Source: PaxForex Premium Analytics Portal, Fundamental Insight

Most traders would agree that making money out of stocks shouldn't be complicated. It's a lot simpler to do when a big name like Microsoft is still posting outstanding operating results every quarter. Last week, the company delivered another sensational quarter, with revenue up 17 percent and earnings per share up 34 percent year-over-year.

Similarly, the company's stock is up 43% over the past year, after more than quadrupling over the past five years. Let's look at a few ideas why this increase in the stock should extend further.

The Productivity and Business Process segment has performed well over the past two years, with revenues up 13% and 15% in fiscal years 2020 and 2019, respectively.

The transition of Office to subscription services has worked miracles for Microsoft's core software. Segment revenue increase prevailed steady in the second fiscal quarter, up 13%, or 11% excluding currency changes.

Microsoft now has 47.5 million consumer subscribers to Microsoft 365, up 28% from a year earlier, as the company combines Word, Excel, and other productivity software into a single subscription plan.

Don't forget that gaming is another consumer business that is now running at full capacity. Xbox's content and services revenues have grown by an astonishing 40% in a year. Xbox hardware was even more impressive when the November launch of the Xbox Series X and Series S was the most prosperous in the company's history, generating an 86% year-over-year increase in gaming hardware revenue.

Gaming accounts for less than 10 percent of Microsoft's total revenue, but the next five years look pretty rosy for the Xbox business. The Xbox Game Pass subscription service now has 18 million subscribers, but it's improving quickly, with 3 million new users added in the last quarter alone.

Management views vital increase possibilities in gaming and consumer software services as the transition to a subscription model in both areas of the business continues.

The most crucial cause to invest in Microsoft is growth in the cloud. Microsoft Azure experienced a slight acceleration in growth last quarter, with revenue up 48%, excluding currency. One analyst predicts that by next year, Azure will exceed the annual revenue of both Office and Windows.

Demand for cloud infrastructure services is growing like never before, as organizations look for more digital solutions in a post-coronavirus world. Azure is one of the few cloud providers that have the global scale to serve large enterprise customers, putting Microsoft in a strong competitive position relative to other cloud providers.

Microsoft continues to expand its cloud presence worldwide, recently announcing seven new data centers in Asia, Europe, and Latin America. In the most recent quarter, Microsoft spent $5.4 billion in capital investment to support growing global demand and customer use of cloud services. This level of investment signals further growth.

Microsoft's profitable software business has been generating strong profits and free cash flow for years. FCF improved 17% over the last quarter, bringing total investment over the past four quarters to $50 billion. This level of cash generation also makes Microsoft an excellent dividend asset.

Over the past ten years, the quarterly dividend has grown from $0.13 per share to $0.56. That brings the annual payout to $2.24 per share, giving investors a dividend yield of 0.94% as of this writing.

The software giant is winning big on consumer software, cloud services, and games. Microsoft is known as a dominant and extremely profitable company. That's why Microsoft is the perfect technology stock for any investor's portfolio.

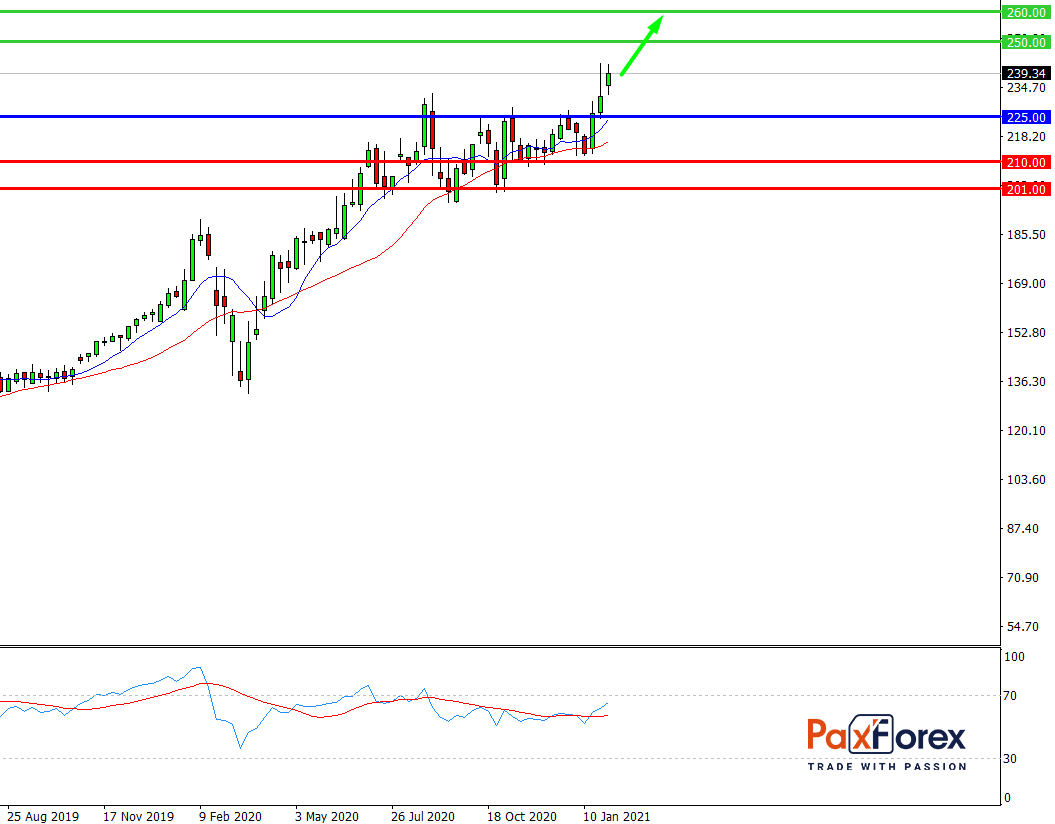

While the price is above 225.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 239.50

- Take Profit 1: 250.00

- Take Profit 2: 260.00

Alternative scenario:

If the level 225.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 225.00

- Take Profit 1: 210.00

- Take Profit 2: 201.00