Source: PaxForex Premium Analytics Portal, Fundamental Insight

Two years ago, Microsoft's market value exceeded $1 trillion for the first time. Several days ago, the company closed the trading day with a market value of more than $2 trillion.

A company's market value, which is determined by multiplying the number of shares in circulation by the stock price, is not in itself a useful metric for investors. Still, it is surprising that Microsoft, one of the world's largest software companies, has doubled its value in such a short time.

Let's see how Microsoft leaped $1 trillion to $2 trillion, and figure out what else needs to be done so the company breaks the $3 trillion mark.

When Satya Nadella was chosen as Microsoft's third CEO in February 2014, the business was worth just over $300 billion. At the time, Microsoft was trying to integrate Nokia's smartphone division in a desperate attempt to save its stricken Windows Phone OS. Its Windows and Office businesses were facing uneven upgrade cycles, and numerous customers were left with outdated versions.

MSFT additionally didn't have a meaningful presence in the developing cloud services market, even as Amazon was expanding AWS and salesforce.com was aggressively replacing desktop enterprise software with cloud services.

Basically, Microsoft fell behind the technology curve under Nadella's forerunner, Steve Ballmer, who notoriously proclaimed that Apple's iPhone had "no chance" of success.

When Nadella took the office, he brought the new concept of "mobile first, cloud first." Under his leadership, Microsoft abandoned Windows Phone and created apps for iOS and Android. He converted Office desktop software to cloud services, which attracted users with subscriptions, and extended Azure into the world's second-largest cloud infrastructure platform after AWS.

Six years ago, Microsoft introduced Windows 10 as the foundation of its "latest" desktop OS, which will be constantly updated online and monetized with an app store and supplementary features. Windows 11 will be provided as a free upgrade to all Windows 10 users.

The firm also released new Surface devices and Xbox consoles and extended its gaming ecosystem with subscription downloads and a cloud-based gaming platform.

Within fiscal 2014 and 2020, Microsoft's commercial cloud revenue - primarily from Office 365 (now known as Microsoft 365), Dynamics, and Azure - grew from $2.8 billion to $51.7 billion.

This impressive growth, which has been fueled by major partnerships, investments, and acquisitions (like the 2016 purchase of LinkedIn) - has boosted the company's total revenue from $86.8 billion in 2014 to $143 billion in 2020. Analysts expect Microsoft's revenue to grow another 16% this year to $166.2 billion.

Nadella's approach originally pinched the company's margins, but it definitely paid off and made it an interesting growth company again. That's why Microsoft is now worth $2 trillion.

Microsoft's market value doubled between 2017 and 2019 and then doubled again between 2019 and 2021. To reach the $3 trillion mark, its stock would need to rise another 50%, which could unquestionably take place within the next two years for the following reasons.

First, as per Allied Market Research, the global cloud market could still develop at a compound annual growth rate of 16.4% from 2020 to 2027. If Microsoft keeps moving with the market, its commercial cloud revenues will continue to grow at high double-digit percentage rates and account for an even higher percentage of total sales.

Azure will continue to attract customers, especially retailers, as a better alternative to AWS. And the growing need for storage and artificial intelligence solutions will increasingly tie those customers to the platform.

Dynamics won't displace Salesforce from its leadership position in customer relationship management (CRM), but it will profit from the same secular digitization of business. Microsoft 365 should also solidify its leadership position in the productivity software market through subscriptions. Windows 11 will keep all its users on the same page and allow the company to introduce new services as smoothly as Apple and Alphabet's Google.

Second, Microsoft's gaming business will keep evolving as the company introduces new Xbox consoles, expands its cloud-based gaming platform, and acquires more publishers, such as Bethesda, to develop exclusive first-person games. Microsoft could also gradually eliminate the gaming boundaries between Windows PCs and Xbox consoles through local streaming and cloud gaming capabilities.

Finally, Microsoft will continue to expand into next-generation markets. The HoloLens augmented reality headset, for example, is likely to pave the way for new consumer-facing devices, which will diversify the company's hardware business and expand its reach far beyond PCs and mobile devices.

In other words, Microsoft is no longer in danger of falling behind the technology curve. Nadella has driven the tech giant forward, and that momentum could lift its value to $3 trillion shortly.

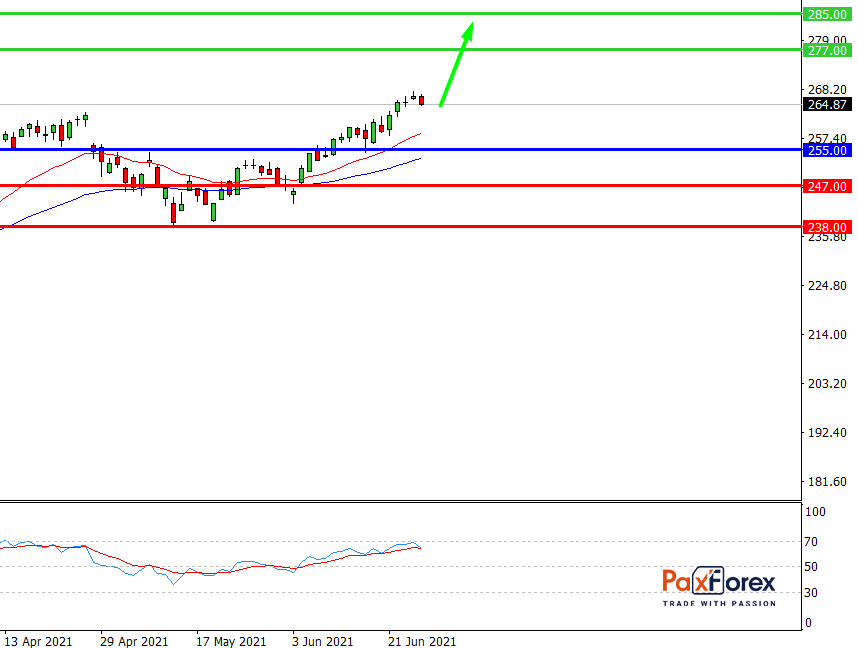

While the price is above 255.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 265.00

- Take Profit 1: 277.00

- Take Profit 2: 285.00

Alternative scenario:

If the level 255.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 255.00

- Take Profit 1: 247.00

- Take Profit 2: 238.00