Source: PaxForex Premium Analytics Portal, Fundamental Insight

Few companies have such a long and glorious history as IBM, which has set the course of computer technology for decades. Now, as the company continues a long and extensive restructuring and with a new CEO at the helm, should we consider buying IBM stock now?

Originally called International Business Machines, IBM helped pave the way for many segments of the computer industry.

But today IBM is not the dominant force it once was. The development of the Internet and the meteoric rise of new technology companies that emerged in the 1980s dramatically changed the architecture of computers. IBM's giant mainframe computers, which could have been the size of an elephant, became metaphorical elephants.

The company was caught off guard as customers moved from centralized computing to a highly distributed technology network.

This forced IBM to embark on a dramatic multi-year restructuring, which accelerated significantly on Oct. 10. IBM announced plans to grow its $19 billion technology consulting business to focus more on cloud computing and artificial intelligence. IBM shares jumped 6 percent, hitting a six-month high.

A business unit called Managed Infrastructure Services will be transformed into a new public company. It will help companies manage their technology infrastructure. IBM sees it as a tax-free deal, completed by the end of next year.

The new company plans to focus on managing and upgrading customer-owned infrastructure, which will generate $500 billion. It will provide hosting and networking services, infrastructure upgrades, and cloud migration services.

IBM's multi-year transformation is focused on developing and expanding what IBM calls an open hybrid cloud platform.

"IBM is focused on a $1 trillion hybrid-cloud capability," CEO Arvind Krishna said in a written statement announcing the restructuring.

The hybrid cloud architecture means IBM can provide its customers with both a public cloud and a private cloud, giving the company additional network security. They share data and applications with each other.

IBM has invested more than $120 billion over the past eight years to reorganize the company. That includes $29 billion in capital spending on things like scaling its cloud operations and artificial intelligence offerings, as well as strengthening security and expanding service capabilities.

IBM's rising star is its Cloud and Cognitive Software division. It provides a variety of cloud computing services, data and transaction platforms. It also includes what IBM calls cognitive applications, which is another term for artificial intelligence.

This is where IBM's $34 billion acquisition of Red Hat came into play. Red Hat is an open-source cloud computing software company. It played a key role in IBM's massive expansion, offering a hybrid cloud architecture to its customers, and should provide support for IBM stock. IBM sees big opportunities ahead.

"We are redefining our future as a hybrid cloud platform and AI company," Krishna said during the company's third-quarter earnings conference call.

"For IBM, as we look forward, the case for the hybrid cloud is clear," he said. "Customers see 2.5 times the value in the hybrid cloud compared to public cloud alone. It's a huge opportunity, valued at $1 trillion, and most of the opportunity is ahead for enterprises."

Krishna was previously senior vice president of cloud technology and cognitive software. He officially took the reins in April, succeeding Ginni Rometty who had led the company since 2012. At the time he became CEO, IBM stock jumped 5 percent on the news.

Key business shifts help explain why revenue and earnings growth have been quite challenging. Over the past 20 quarters, only three of them have posted year-over-year revenue growth.

IBM reported fourth-quarter results on Jan. 21 that fell short of revenue expectations but beat earnings expectations. Adjusted earnings fell 56% to $2.07 a share, beating estimates of $1.81. Revenue fell 6 percent to $20.37 billion, below the $20.7 billion estimates, according to FactSet.

The company's Cloud and Cognitive Software segment, which includes Red Hat, generated $6.84 billion in revenue. That's about 5 percent less and below Wall Street's estimated $7.18 billion. However, total cloud computing revenue of $7.5 billion is up 10 percent.

"We made progress in 2020 by growing our hybrid cloud platform as the foundation for our customers' digital transformation while coping with the broader uncertainty of the macroeconomic environment," CEO Arvind Krishna said in a written earnings call to IBM. "The actions we are taking to focus on hybrid cloud and artificial intelligence will continue, which gives us confidence that we can achieve revenue growth in 2021."

For the current quarter, Wall Street expects IBM's revenue to fall 1% to $17.4 billion and adjusted earnings to be $1.68, down 9%.

Overall, according to most analysts, investors would be better off refraining from buying until IBM stock can deliver solid leading growth.

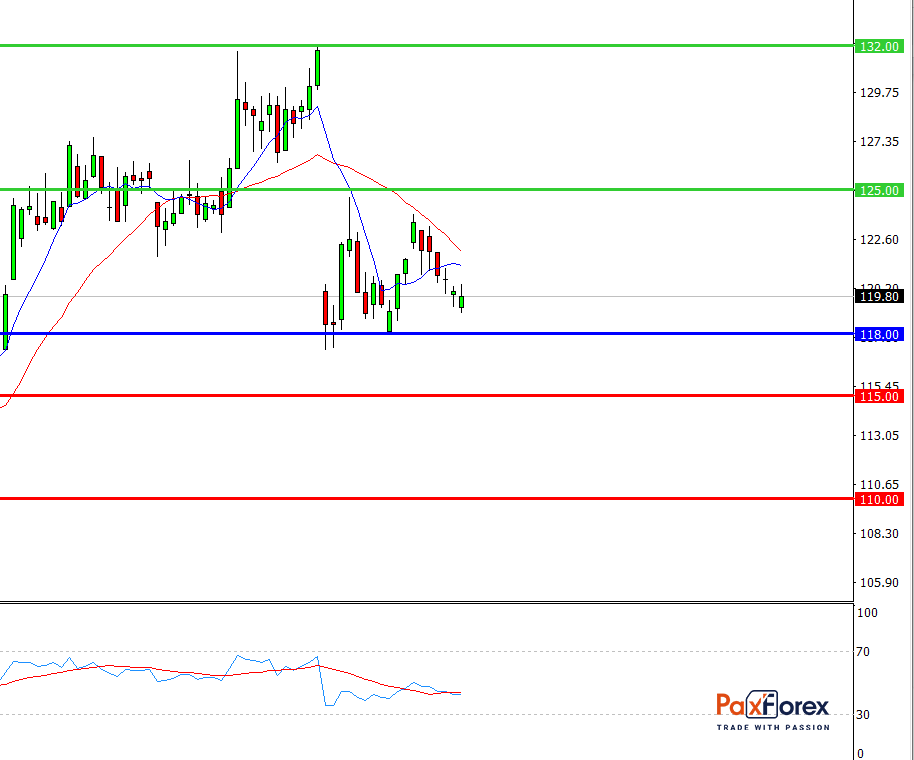

While the price is above 118.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 120.00

- Take Profit 1: 125.00

- Take Profit 2: 132.00

Alternative scenario:

If the level 118.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 118.00

- Take Profit 1: 115.00

- Take Profit 2: 110.00