Source: PaxForex Premium Analytics Portal, Fundamental Insight

The New Zealand Business Manufacturing PMI for May was reported at 58.6. Forex traders can compare this to the New Zealand Business Manufacturing PMI for April, reported at 58.4.

Preliminary US Michigan Consumer Sentiment for June is predicted at 84.0. Forex traders can compare this to US Michigan Consumer Confidence for May, reported at 82.9. Preliminary Current Conditions for June are expected at 92.3, and Preliminary Expectations are predicted at 79.0. Forex traders can compare this to Current Conditions for May, reported at 89.4, and to Expectations, reported at 78.8.

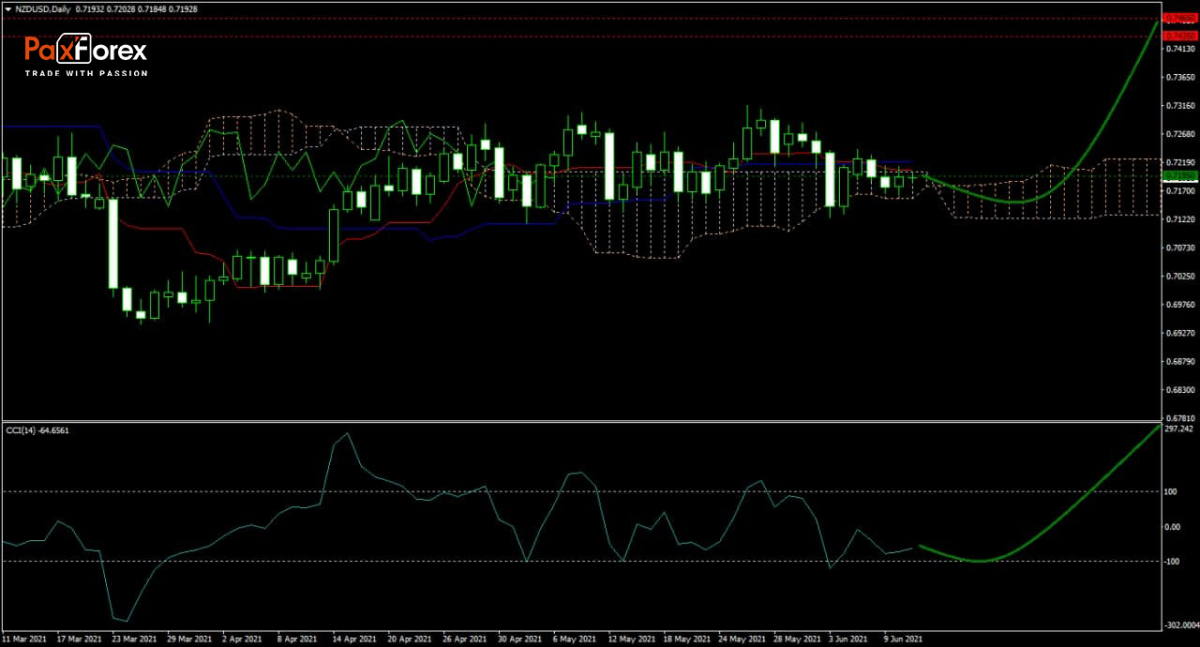

The forecast for the NZD/USD turned bullish following a sideways trend, as the outlook for the US Dollar continues to deteriorate amid high debt and rising inflation. While the Tenkan-sen and the Kijun-sen continue to drift sideways, the Ichimoku Kinko Hyo Cloud adopted a minor bullish bias. The CCI moved out of extreme oversold territory and is expected to advance. Can bulls take positive developments and pressure the NZD/USD into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the NZD/USD remain inside the or breakout above 0.7160 to 0.7220 zone, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.7195

- Take Profit Zone: 0.7435 – 0.7465

- Stop Loss Level: 0.7125

Should price action for the NZD/USD breakdown below 0.7160, PaxForex recommends the following trade set-up:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.7125

- Take Profit Zone: 0.6965 – 0.7000

- Stop Loss Level: 0.7160

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.