Source: PaxForex Premium Analytics Portal, Fundamental Insight

Software giant Microsoft certainly deserves some credit for its successful transition from desktop computing to cloud computing. As a result, MSFT stock has surged. Many investors may be wondering whether Microsoft stock is worth buying right now.

Bill Gates and Paul Allen founded Microsoft in 1975 at the dawn of the personal computer era to create software for PC operating systems. The Windows operating system came to dominate the personal computer market. Over the years, Microsoft expanded into productivity software, server software, Internet services, video games, and PC hardware and accessories.

The current CEO, Satya Nadella, took over the company in 2014 and steered Microsoft toward cloud computing.

Today, the company's cloud offerings include Azure infrastructure services, Office 365 software, and Dynamics enterprise software. Microsoft also owns LinkedIn, Skype, and GitHub.

On June 24, Microsoft unveiled its Windows 11 operating system for personal computers. Microsoft stock rose 0.5 percent on the news.

Windows 11 features an updated design with a new user interface and a Start menu. It also has improved PC performance and integrates the Teams video conferencing app. Windows 11 is the successor to Windows 10, which was released in July 2015. Windows 11 will be available this holiday season.

In other recent news, Microsoft announced a deal on April 12 to buy Nuance Communications for $19.7 billion. The Nuance acquisition will give Microsoft more weight in the healthcare sector. Microsoft stock rose slightly on this news.

In addition, Microsoft was awarded a contract on March 31 to supply more than 120,000 Microsoft HoloLens augmented reality headsets to the U.S. Army. The contract is part of the Integrated Visual Augmentation System (IVAS) program. The deal could be worth up to $21.88 billion over 10 years. As might be expected, MSFT stock rose 1.7%.

On July 6, the U.S. Department of Defense canceled a major cloud computing contract it awarded to Microsoft in October 2019. Microsoft beat Amazon.com to win the contract, known as JEDI, or Joint Enterprise Defense Infrastructure. However, Amazon challenged the $10 billion contract in court and delayed its execution.

Now the Pentagon plans to open a new contract, the Joint Warfighter Cloud Capability, to competition. Both Amazon and Microsoft will participate in the competition, the agency said.

Amazon Web Services is the world's largest provider of cloud infrastructure services. AWS had a 32 percent market share in the first quarter, according to research firm Canalys. Microsoft was in second place with a 19% market share.

Other major cloud players include Alphabet's Google Cloud Platform division and China's Alibaba and Tencent. According to Canalys, total enterprise spending on cloud infrastructure services reached $41.8 billion in the first quarter, up 35% year over year.

On Feb. 24, Microsoft announced three new industry cloud offerings. These included Microsoft Cloud versions for financial services, manufacturing, and nonprofits. A preview version for retail was also unveiled. In addition, the company unveiled the first update to Microsoft Cloud for healthcare. Microsoft stock rose 0.6 percent on this news.

Later on April 27, Microsoft beat Wall Street forecasts for its fiscal third quarter ended March 31, thanks to strong sales of cloud computing services. The company also made a forecast for the current quarter. The next day, however, Microsoft stock fell 2.8% on that news.

For the March quarter, Microsoft posted adjusted earnings of $1.95 per share on sales of $41.71 billion. Analysts had expected Microsoft earnings of $1.78 per share on sales of $41.03 billion. Compared to last year, Microsoft's earnings were up 39 percent and sales were up 19 percent.

The report marked Microsoft's third consecutive quarter of accelerated earnings growth. It was also the company's fastest sales growth in 11 quarters.

For the June quarter, Microsoft expects sales of $44.05 billion, up 15.8 percent from last year, based on the midpoint of the forecast. For the fiscal fourth quarter, Wall Street forecasts revenue of $42.98 billion.

Undoubtedly, the next impetus for MSFT stock could be the fiscal fourth-quarter earnings report due out at the end of July.

Microsoft has benefited from work-at-home trends and homeschooling during the pandemic. These trends have spurred growth in personal computer purchases. In addition, Microsoft's cloud-based software and services are helping work-at-home workers and students.

On May 17, investment bank UBS published a report questioning whether Microsoft and other software companies are really seeing a wave of "digital acceleration" spending caused by the Covid pandemic. The report said that the software sector has experienced "unprecedented lifetime value growth" on expectations of increased information technology spending related to digital transformation in corporations. However, UBS said it saw no tangible evidence of such an increase in information technology spending.

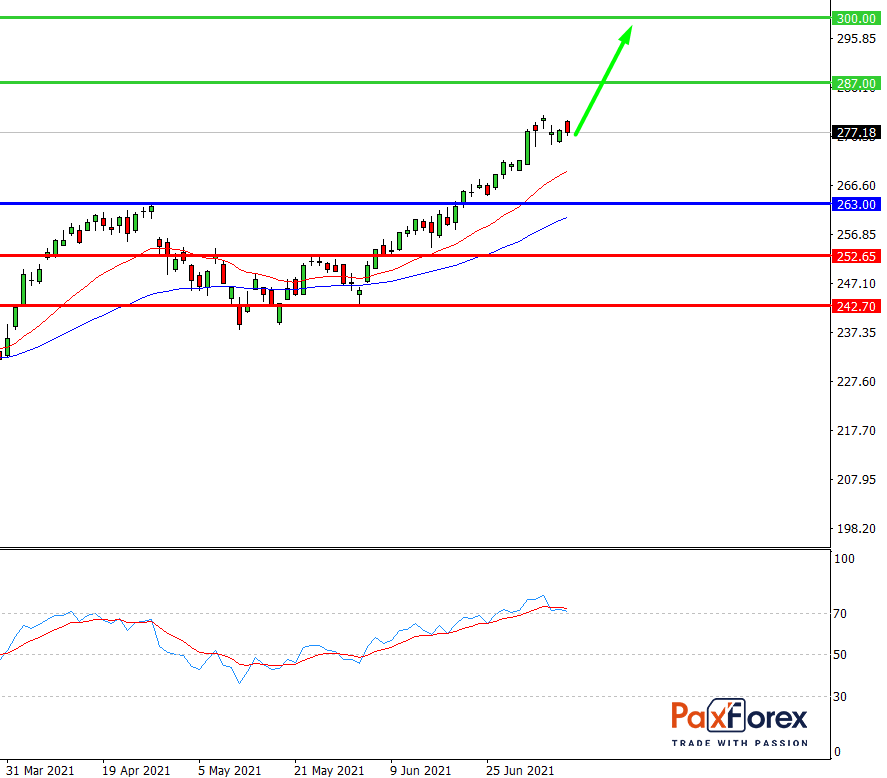

While the price is above 263.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 277.49

- Take Profit 1: 287.00

- Take Profit 2: 300.00

Alternative scenario:

If the level 263.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 263.00

- Take Profit 1: 252.65

- Take Profit 2: 242.70