Source: PaxForex Premium Analytics Portal, Fundamental Insight

International Business Machines did not disappoint analysts and experts when it reported its first-quarter earnings earlier this week. The century-old technology giant recovered the revenue growth and exceeded both top-and bottom-line analyst estimates. A strong increase in cloud computing and solid mainframe performance contributed to that.

Today, we take a look at a few key points from IBM's financial report to help assess the company's current situation.

IBM provides a public cloud platform like those of Amazon and Microsoft, but the company is focusing on hybrid cloud computing. IBM believes that its large customer base will benefit from a mix of on-premises hardware and public cloud services, rather than simply moving to the public cloud.

In the first quarter, IBM delivered 18 percent growth in cloud computing revenue. In the cloud computing and cognitive software segment, cloud revenue grew 34%, and the company now has about 3,000 hybrid cloud platform customers. Cloud computing revenues grew 28% in the global business services segment, 2% in global technology services, and 21% in the systems segment.

Also, as a reminder, IBM announced its $34 billion acquisition of Red Hat in late 2018 and closed the deal in mid-2019. Under accounting standards, IBM could not account for all of Red Hat's post-acquisition revenues, but the company has now overlapped those periods.

In the first quarter, IBM reported 53 percent more revenue from Red Hat than in the previous quarter. Red Hat's actual growth rate was much more moderate but still stunning. Adjusted for both accounting rules and currency, Red Hat boosted revenues by 15% year-over-year.

After the acquisition closed, IBM has tripled its revenue base for Red Hat's OpenShift hybrid cloud platform. Red Hat software is a key part of IBM's hybrid cloud strategy, and the business has a tremendous chance to sell its existing customers on the Red Hat platform.

Every few years, the company presents a new mainframe system, launching an upgrade cycle that temporarily boosts revenue in the systems segment. Although mainframes may seem obsolete, the systems are still widely used in industries such as financial services. IBM's mainframe revenues were up 49 percent year-over-year in the first quarter. Such growth almost two years after the launch of the latest mainframes is not typical of IBM.

IBM's mainframe business drives software and services sales, including sales of the Red Hat platform. OpenShift runs on IBM mainframes, so the systems are part of IBM's hybrid cloud strategy. Mainframe sales will eventually decline as the product cycle tightens further, but it gave a nice increase to revenue in the first quarter.

IBM loaded its balance sheet with debt to fund the Red Hat acquisition. The company is working hard on enhancing its balance sheet.

IBM ended the first quarter with total debt of $56.4 billion, up from $64.3 billion a year earlier. About $18 billion. Of that debt, about $18 billion is related to IBM's global finance business, while the rest is not. Non-global finance debt fell $4 billion to $38.1 billion last year.

In addition to reducing its debt load, IBM maintained a strong cash balance. The company had $11.3 billion in cash and marketable securities at the end of the quarter, down slightly from the same period last year.

For now, IBM is sticking with its previously released guidance for 2021. The management foresees revenue growth throughout the year, and it sees adjusted free cash flow between $11 billion and $12 billion.

That amount of free cash flow misses several significant items. First, the company is returning about $3 billion related to restructuring initiatives started late last year. Next, it eliminates any costs associated with the prepared spin-off of its managed infrastructure services business. This spin-off is told to be finished by the end of the year.

Although IBM improved revenues in the first quarter and beat all analyst estimates, the company still has a lot of work to do to prove to investors that this growth is sustainable. Legacy divisions continue to drag down the company's results, and the upcoming spin-off will help improve the situation.

IBM stock is trading at fairly low levels relative to earnings. Analysts expect IBM's adjusted earnings to be about $11 this year, resulting in a price-to-earnings ratio of only about 12.5.

The company also pays dividends, which currently generate about 4.7 percent of earnings for investors.

If IBM's hybrid cloud strategy is successful, the combination of profit growth and multiple expansions could yield solid returns for patient investors.

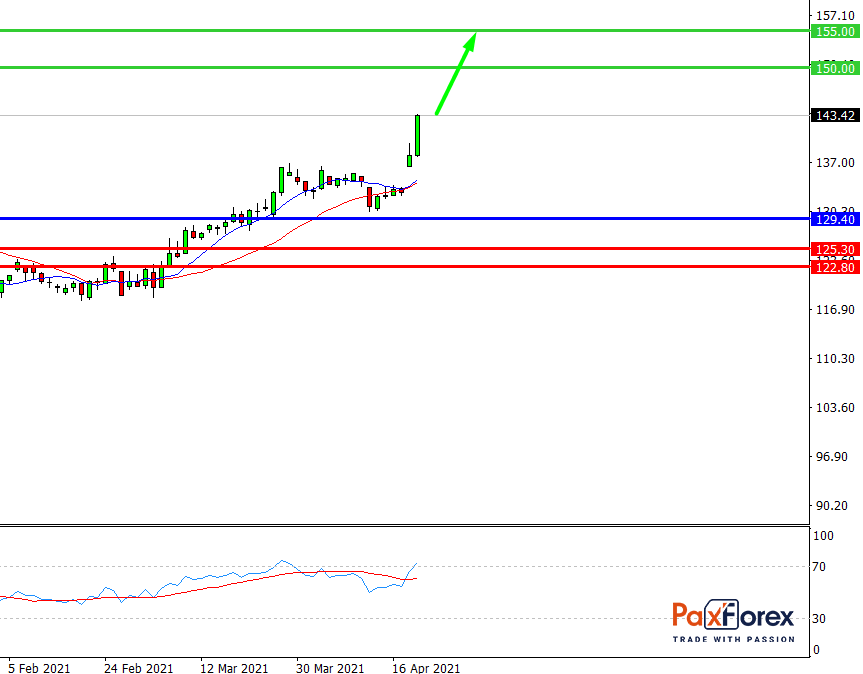

Provided that the price is above 129.40, follow these recommendations:

- Time frame: D1

- Recommendation: long position

- Entry point: 133.00

- Take Profit 1: 150.00

- Take Profit 2: 155.00

Alternative scenario:

In case of breakdown of the level 129.40, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 129.40

- Take Profit 1: 125.30

- Take Profit 2: 122.80