Source: PaxForex Premium Analytics Portal, Fundamental Insight

Despite the economic shocks of last year, the S&P 500 Index had a magnificent 43% year-over-year gain. But that growth was far from even for all stocks, and indeed, many were left behind. One such relative loser was the pharmaceutical company Johnson & Johnson: its stock has lagged behind the index by more than 20 percentage points in the past 12 months.

That was a big disappointment to shareholders, many of whom had bet that a successful J&J coronavirus vaccine would lift the company's stock. But is this pharmaceutical company stock worth buying today?

Last year, Johnson & Johnson (with $1 billion in federal support) developed a single-dose coronavirus vaccine that was 72% effective in clinical trials. It has several significant advantages over mRNA vaccines, which the FDA has also approved for use: It has much less stringent refrigerated storage requirements, so it can be distributed in places without expensive cold storage infrastructure. And its single administration regimen gives it an advantage in terms of vaccinating hard-to-reach populations.

However, the introduction of this vaccine dubbed Ad26.CoV2.S has not turned out so rosy. Johnson & Johnson's vaccine currently accounts for only 5 percent of the total vaccine volume in states such as California.

Since the release of Ad26.CoV2.S, there have been problems with the public image. First, people noticed that its distribution was associated with communities in the poorest communities and rural areas. It was because the vaccine could easily go where other vaccines could not, but this discrepancy led to unfounded conspiracy theories claiming that the distribution strategy was inherently racist because Ad26.CoV2.S had a slightly lower level of effectiveness than the Pfizer and Moderna vaccines.

The FDA then discovered that the company's contract manufacturer, Emergent Biosciences, was not authorized to produce the vaccines at its Baltimore plant. Among many other problems, Emergent Biosciences employees had tainted up to 15 million doses of Johnson & Johnson vaccines with ingredients intended for AstraZeneca's coronavirus vaccine.

After that, AstraZeneca had to move the production of its vaccine overseas to the Netherlands. In addition, 28 people developed severe blood clots after vaccination with Ad26.CoV2.S. It's an extremely rare result, considering that 8.7 million people received the vaccine. Nevertheless, it has contributed to the perception that Johnson & Johnson's vaccine is substandard, so people mostly choose mRNA shots when possible, even if it means a longer wait to get vaccinated.

Investing in Johnson & Johnson stock should not have been about speculating on the potential of the COVID-19 vaccine. Last year, the company pledged to sell Ad26.CoV2.S on a nonprofit basis throughout the pandemic.

Meanwhile, the pharmaceutical giant's first-quarter revenue rose 7.9 percent year over year to $22.3 billion. At the same time, earnings per share rose 6.9% to $2.32. This growth is particularly impressive because Johnson & Johnson is already a giant corporation.

Notable sales growth was seen globally in the pharmaceutical and medical device segments, although it was held back slightly by a modest decline in the consumer health segment, where sales of some products that were in high demand at the beginning of the pandemic fell.

Key to Johnson & Johnson's long-term growth is its commitment to research and development. More than $2.3 billion of the company's sales are being reinvested in new drug development. 10 drug applications are pending approval in areas ranging from multiple myeloma to pulmonary arterial hypertension to schizophrenia. Johnson & Johnson has five more candidates waiting to be submitted to regulators and four drugs in Phase 3 clinical trials, with results due by the end of the year.

Currently, the average stock price of pharmaceutical companies is about 5 times sales and 123 times earnings, and most companies in the field do not pay dividends. Meanwhile, Johnson & Johnson stock is valued at 4.8 times earnings, but only 18 times earnings. Its dividend yield is also 2.37%, noticeably higher than the 1.4% average for the S&P 500.

Overall, given the strength of its core operations, large R&D, and low valuation, Johnson & Johnson is a solid stock to buy. Investors should keep in mind that the stock has significant untapped value, regardless of whether it ultimately achieves financial success from its coronavirus vaccine program.

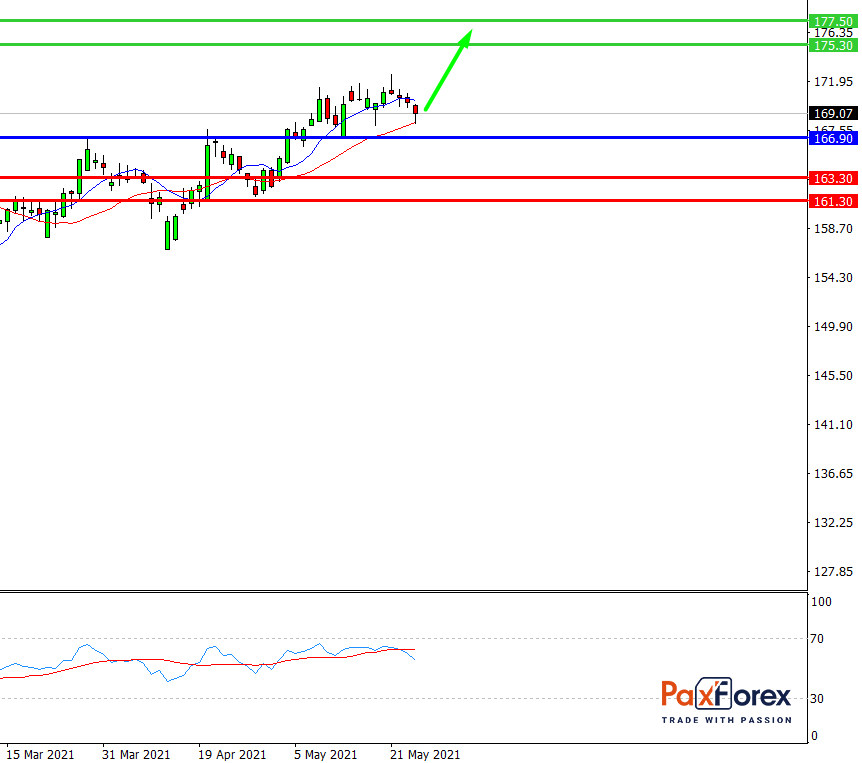

While the price is above 166.90, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 170.00

- Take Profit 1: 175.30

- Take Profit 2: 177.50

Alternative scenario:

If the level 166.90 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 166.90

- Take Profit 1: 163.30

- Take Profit 2: 161.30