Source: PaxForex Premium Analytics Portal, Fundamental Insight

In recent years, International Business Machines, more commonly known as IBM, has focused on its growing business processes, such as cloud computing and artificial intelligence (AI). Nevertheless, this adjustment in priorities has yet to drive strong quarterly results. During the tech giant's fourth-quarter earnings conference call last week, management reiterated its optimism about revenue and free cash flow growth over the next two years. Stock trading results on the day of the earnings report showed that the market reacted very skeptically.

Given the company's current low valuation and the challenging change it has initiated for itself, does it make sense to buy IBM stock now?

Over the past few years, Big Blue has struggled to compensate for the decline of its large traditional business segments (on-premises software, hardware, and enterprise services).

The fourth quarter was no exemption. Adjusted for divestitures and in constant currency, revenue fell 8% year over year to $20.4 billion. Throughout the earnings discussion, CEO Arvind Krishna explained these lackluster results by saying that customers are postponing projects and signing shorter-term service contracts amid an unstable economic environment. Besides, the planned completion of IBM's traditional consulting led to longer negotiations, which delayed some deals.

Nevertheless, the company's cloud business continued to make a solid contribution to the company's revenues. For example, cloud specialist Red Hat, obtained by IBM two years ago for $34 billion, increased 18 percent year-over-year on a normalized basis a year after. And the number of customers using IBM's hybrid cloud platform, which enables applications to run in private and public clouds, grew 40% year-over-year to 2,800.

Overall, cloud revenue grew 8% year over year (in constant currency) to $7.5 billion and accounted for 37% of total revenue in the fourth quarter, up from 31% of total revenue the previous year.

As a thriving part of IBM's revenue, cloud computing activities should increasingly add to the company's efficiency. And management is investing in that extension due to the company's solid free cash flow of $10.8 billion in the past 12 months.

To provide a clear picture, since Krishna took office in April 2020, the business has declared ten acquisitions to strengthen its portfolio of hybrid cloud and AI services. For example, Red Hat signed a definitive agreement earlier this year to acquire security specialist StackRox and enhance its flagship OpenShift hybrid cloud platform with cloud security capabilities.

The investment in the hybrid cloud has been pivotal to IBM's transformation. Indeed, management expects that the hybrid cloud market is $1 trillion, and with appropriate acquisitions and internal development, IBM can leverage and expand its software and services offerings to take advantage of this significant opportunity (to date, less than 25% of workloads have been migrated to the cloud).

Effective implementation should result in improved performance by the second half of the year. And with operating leverage, the increase in free cash flow should fund the company's ambitions to invest in hybrid cloud and artificial intelligence capabilities, retain dividends and reduce its debt load.

Thus, management expects adjusted free cash flow to reach $11 billion to $12 billion in 2021 and $12 billion to $13 billion in 2022. This figure over the next two years will depend on the timing of the cash tax items, and it does not include reorganization costs. But if you consider $11 billion in annual free cash flow going forward, IBM stock looks undervalued at less than ten times the estimated free cash flow.

Granted, in addition to operational risks, the company's reorganization, which includes a spin-off of its legacy consulting business and a simplified go-to-market model, will result in a significant exceptional expense of about $4 billion over the next 18 months.

However, investors should regard IBM as an engaging technology company. Unlike some fast-growing tech specialists, the company won't generate exciting results over the next few years. But its valuation meets low expectations, notwithstanding a growing presence in the promising markets of hybrid cloud and artificial intelligence.

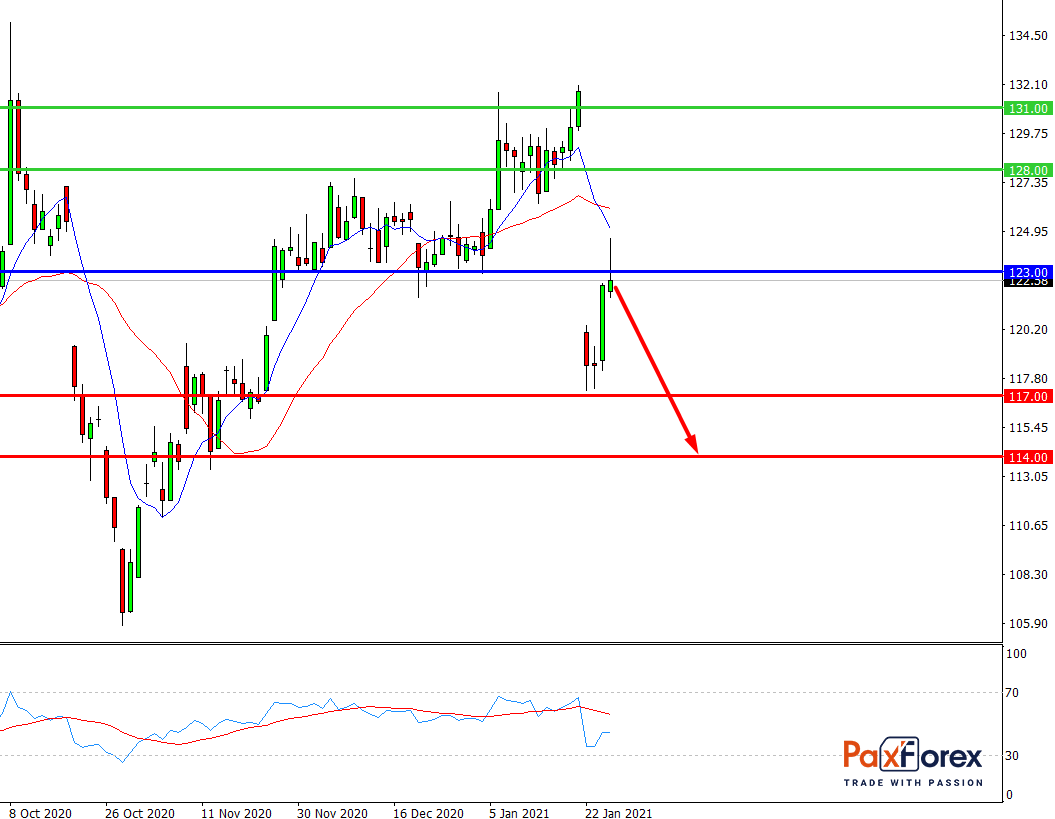

Provided that the price is below 123.00, follow these recommendations:

- Time frame: D1

- Recommendation: short position

- Entry point: 121.00

- Take Profit 1: 117.00

- Take Profit 2: 114.00

Alternative scenario:

In case of breakout of the level 123.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 123.00

- Take Profit 1: 128.00

- Take Profit 2: 131.00