Source: PaxForex Premium Analytics Portal, Fundamental Insight

New Zealand Permanent/Long-Term Migration for November was reported at 672. Forex traders can compare this to Permanent/Long-Term Migration for October, reported at 892. External Migration & Visitors for November decreased by 98.6% monthly. Forex traders can compare this to External Migration & Visitors for October, down by 98.2% monthly. New Zealand Offshore Holdings for December were reported at 44.0%. Forex traders can compare this to New Zealand Offshore Holdings for November, reported at 43.2%.

US Housing Starts for December are predicted at 1,560K starts, and Building Permits 1,604permits. Forex traders can compare this to US Housing Starts for November, reported at 1,547K starts, and to Building Permits, reported at 1,635K permits. The Philadelphia Fed Manufacturing Index for January is predicted at 12.0. Forex traders can compare this to the Philadelphia Fed Manufacturing Index for December, reported at 9.1.

US Initial Jobless Claims for the week of January 16th are predicted at 910K, and US Continuing Claims for the week of January 9th are predicted at 5,400K. Forex traders can compare this to US Initial Jobless Claims for the week of January 9th, reported at 965K, and to US Continuing Claims for the week of January 2nd, reported at 5,271K.

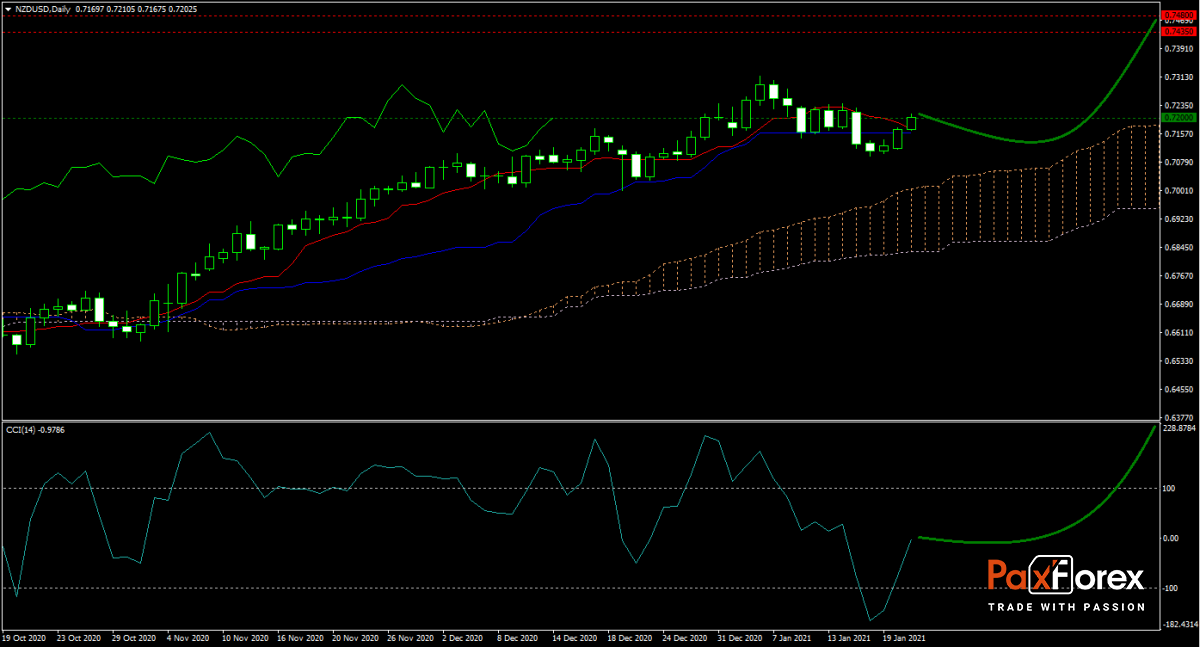

The forecast for the NZD/USD remains long-term bullish with the Ichimoku Kinko Hyo in a firm advance. Short-term volatility could increase with the descending Tenkan-sen likely to briefly cross below the flat Kijun-sen. With the US set to add trillions in debt and increase taxes, the US Dollar remains under long-term downside pressure. The CCI accelerated out of extreme oversold territory and has more upside potential. Can bulls deliver another push higher in the NZD/USD and force it into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the NZD/USD remain inside the or breakout above 0.7170 to 0.7230 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.7200

- Take Profit Zone: 0.7435 – 0.7480

- Stop Loss Level: 0.7140

Should price action for the NZD/USD breakdown below 0.7170 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.7140

- Take Profit Zone: 0.7040 – 0.7095

- Stop Loss Level: 0.7170

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.