Source: PaxForex Premium Analytics Portal, Fundamental Insight

The past five years have been tough for Intel, the world's largest maker of x86 processors for PCs and data centers. It has underperformed Taiwan Semiconductor Manufacturing Company and Samsung in the "technology race" to produce smaller, more high-level chips, and persistent lags and chip shortages have ended in a huge loss of market to AMD.

INTC has also rejected the mobile market, ceasing production of chips for smartphones and baseband modems, and made scattered investments in programmable chips, Internet of Things (IoT) chips, and automotive chips - none of which have solved the company's core problems.

Former Intel CEO Brian Krzanich unexpectedly quit three years ago. His "inheritor", Bob Swan, concentrated on lowering costs and buying back stock instead of addressing pressing R&D issues. Swann had even considered outsourcing much of Intel's production to TSMC - rather than upgrading his foundries - before he was ousted in January.

Swan's successor, Pat Gelsinger, has rejected the concept of Intel growing a "fabless" chipmaker similar to AMD and has redoubled efforts to expand its internal foundries. The company is reportedly even considering an acquisition of GlobalFoundries, AMD's past factory division, to stimulate those intentions. Gelsinger anticipates that the manufacturing extension will benefit Intel regain technology leadership from TSMC and win back succumbed market share from AMD.

If Intel can achieve those lofty goals remains a controversial question. But Intel lately updated its 2025 plans, and there are some dramatic changes. Let's take a look at the most significant changes and how they might affect Intel's growth over the next five years.

The technology race is measured in nodes. Smaller nodes, which are currently measured in nanometers, are commonly recognized as more advanced than larger nodes since they are more energy-efficient.

TSMC began mass production of 7-nanometer chips in 2018 and 5-nanometer chips in 2020. Intel began mass production of 10-nanometer chips in 2019 after several years of delays, and previously delayed production of the next generation of 7-nanometer chips until late 2022 or early 2023.

Initially, it appears that Intel is two generations behind TSMC's chips. However, Intel's 10-nanometer chips have the same density as TSMC's 7-nanometer chips, about 100 million transistors per millimeter square. Basically, Intel's 10-nanometer chips are technically comparable to TSMC's 7-nanometer chips, but the size of the nodes (which are set by each foundry instead of a single industry standard) still puts TSMC in the lead.

But as part of its new plan, Intel is renaming its 10+ node, also known as the 10-nm Super Fin node, to the "new" 7-nanometer node. These new chips, to be released by the end of 2021, should offer better performance than TSMC's 7-nanometer chips, but won't be able to match TSMC's 5-nanometer chips.

Intel is renaming its old 7-nanometer node, which was originally delayed, to a "new" 4-nanometer node to show that it will outperform TSMC's 5-nanometer node. Intel still prepares to release chips later next year or early 2023, but it will then lag behind TSMC, which will begin mass production of its 3-nanometer chips in the second half of 2022 and possibly release its 2-nanometer chips in 2023.

Intel intends to slowly gain on TSMC by supplying its new factories with more high-tech extreme ultraviolet (EUV) lithography machines. It also wants to become the first chipmaker to use next-generation EUV machines with the high NA required to produce smaller chips beyond the 3-nanometer node. The company claims to be working closely with ASML, the world's only EUV and High-NA machine maker, to get these orders-but ASML also supplies the same machines to TSMC.

Intel plans to release its first 3-nanometer chips in the second half of 2023. The company expects the performance of the new node to be 18 percent faster than earlier projected 3-nanometer chips.

Intel plans to begin production of 2-nanometer chips, also known as "20A" (20 angstrom) chips, in 2024. These chips, which will replace Intel's old 5-nanometer process, could have nearly twice the density of 3-nanometer chips. In 2025, the company will release 18A (1.8-nanometer) chips. We don't know much about these chips yet, but the company believes that the 20A and 18A chips will help it wrest technology leadership from TSMC and Samsung by 2025.

Intel factories in Arizona, Ireland, Israel, and Oregon are getting ready to produce 4-nanometer, 3-nanometer, and 20A chips. That speedup, likely to be backed by subsidies in the U.S. and Europe, could greatly expand its contract chip manufacturing services and help fabless chipmakers decrease their over-dependence on TSMC and Samsung.

It is not that obvious whether Intel can accomplish its lofty new purposes, but its new schedule shows that it intends to keep pace with TSMC and Samsung by expanding its capacity and ordering more high-performance machines from ASML.

Many still have doubts that Intel will be able to regain its lead in process technology by 2025, particularly as TSMC decidedly

increases its costs to maintain its advantage, but significant changes in its foundry business could back it to evade expected delays and shortages and recover some of its lost market share from AMD.

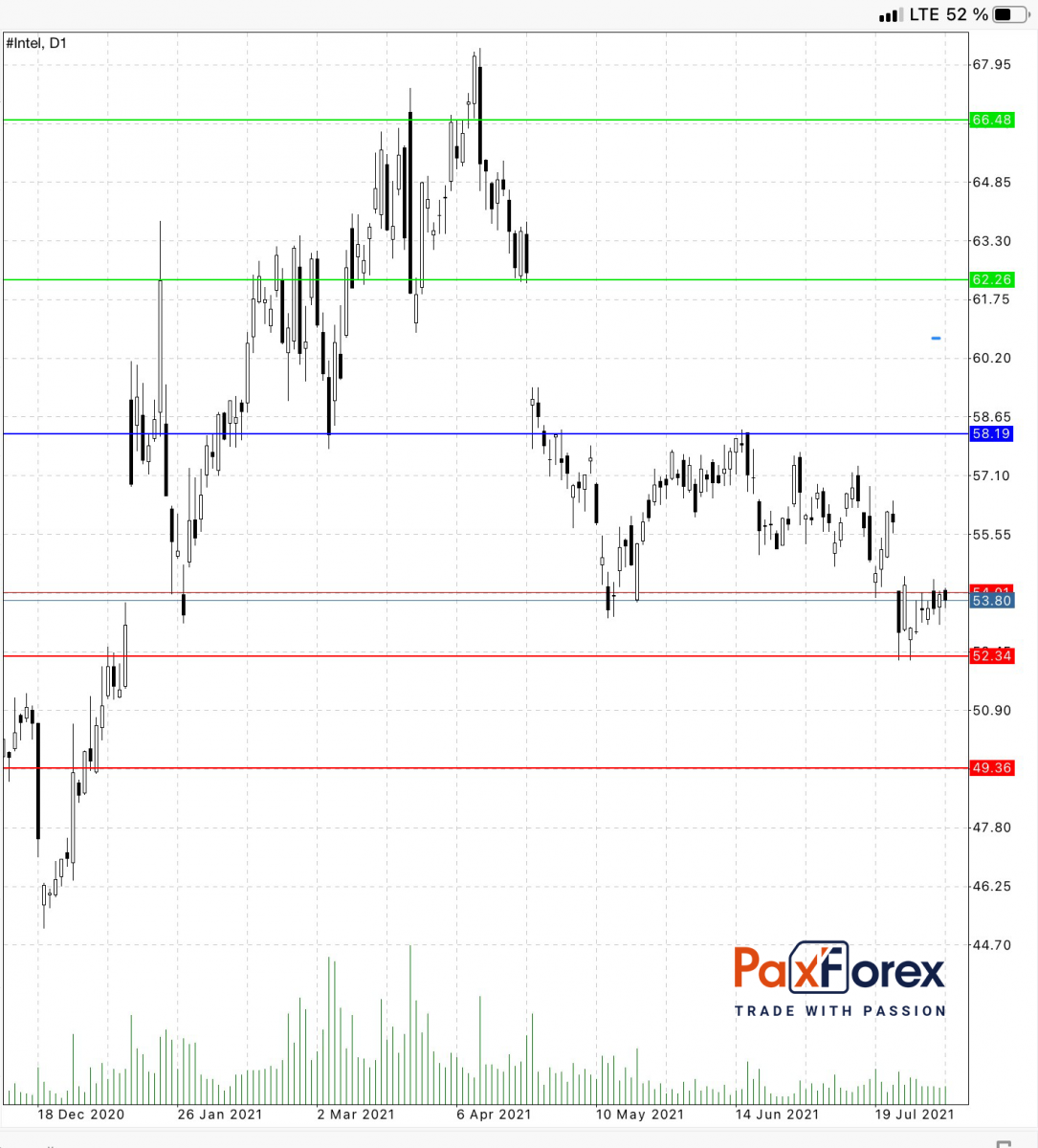

As long as the price is below 58.19, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 53.80

- Take Profit 1: 52.34

- Take Profit 2: 49.36

Alternative scenario:

If the level of 58.19 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 58.19

- Take profit 1: 62.26

- Take Profit 2: 66.48