Source: PaxForex Premium Analytics Portal, Fundamental Insight

Home Depot, the world's biggest home improvement business, shows no signs of losing its momentum. The Atlanta-based company recently announced revenue and earnings growth for the first quarter of the fiscal year 2021 of 32.7% and 84.6%, respectively.

Even though growth was expected to slow after the pandemic as consumers began spending money on more than just home projects. But so far, they haven't lived up to expectations.

It's certainly great news for the company's shareholders.

The business still faces two very tough measurements in Q1 and Q2 of 2021 (opposed to the same periods if 2020). So, what is in store for Home Depot in the next 12 months?

HD is the largest retailer on the planet in its sector, with 2,144 stores with an average of 105,000 square feet. The largest, 225,000 square feet, is located in New Jersey. And the potential for expansion is clearly not entirely exhausted. Home Depot (operates in both the professional and DIY (do-it-yourself) segments. In addition to tools, paints, materials, and garden supplies, Home Depot offers its customers installation and delivery services for a variety of products and structures. After the deepest housing crisis, the company focused on developing its U.S. division. In addition to the U.S., Home Depot has a presence in Canada, Mexico, and China.

Home Depot is currently benefiting from the excessive housing market recovery. During the four weeks ending May 9, the average price of homes sold was up 22% over the same period back in 2020. Homes sold throughout that period were on the market for less than three weeks, a record low.

Home Depot will undoubtedly benefit as consumers tend to spend money on home improvement projects before selling a home and after buying a new one. And as home prices continue to rise, homeowners feel more comfortable investing in home improvements.

Adding fuel to the fire is the emerging peril of likely higher interest rates, encouraging consumers who may have been on the sidelines to enter the new home market. Such excitement does not appear to abate over the next year.

Home Depot is definitely operating in a great economic environment for its business. Its two customer segments, DIY (do-it-yourself) and DIFM (do-it-for-me) saw accelerating growth in the first quarter. In fact, the DIFM group outperformed DIY in the first quarter, which shouldn't be a surprise given that people are now quietly allowing contractors into their homes to work on larger projects.

Investors shouldn't bother about Home Depot's outlooks next year, even when you consider the successful second and third quarters of 2020 (sales are up more than 23% in those six months). The company looks stronger than ever, and it will manage to weather anything that comes its way.

However, in 12 months, investors will have more clarity about what the post-pandemic world will look like, and that is what matters most. Consumers will continue to rethink their living arrangements, especially as work-at-home jobs become increasingly popular. It could be another boost for Home Depot's business.

Since the company's fundamental outlook has been left out, let's turn to its stock.

Over the past year, Home Depot stock has lagged significantly behind the S&P 500, despite outstanding quarter-over-quarter results. And today, Home Depot's stock valuation (based on a forward price to earnings) almost matches the broader index.

Even for those who barely follow the company, it's not difficult to understand that Home Depot is much better than the average business. It is an industry leader in a major sector of the U.S. economy and boasts a return on invested capital (ROIC) of 45.1%, indicating a profound competitive advantage. Consequently, it should outperform the index and trade higher than it.

While it is extremely difficult to predict share price performance in the short term, the booming housing market, Home Depot's competitive strength, and attractive stock valuation give experts great reliance that the next 12 months will be very favorable for the company.

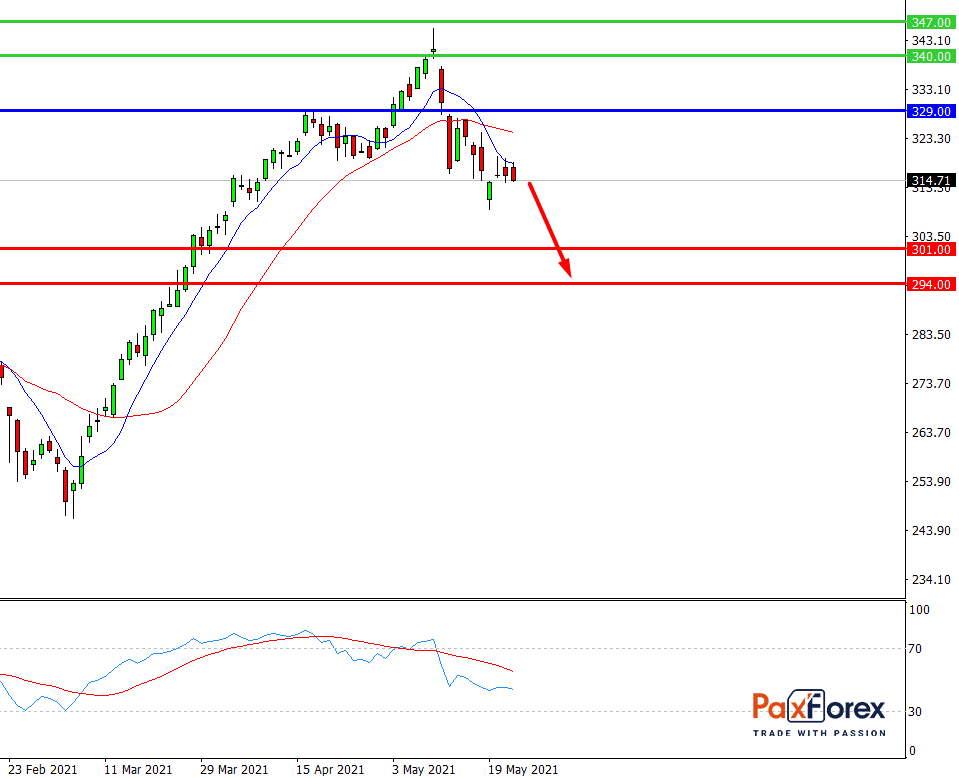

Provided that the company is traded below 329.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 315.00

- Take Profit 1: 301.00

- Take Profit 2: 294.00

Alternative scenario:

In case of breakout of the level 329.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 329.00

- Take Profit 1: 340.00

- Take Profit 2: 347.00