Source: PaxForex Premium Analytics Portal, Fundamental Insight

Imagine you have a product that made $919 million in sales last year. Now imagine having to stop supplying that product not just to one market, but all over the world. That is precisely the situation that Pfizer is in right now.

The health care giant recently announced that it has halted the global distribution of the drug Chantix. This anti-smoking drug ranked eighth among the company's best-selling products in 2020. Below, we'll tell you why Pfizer has halted shipments of one of its best-selling drugs.

Chantix, marketed outside the U.S. as Champix, has long been the most popular drug for cigarette smokers looking to quit. Fear of getting cancer is one of the main reasons many people choose to use smoking cessation medications to kick the addiction. Ironically, Pfizer has stopped supplying the drug Chantix because of impurities found in it that can cause cancer.

The company said that nitrosamines were found in some production batches of Chantix. Nitrosamines are often found in water and food. However, they can potentially increase the risk of cancer when people are exposed to them above a certain level and for long periods.

A Pfizer spokesperson told Reuters via e-mail, "The benefits of Chantix outweigh the very low potential risk, if any, associated with lifetime exposure to nitrosamines from varenicline [common name for Chantix] and other common sources." Nevertheless, the company has decided to discontinue shipments as a precautionary measure.

The FDA has set levels of nitrosamines in drugs that it considers acceptable. The agency requires drug manufacturers to conduct risk assessments of nitrosamines in the products they sell. If a drug exceeds the acceptable level of nitrosamines, the FDA can force the company to recall the product. Pfizer has not announced a recall of Chantix in the U.S., but Canadian health authorities initiated a recall of the drug (sold under the brand name Champix) early last month.

Pfizer is stepping up internal testing to identify batches with unacceptable levels of impurities before they are shipped. The pause in the global distribution of Chantix will be temporary, although it is not known at this time how long it will last.

But if the pause will only be a short-term problem, Chantix faces longer-term problems. The smoking cessation drug began facing generic competition in the U.S. in November 2020.

In the fourth quarter of 2020, U.S. sales of Chantix dropped 40% year-over-year due to the loss of market share to generic competitors. Although international sales rose slightly, it was not enough to offset the decline in U.S. sales.

One would think that such bad news would have a big impact on Pfizer's stock price. However, it hasn't. Over the past month, the stock of this major pharmaceutical company has even risen slightly.

Investors didn't even blink an eye when the FDA updated the label of the COVID-19 vaccine sold by Pfizer and BioNTech, warning of possible problems with heart inflammation in young people. A similar label warning was also applied to Moderna's RNA messenger vaccine.

This FDA warning is not a problem for Pfizer because it should not affect sales of the COVID-19 vaccine. However, the suspension of shipments of Chantix will definitely affect Pfizer's sales. So why hasn't this problem pulled the stock down? Probably the best answer to this question is that Pfizer is big enough to withstand a temporary problem with one product.

Although Chantix remains the best-selling product for Pfizer, investors realize that it is no longer a growth driver for the company. A surge in sales of a drug that has already outlived its prime is unlikely to cause as much concern as problems with the promising product on which Pfizer depended for growth.

A smaller drug maker, faced with a problem similar to the one Pfizer is experiencing with Chantix, would likely see its stock price plummet. The bottom line for Pfizer is that it is good to be a big company.

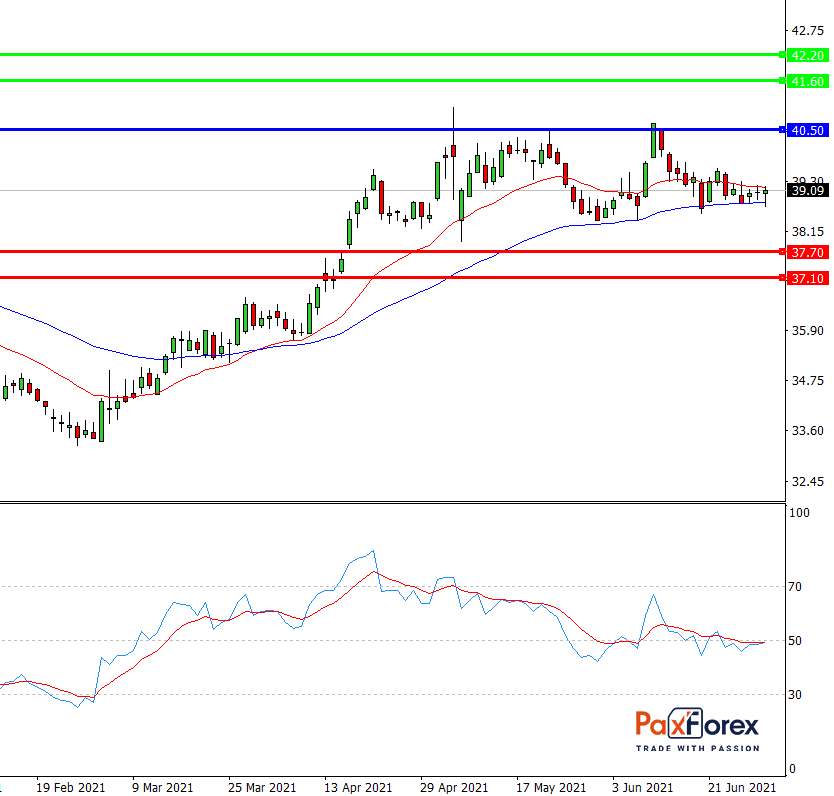

While the price is below 40.50, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 39.05

- Take Profit 1: 37.70

- Take Profit 2: 37.10

Alternative scenario:

If the level 40.50 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 40.50

- Take Profit 1: 41.60

- Take Profit 2: 42.20