Source: PaxForex Premium Analytics Portal, Fundamental Insight

Johnson & Johnson's COVID-19 vaccine has faced a number of problems this year. From manufacturing problems to alarming reports of blood clots probably related to the vaccine, it has not had the success the company probably hoped for at this point. Vaccines from Pfizer and Moderna have brought these companies much more revenue and seem to be the vaccines of choice for numerous people.

Nevertheless, the delta variant could make a difference, as both Moderna and Pfizer suggest that repeat vaccinations are required. And the FDA lately approved a third dose for people with compromised immune systems. Meantime, a new study shows that J&J's vaccine is highly effective against the delta variant, so revaccination may not be necessary for people who have received this vaccine. Although not requiring revaccination will not increase vaccine revenues, this event could eventually lead to Johnson & Johnson's vaccine growing in popularity and capturing more market share.

Johnson & Johnson expects COVID-19 vaccine revenue to be $2.5 billion in 2021. That's a drop in the bucket for a giant business that brought more than $80 billion in revenue in 2020.

By the end of this year, Moderna's vaccine sales could reach $20 billion. And that still lags far behind Pfizer, which expects sales of its vaccines at $33.5 billion this year, as it takes the lead by producing up to 3 billion doses in 2021. Moderna doesn't expect to deliver that many doses annually until next year. Its production could reach 1 billion doses in 2021.

Johnson & Johnson anticipates providing only up to 600 million doses of its single-dose vaccine this year, less than its earlier goal of 1 billion doses. Its difficulties are due in large part to problems at the Baltimore plant operated by Emergent BioSolutions, where the plant was shut down in March because of cross-contamination problems. The FDA only lately authorized it to resume operations.

It also didn't help that some people felt, rightly or wrongly, that J&J's vaccine was not as effective as others that had received FDA approval for emergency use.

One of the problems Johnson & Johnson's vaccine has had is that from the beginning it didn't look very effective compared to vaccines from Moderna and Pfizer. In January, the company reported that its vaccine was 66 percent effective in preventing moderate to severe cases of COVID-19. In preventing only severe cases, that figure rose to 85%. However, that looks far less exciting than the vaccines from Pfizer and Moderna, both of which showed the efficacy of over 90% when those companies reported their November 2020 trial results.

But the problem is that Johnson & Johnson's vaccine data was never a fair comparison: the company didn't finish recruiting participants in the first phase of its vaccine trial until a month later, in December 2020. By then, the coronavirus had evolved, with new variants of concern in the United Kingdom, Brazil, and South Africa. In earlier Moderna and Pfizer trials, these variants would not have played as much of a role (if at all) in overall efficacy as they did in the Johnson & Johnson trials; if we consider only the United States, the J&J vaccine increased in efficacy to 72% in preventing moderate to severe disease.

From the beginning, the J&J vaccine was at a disadvantage because of the numbers, which unavoidably directed to comparisons. But a new study has emerged that could prove much more encouraging for Johnson & Johnson and lead to increased demand for its vaccine.

A new study from South Africa called Sisonke has shown the high efficacy of Johnson & Johnson's vaccine against one of the most dangerous variants of the virus, delta. The study is large, involving 480,000 health care workers (the company's original Phase 3 study was relatively large, with only 45,000 participants). Although the data have not yet been peer-reviewed, the early numbers are extremely encouraging: the effectiveness in preventing hospitalizations for delta-related cases is 71%. And in terms of preventing death, the overall effectiveness rose to 96%.

By comparison, studies of two doses of the Pfizer vaccine show that effectiveness against delta can range from 42% to 96%. The efficacy of the Moderna vaccine also varies, but it seems to be slightly higher at about 76%. But what both vaccines have in common is that people need two doses of the vaccine because one dose provides weaker protection. And this is where the advantage may be greatly tipped in Johnson & Johnson's favor since its single-dose vaccine is much easier to administer.

The company's vaccine can quickly help countries around the world raise the vaccination pace. Without having to wait several weeks between doses, a single-dose vaccine effective against the delta variant could be in high demand.

If production problems are resolved and concerns about vaccine efficacy are allayed, J&J could make serious inroads into the COVID-19 vaccine market. It has a long way to go to overtake Pfizer and Moderna in market share, but the health care giant is a major player in the industry with significant resources. It can increase production to meet a surge in demand.

That's why investors shouldn't discount the role vaccine sales can play in its future.

But there is a danger in investing based on a particular COVID-19 option. The situation is changing rapidly, and a new variant could emerge that would render all currently available vaccines virtually useless. And so while Johnson & Johnson's vaccine looks like it should revive in the future, and while it has a chance to overtake both Moderna and Pfizer, these factors are not enough to make it reliable; there is simply too much uncertainty. In the long run, the stock is not too safe either; Johnson & Johnson's legal problems in other areas of its business are reason enough to stay away from the stock.

Nevertheless, if you're not afraid of risk and uncertainty and want to get into the COVID-19 vaccine market, investing in Johnson & Johnson is still better than buying stock in a fast-growing company like Moderna, which is trading more than $100 above the price benchmarks set by even some of the most bullish analysts. And given that the company is a bit of an outsider in this race, Johnson & Johnson's ability to produce higher-than-expected vaccine sales could lead to a meaningful upgrade in analysts' ratings, which in turn could lead to big returns for shareholders who buy the stock today.

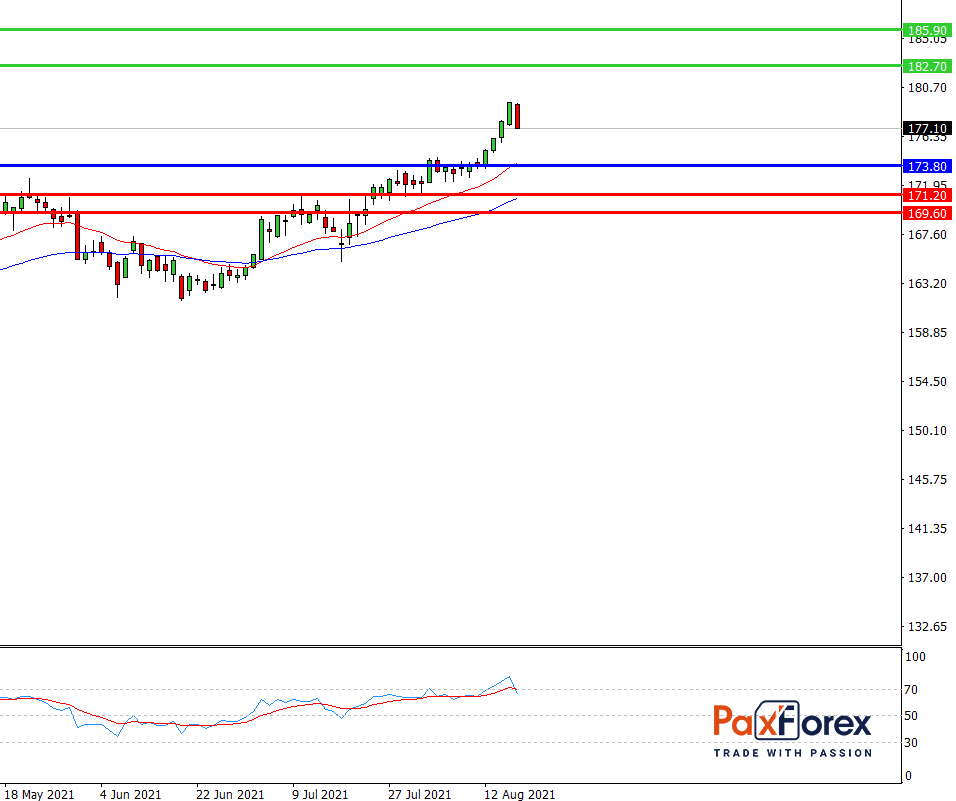

As long as the price is above 173.80, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 177.10

- Take Profit 1: 182.70

- Take Profit 2: 185.90

Alternative scenario:

If the level of 173.80 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 173.80

- Take Profit 1: 171.20

- Take-profit 2: 169.60