Source: PaxForex Premium Analytics Portal, Fundamental Insight

For a variety of reasons, investors pay attention to stocks with growing dividends. However, finding a stock with a great track record is crucial, but not enough - you also need some kind of proof that payouts will keep growing.

Healthcare behemoth JNJ is the dividend king, with almost sixty successive annual dividend rises to its credit. But how likely is it that this will continue? Let's try to find out whether Johnson & Johnson's dividend is the most reliable in the health care industry.

Let's start by examining the company's payout ratio, the portion of earnings per share (EPS) that is paid as a dividend.

Johnson & Johnson made $8.03 in 2020 adjusted diluted earnings per share ( non-GAAP) with a dividend per share of $3.98, a reasonable payout ratio of 49.6% of adjusted diluted earnings per share - a strong equilibrium between rewarding shareholders right now and investing in future growth to increase dividends for years to come. And it's especially impressive in a disappointing 2020, in which adjusted diluted earnings per share fell 7.5% year-over-year.

Johnson & Johnson is expecting 2021 adjusted diluted earnings per share to be about $9.50 and plans to pay a dividend per share of $4.19, a payout ratio of 44.1%.

Thus, the payout ratio looks perfect. So what about the balance sheet?

One of the most useful metrics is the interest coverage ratio, which measures a company's ability to cover its interest expense with pretax earnings (or EBIT). It is essential to pay attention to since a higher interest coverage ratio makes it less likely that a company will get broke when times are tough for it.

In the first quarter of 2021, Johnson & Johnson had an interest coverage ratio of 155 ($7.4 billion EBIT/$48 million net interest expense), which is significantly higher than similar companies - AbbVie, for instance, has an interest coverage ratio of 6 and Pfizer has 17.

That's even more stunning when you consider that first-quarter performance declined from the first quarter of 2020, when the company had a net interest income of $42 million, making its interest coverage ratio technically absolute. This change was due to both lower interest rates on cash and marketable securities and an increase in the debt balance.

These numbers help explain why Johnson & Johnson stands out in the health care industry with its impeccable AAA credit rating from S&P Global, the largest credit rating agency. It and Microsoft are the only ones with impeccable credit ratings.

While management will need to be deliberate in repurchasing shares in the future to maintain an impeccable credit rating, its extremely high interest coverage ratio will allow it to continue to deliver solid dividend growth for years to come.

Finally, one cannot argue with the structure of this company's business or the strength of its brand. The company has three divisions: pharmaceuticals, medical devices, and consumer health. Pharmaceuticals, including the COVID-19 vaccine, accounted for 54.7% of net revenue in Q1 2021.

Medical devices (including joint replacement and spine products) contributed 29.5%, and the consumer health segment contributed 15.9%. Overall, net revenue in 2020 was up 0.6% to $82.6 billion.

Now that many regions of the U.S. and the world have resumed elective procedures, the medical devices and pharmaceuticals segments have rebounded. In the first quarter of 2021, revenues in these divisions grew 10.9% and 9.6%, respectively, year over year. Meanwhile, consumer products segment revenues declined 2.3% over the same period.

Their performance during and after the pandemic shows that the company's three segments can strike a fine balance, regardless of the operating environment, to deliver decent operating results - and future dividend growth.

Johnson & Johnson's historic legacy as a dividend king is attractive to investors, but its future should be even more attractive. The company's payout looks solid, its interest coverage ratio is very high, its AAA credit rating is unparalleled in the healthcare industry, and its solid business mix should allow the company to continue growing its dividend for years to come.

Investors looking for both safety and moderate growth potential would be wise to put Johnson & Johnson on their list and expect the stock to drop to below $160 per share.

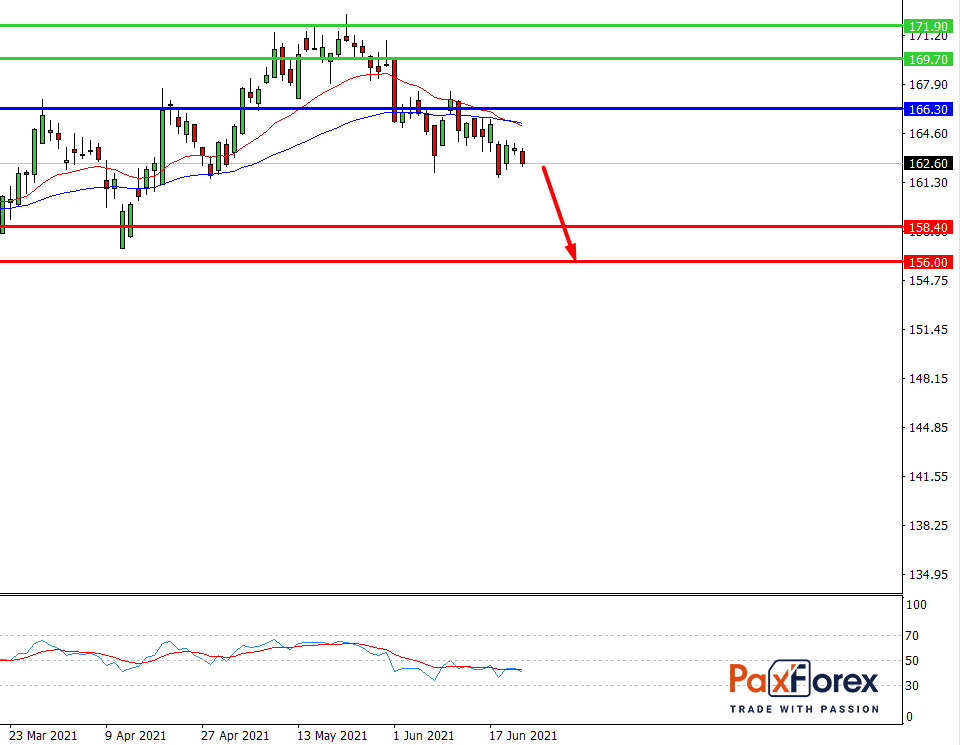

While the price is below 166.30, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 163.11

- Take Profit 1: 158.40

- Take Profit 2: 156.50

Alternative scenario:

If the level 166.30 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 166.30

- Take Profit 1: 169.70

- Take Profit 2: 171.90