Source: PaxForex Premium Analytics Portal, Fundamental Insight

While Covid-19 continues to depress the global economy and news of vaccines being significantly less effective for the latest mutations, traders should monitor inflation. Governments spiked debt to all-time highs and close to 350% of global GDP. The 2015 Eurozone debt contagion occurred with levels half of that, and most countries have a debt-to-GDP ratio above 100%, which is beyond catastrophic. The Covid-19 collapsed the healthcare system and keeps pressure on it, but central banks will lead to the collapse of the financial system with their reckless policies.

Safe-haven assets like gold and silver will benefit from the deadly combination of a slowing economy and rising inflationary pressures. It is unlikely that the global economy will reach pre-pandemic levels until 2022, poverty rates rise, and consumers follow central banks in increasing household debt fueled by hopes of economic recovery. Today’s US CPI data is expected to show an uptick, and the next few months will offer a clearer inflationary picture.

Silver also attracted attention from the Reddit group that created a brief short-squeeze in GameStop before the trade collapsed, causing tens of millions of losses to retail traders who followed social media advice and blindly bought a company struggling to avoid bankruptcy. Some capital inflows into silver may follow, but recent retail losses related to GameStop make it less of a threat to the price stability of this inflation-hedge. It may add to volatility, but silver is positioned for growth throughout 2021.

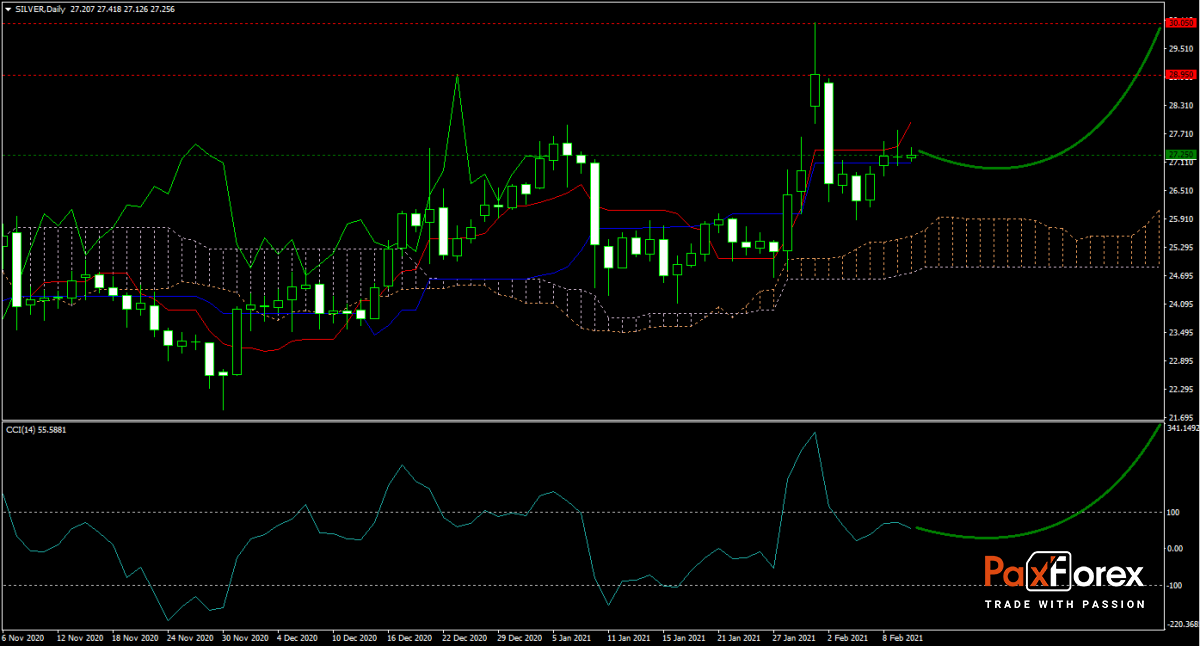

The forecast for silver remains bullish despite its recent price spike. It remains above it sideways trending Kijun-sen, while its ascending Tenkan-sen points to more gains ahead. The Ichimoku Kinko Hyo Cloud also started to slowly slope higher, confirming long-term bullish pressures in this precious metal. The CCI moved out of extreme overbought territory and has more upside potential. Will bulls rally and force silver into its horizontal resistance area, including the psychological resistance level of 30.000? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for Silver remain inside the or breakout above the 27.000 to 27.800 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 27.250

- Take Profit Zone: 28.950 – 30.050

- Stop Loss Level: 26.800

Should price action for Silver breakdown below 27.000 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 26.800

- Take Profit Zone: 25.950 – 26.150

- Stop Loss Level: 27.000

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.