Source: PaxForex Premium Analytics Portal, Fundamental Insight

When Intel appointed a new CEO in February, some investors began to question whether it was worthwhile to buy the stock now. In decades past, the company led the PC semiconductor chip market, but some management mistakes amid declining PC sales have left Intel behind Taiwan Semiconductor Manufacturing and its client, Advanced Micro Devices

Under the leadership of CEO Pat Gelsinger, Intel has taken some important steps that could pave the way for a return to first place in semiconductor manufacturing, but there are also signs that investors may have to be patient if they expect this company's stock to make such a leap.

At first glance, Intel doesn't stand out among its competitors in any meaningful way. TSMC will probably soon develop a faster chip than the 7nm semiconductor it now sells. It comes at a time when Intel is struggling to move beyond making 10nm chips without the help of TSMC.

That doesn't mean its competitive edge can't improve soon. For one thing, with Gelsinger taking over as CEO, the company will again be led by someone with an engineering background. It could return Intel's focus to achieving a technological advantage. Under the previous CEO, Intel seemed resigned to the fact that production would be outsourced to TSMC. Gelsinger, however, seems intent on reviving Intel's foundries, pledging $20 billion to expand the company's manufacturing capabilities.Moreover, unlike AMD and other " no-factory " companies, Intel is not outsourcing most of its production to TSMC, Samsung, and other factories. It could end up giving Intel an advantage since it has its foundries in the U.S.

According to TrendForce, Taiwan accounts for about two-thirds of global chip production today. Taiwan faces direct threats from neighboring China, making the chip industry vulnerable to geopolitical forces it cannot control.

Because of this, Gelsinger and other industry leaders also lobbied the Biden administration for government subsidies to partially fund a revived domestic chip industry. Since Intel owns more factories in the U.S. than any other company, it should give Intel a distinct advantage should the political situation in Taiwan deteriorate.

The current geopolitical situation and the severe chip shortage may also provide capital for technological improvements, a process Intel has already begun. Since the chip development cycle takes three to five years, investors will not soon know if Intel can catch up with TSMC. Nevertheless, in the mid-2010s AMD managed to make a comeback when many observers thought it would not be able to recover. Investors should not assume that such a feat cannot be repeated.

The good news for investors is that the market has taken a view of Intel's current situation in its stock price. Intel is selling at about 13 times its current earnings. That's much lower than AMD and TSMC, which are trading at P/E ratios of 35 and 33, respectively. Consequently, some analysts see Intel as a low-cost prospect for a reversal.

Unfortunately, for those betting on long positions on the stock, this valuation seems to reflect the company's growth rate. Intel's sales have temporarily increased because of the increased demand for chips during the pandemic. In 2020, the company's revenue was $78 billion, up 8 percent from 2019.

However, revenue growth was not reflected in the bottom line. Revenue under generally accepted accounting principles (GAAP) was down 1% from year-ago levels in both the fourth quarter of 2020 and the first quarter of 2021. In the first quarter of 2021, net income also fell 41% to $3.4 billion for the same period. Investors should consider that net income would have declined modestly due to higher sales costs. Nevertheless, Intel paid $2.2 billion to restructure because it lost a patent infringement suit with VLSI in March.

In addition, the company is projecting revenue of $77 billion in fiscal 2021, down 1 percent from 2020. It might partially explain why Intel's stock price has fallen about 7 percent over the past year. In addition, if Intel meets expectations for a free cash flow of $10.5 billion in 2021, that would be less than half of its 2020 free cash flow of $21.5 billion.

However, the company is planning capital spending of $19 billion to $20 billion during 2021. That's far more than the $14.3 billion allocated to capital spending in 2020, which could boost the stock in the long run.

Given the promising investment and stagnant financial performance, Intel stock appears slightly speculative.

In the company's favor, Gelsinger's plan to revive Intel and increase capital spending is encouraging, especially when combined with a modest P/E ratio. However, revenue, earnings, and free cash flow metrics again point in the wrong direction. In addition, it will take years to see whether Gelsinger's moves today will help revive Intel in the long run.

Such uncertainty indicates that investors should proceed cautiously, if at all.

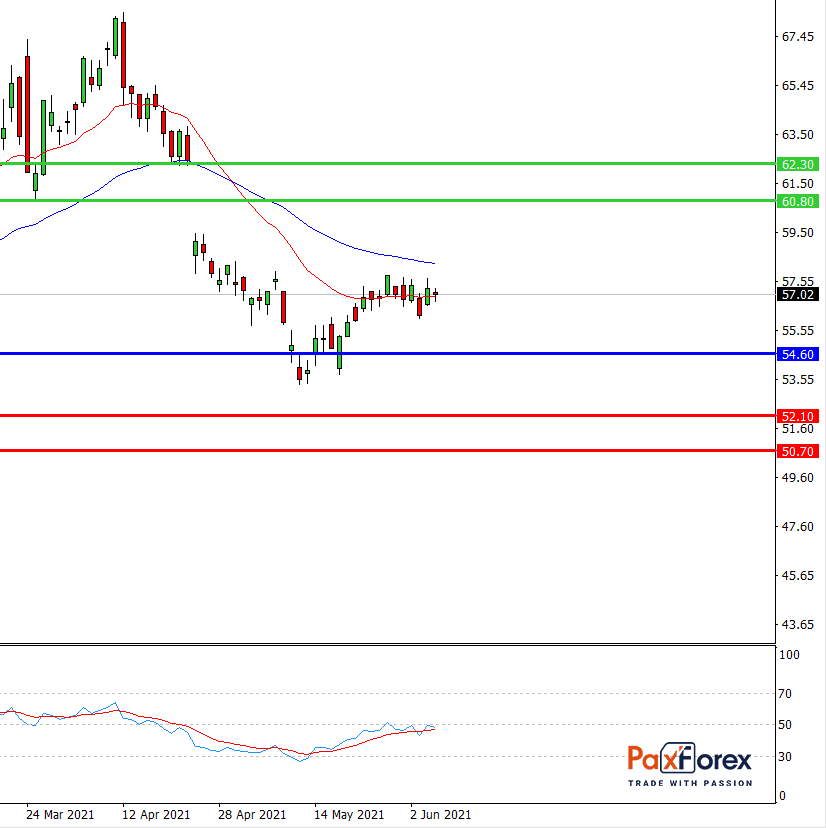

While the price is above 54.60, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 57.37

- Take Profit 1: 60.80

- Take Profit 2: 62.30

Alternative scenario:

If the level 54.60 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 54.60

- Take Profit 1: 52.10

- Take Profit 2: 50.70