Source: PaxForex Premium Analytics Portal, Fundamental Insight

It's not hard to name a reason, if not several, insinuating that it's better to get rid of McDonald's stock. Many franchisees were upset lately with their ever-increasing expense requirements, particularly given the pressure on the $15-an-hour minimum wage in the United States. Then there's the not-so-subtle fact that the fast-food business is amazingly competitive and apparently saturated. There are approximately 200,000 such restaurants in the U.S. alone. There is a renewed interest in healthier eating, and it seems as if McDonald's is facing too many headwinds.

But McDonald's is still a buy because a single, simple advantage easily overcomes every possible vulnerability: simply being the most recognizable brand in the industry.

The Golden Arch, the brand symbol, is prominently displayed in 39,198 restaurants worldwide, 93% of which are franchises. It is second only to Subway's 42,000 stores, although the latter company definitely does more business. McDonald's restaurants collectively bring about $100 billion in sales a year (in a typical year). No other restaurant business approaches it in terms of geographic reach or total sales. Indeed, no other restaurant chain even gets a chance to try to catch up, unable to break through the dominance that McDonald's enjoys.

This dynamic raises a philosophical question: is McDonald's big because it's good, or good because it's big? The answer is probably a little of both. Leading the market, McDonald's has the size and cash reserve necessary to maintain its leadership on what is arguably the most important front in the industry. McDonald's brand name and logo are not only universally recognized, but they are also very popular.

IG Markets Limited quantified the idea early last year, concluding that McDonald's is the ninth most recognized brand in the world. That's an order of magnitude better than the 10th place ranking of Walt Disney, and in the same year, the company did similar research for Appy Pie and BrandZ, which ranks McDonald's as the ninth most valuable brand in the world, just behind Facebook.

Considering there's nothing special about a hamburger, the fact that McDonald's stands alongside such giants as Facebook and Disney speak volumes.

The positive side of this brand recognition and respect is twofold. First, it stimulates consumer loyalty.

In the same sense that it's not clear whether a restaurant chain is good or just big, or both, it's not really clear whether consumers visit McDonald's because it's their first choice or because it's the most affordable option. But the reason doesn't really matter, since visiting McDonald's is clearly a habit. About 70 million people visit McDonald's every day, where they are greeted with a specially designed color scheme and environment intended to keep those customers coming back. The color red has been shown to induce hunger in addition to attracting attention, while yellow induces a sense of friendliness. If you see those Golden Arches on top of the red banner enough times right before you pull into the McDonald's parking lot, your brain makes a powerful connection between the logo and a satisfied thirst.

It sets the stage for the second upside of this strong brand recognition factor: As much as franchisees complain about rising fees and required investments in real estate, which is owned by the company, not the owner, there is no other restaurant name so stable and profitable for the franchisee.

Nevertheless, some figures franchise owners should consider: While the average cost of setting up a new store can range from $1 million to $2 million, the average store reportedly generates $2.7 million in profits annually. Of that top average revenue, about $150,000 turns a profit for the franchise owner, although some stores make much more profit. It would be unmanageable for a fast-food restaurant to generate similar revenue under a different banner. To put that in perspective, Wendy's comparables are about two-thirds of the top and bottom lines in McDonald's stores.

As long as this continues, McDonald's will proceed to bring and retain the best talent in the industry.

None of this is to say that McDonald's is invulnerable. It is not. Everything can go wrong, and while to date it has caused the only resentment, the latest round of pay raises imposed at the end of 2020 showed just how tenuous the company's relationship with franchisees remains. It's definitely worth watching.

For investors, however, paying a high price for a "best-in-class" choice usually pays off. These companies are industry-leading for a reason, and McDonald's is no exception. And that's what makes McDonald's stock worthy of a place in any portfolio.

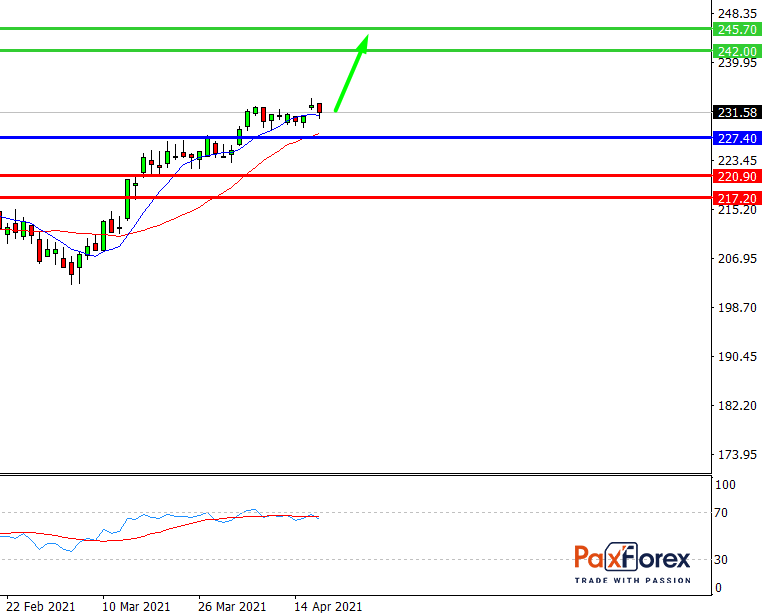

While the price is above 227.40, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 233.08

- Take Profit 1: 242.00

- Take Profit 2: 245.70

Alternative scenario:

If the level 227.40 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 227.40

- Take Profit 1: 220.90

- Take Profit 2: 217.20