Source: PaxForex Premium Analytics Portal, Fundamental Insight

Many investors know the reasons to invest in Johnson & Johnson. It is a large, diversified company with one of the highest dividend yields in the Dow Jones Industrial Average. In addition, many are well aware of a good reason to avoid it -- the company's recent history of legal problems.

A deeper analysis can help determine how much someone should weigh each of these factors. It can also serve as a starting point if the reasons for buying change. Without delay, here are three reasons why the company may be a good fit for your portfolio, and one reason to put your money elsewhere.

First, the company is practically a global health care index fund.

Johnson & Johnson is not only the largest publicly traded healthcare company by market capitalization but also the most diversified. If you break down its sales by a line of business as well as by geography, you can see a company whose assets are spread across different baskets.

The company's largest business is pharmaceuticals. Its drug portfolio treats everything from cancer and cardiovascular disease to immunology and infectious diseases. The latter category would benefit from the COVID-19 vaccine. The company's best-selling drug is Stelara. It treats plaque psoriasis and psoriatic arthritis, with sales of $7.7 billion last year. The drug continues to gain approval for new indications, which led to a 15% increase in sales last year.

Medical devices account for more than a quarter of sales and are spread across areas such as orthopedics and vision. Instruments and surgical systems also contribute significantly to this area. Johnson & Johnson has also made several significant acquisitions to bring innovative new technologies. More on that below. Finally, the Consumer Health segment - known for products such as Tylenol, Neosporin, and patches - accounts for just over one-sixth of sales.

As with no reliance on any one area of health care, the company's sales are also distributed around the world. Although the U.S. accounts for a little more than half of total revenue, company executives say it operates in virtually every country in the world.

Second, it's an increase in the benefits you can count on.

This diversification provides stability through all economic cycles. It also helps mitigate any problems in one division. Predictability has allowed management to pay a growing dividend for the past 59 years. The 2.6% dividend is respectable. But thanks to the dividend increase, those who bought the company 20 years ago will receive checks worth 7.7% of their original investment this year. Such is the power of long-term dividend growth.

Despite this history of growth, the company still has plenty of room for further payout increases. Last year, it distributed just 62% of earnings and 51% of free cash flow. The latter figure, the cash dividend payout ratio, has fluctuated between 50% and 60% for a decade. Not only has the dividend not gone anywhere. Management is not raising them faster than it can pay them. It is a conservative approach that should allow risk-averse investors to sleep well at night.

Third, it is the acquisition of growth opportunities.

Another thing that stability and free cash flow allow Johnson & Johnson to do is acquisitions. Lately, the company has been using them to acquire medical device companies that bring robotics and data science into the operating room.

In 2019, it acquired Auris Health and Verb Surgical. Auris was founded by Fred Moll, who also founded Intuitive Surgical. His last venture focused on treating lung cancer, but Johnson & Johnson sees more potential applications for its Monarch surgical system.

Before the purchase, Verb Surgical partnered with Verily, an Alphabet-owned company. It brings analytics and artificial intelligence to surgery. CEO Alex Gorsky called it "computerized surgery." The term may not catch on with patients, but it's just the beginning of exploring the market's potential.

Despite a rich history that dates back to the 1880s, the company has conducted some product recalls in all of its divisions over the past two decades and has paid out billions in compensation. Reasons can range from selling the drug to patients for whom it was not approved, promoting another drug for an unapproved use, allegations that baby talcum powder contained cancer-causing asbestos, defective hip implants, and many others. Perhaps most troubling, Johnson & Johnson is at risk because of its role in the opioid crisis.

While much of the blame for the opioid crisis has fallen on the brand-name manufacturers of addictive painkillers, some companies further down the supply chain have also been implicated. Johnson & Johnson is among them. In the 1990s, the company spurred the development of "super poppy," which contained particularly high levels of opiates, which it converted into oxycodone and hydrocodone. The company had previously pledged to pay $5 billion to settle the claims and a few days ago agreed to pay the state of New York $230 million.

Johnson & Johnson also closed its opioid business last year. Nevertheless, the litigation between the states leaves many potential liabilities. In 2019, an Oklahoma judge ordered the company to pay $465 million for its role in that state's crisis. That was far less than the $9.3 billion demanded by the state attorney general. It remains to be seen how things will play out in other states. Either way, it's a messy situation that could end up costing the company billions more than it plans.

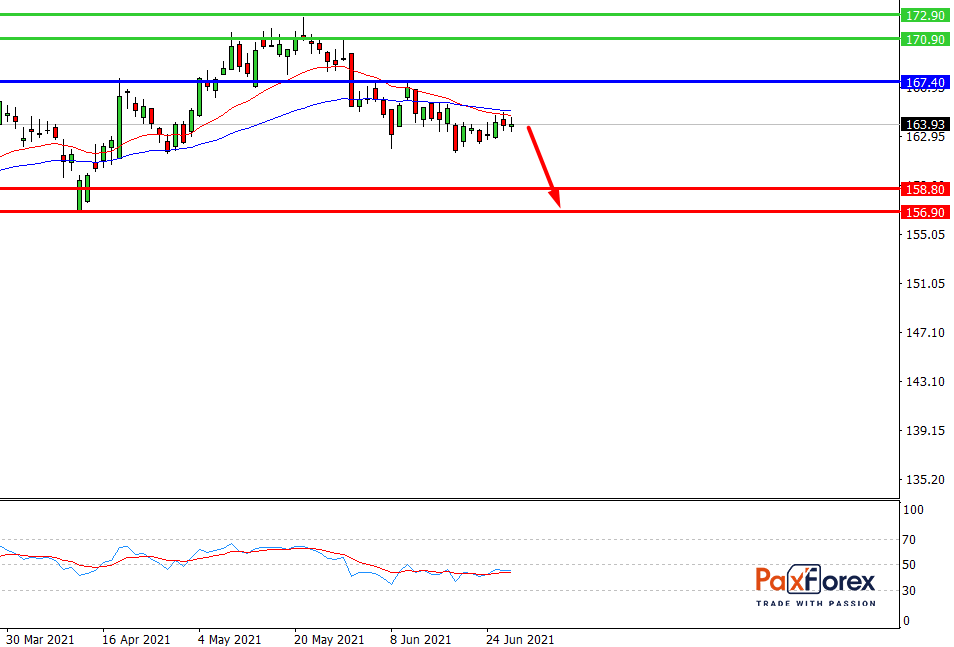

While the price is below 167.40, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 164.00

- Take Profit 1: 158.80

- Take Profit 2: 156.90

Alternative scenario:

If the level 167.40 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 167.40

- Take Profit 1: 170.90

- Take Profit 2: 172.90