Source: PaxForex Premium Analytics Portal, Fundamental Insight

New Zealand Retail Card Spending for November increased by 0.1% monthly and by 1.4% monthly. Forex traders can compare this to New Zealand Retail Card Spending for October, which increased by 8.8% monthly and by 8.2% monthly.

US Initial Jobless Claims for the week of December 5th are predicted at 725K, and US Continuing Claims for the week of November 28th are predicted at 5,335K. Forex traders can compare this to US Initial Jobless Claims for the week of November 28th, which were reported at 712K, and to US Continuing Claims for the week of November 21st, which were reported at 5,520K.

The US CPI for November is predicted to increase by 0.1% monthly and by 1.1% annualized. Forex traders can compare this to the US CPI for October, which increased by 0.2% monthly and by 1.2% annualized. The US Core CPI for November is predicted to increase by 0.1% monthly and by 1.6% annualized. Forex traders can compare this to the US Core CPI for October, which increased by 0.2% monthly and by 1.6% annualized. The US Monthly Budget Statement for November is predicted at -$200.0B. Forex traders can compare this to the US Monthly Budget Statement for October, reported at -$284.0B.

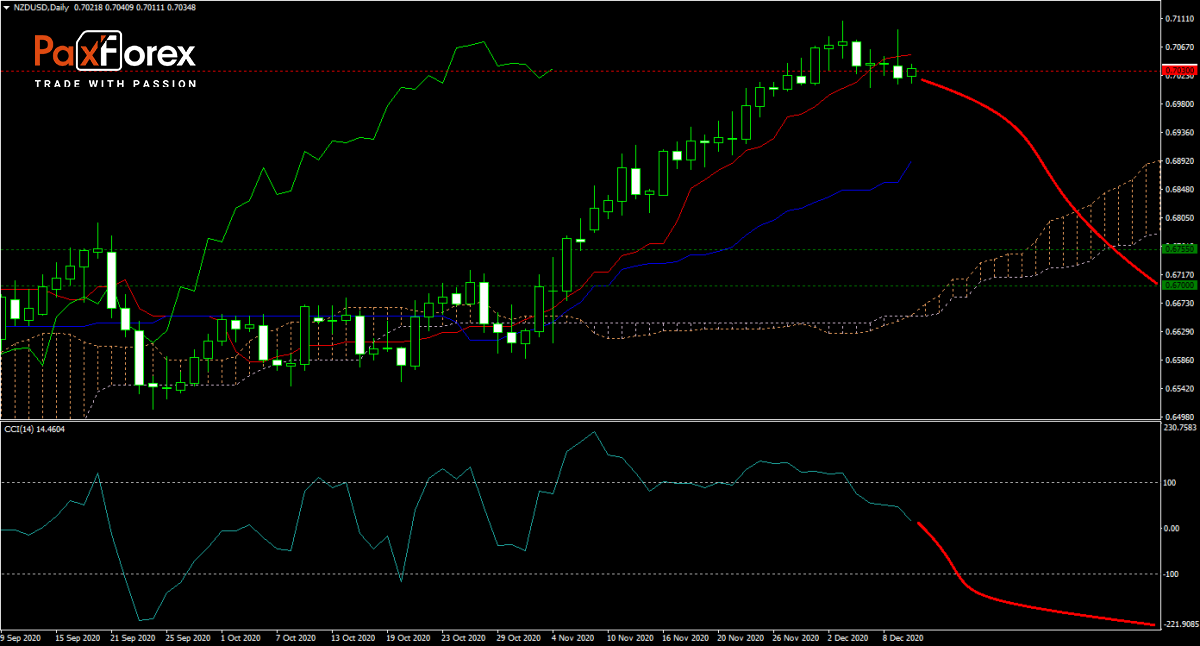

The forecast for the NZD/USD turned bearish in the short-term despite US Dollar bearishness. After the strong rally, price action is poised for a counter-trend sell-off that can take its ascending Kijun-sen and into its Ichimoku Kinko Hyo Cloud, which is sloping upwards. The New Zealand Dollar is threatened by looming negative interest rates in 2021. The CCI moved out of extreme overbought conditions and has more room to the downside. Will bears take the NZD/USD into its horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the NZD/USD remain inside the or breakdown below the 0.7000 to 0.7055 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.7030

- Take Profit Zone: 0.6700 – 0.6755

- Stop Loss Level: 0.7095

Should price action for the NZD/USD breakout above 0.7055 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.7095

- Take Profit Zone: 0.7155 – 0.7200

- Stop Loss Level: 0.7055

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.