030.

In addition to production problems, Tesla needs to find enough buyers for its cars around the world. The company is currently the leader in electric car production. The International Energy Agency estimates that with current policies, the number of electric cars in the world could grow to 145 million by 2030 from about 11 million in 2020. Tesla is well-positioned to take advantage of this expected growth.

However, traditional automakers are also producing electric versions of their flagship car models. This could significantly increase competition for Tesla in the coming years. The brand image and product features are its key strengths. Its top models currently offer the largest range.

Let's not forget that Tesla surpassed analysts' expectations in the first quarter, announcing that it delivered about 185,000 vehicles during the quarter, a 109% year-over-year increase.

Apparently, Wall Street expects the company to deliver another quarter, as the consensus analyst forecast is that Tesla will deliver about 200,000 vehicles -- up 120% from a year ago.

This is a particularly bullish view from analysts in light of the global supply shortages and logistical challenges as the economy recovers.

While the exact impact of these problems on Tesla in the second quarter is unclear, the company's management acknowledged the uncertainty surrounding global supply chain issues during its first-quarter earnings report. But perhaps Wall Street is just listening to Tesla's management; in the same report, management was optimistic about the company's growth prospects, saying it expects improved production and strong demand.

While the manufacturer's second-quarter deliveries of electric cars will provide some useful context, investors are probably already looking forward to the company's second-quarter earnings report, which will provide more details about the quarter than just deliveries.

Tesla is focused on ramping up production, eliminating delays, and increasing battery range. The company is working on all areas at once and plans to expand quickly. In short, despite the competition and challenges, Tesla has the potential to become one of the largest automakers in the next decade.

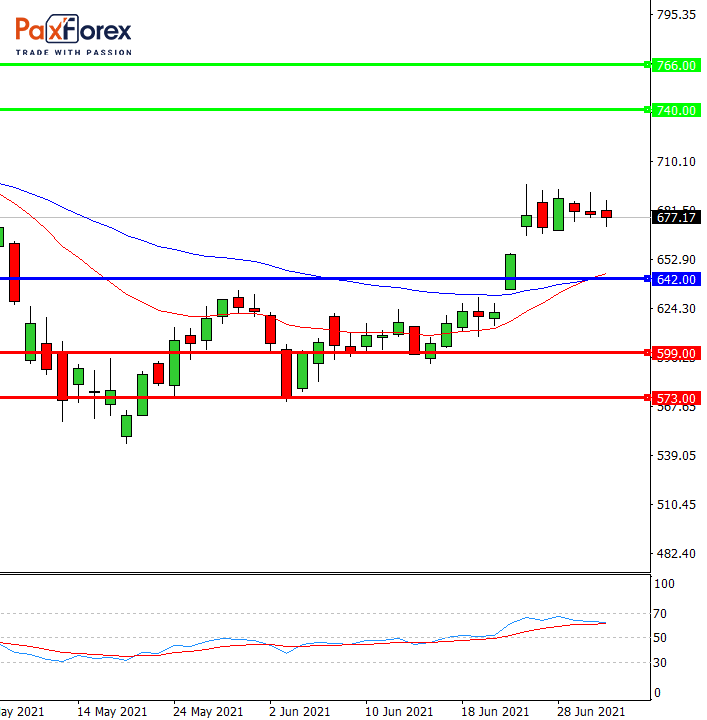

While the price is above 642.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 680.76

- Take Profit 1: 740.00

- Take Profit 2: 766.00

Alternative scenario:

If the level 642.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 642.00

- Take Profit 1: 599.00

- Take Profit 2: 573.00