Source: PaxForex Premium Analytics Portal, Fundamental Insight

Home Depot, the home improvement retailer, has delivered impressive returns for investors over the past decade, growing 865% over that period, more than three times the returns of the broad market. The company is doing better than ever, thanks to a booming housing market that is driving demand for building and home improvement products.

However, investors expecting the stock to repeat that performance are likely to be disappointed. There are several signs that Home Depot is going to slow down in the coming years.

- The overheated housing market will cool down sooner or later

Even if you're not looking to buy or sell a home right now, it's hard not to see that the U.S. housing market is overheated. According to the National Association of Realtors, the average price of existing homes rose 17.8 percent year-over-year in July (after rising 23.4 percent in June).

A quick Internet search will show videos of people lining up to look at homes for sale, stories of sellers swamped with offers, and buyers forced to bid well above the asking price just to have a chance to come out on top.

Several factors contribute to this: record-low mortgage interest rates; the rapid normalization of remote work, which has enabled many people to live far from their "offices"; and the government's distribution of stimulus funds during the pandemic, which can help people save up for a down payment.

As sellers tidy up their properties in preparation for putting them on the market and buyers remodel their new purchases, Home Depot is seeing revenue growth. In fiscal 2019, sales are up just 1.8 percent, and in fiscal 2020, sales are up 19.9 percent.

Overall, the company's business is quite sensitive to the state of the housing market. For example, between fiscal years 2007 and 2009, after the housing market bubble burst, causing the financial crisis, the company's sales declined by about 15 percent. Much of the last decade was a recovery from the Great Recession. If the housing market begins to decline in the next decade, it will likely slow Home Depot's growth.

- Home Depot struggles with the law of large numbers

Home Depot also faces an obstacle related to its own size. Most businesses are finding it increasingly difficult to grow at the same rate as their size increases. For example, it is usually much easier to increase sales from $10 to $100 than from $100 to $1,000, even though it is a 10-fold increase in both.

Home Depot nearly doubled its annual revenue from $67.8 billion in fiscal 2010 to $132.1 billion last year. It will probably take much longer for the company to double its revenue again if it ever does. As the company grows in size and its core business matures, its growth should eventually slow down. That is the " cycle of life" for businesses, and it's one reason why stocks of companies that have reached maturity tend to trade at lower valuations.

- Not much room for valuation growth

If Home Depot's growth slows in the coming years, what could happen to valuations? The stock trades at a price-to-earnings ratio of 23. Over the last ten years, the average P/E ratio has been 22, so it's currently just above that long-term average. But let's remember that this period has coincided with Home Depot's booming business, and the overall stock market is consistently hitting new all-time highs.

If conditions for Home Depot's business deteriorate, the market will struggle to maintain as high a valuation for the company as it has over the past decade. And don't forget that the recent double-digit growth is a short-term outlier due to the current state of the housing market.

None of this is to say that Home Depot is a bad investment. It is one of the world's largest and best-run retailers, but the bigger the company gets, the harder it is to maintain the same growth rate. Home Depot sells lumber, paint, appliances, and tools - it's not a business model that can expand and scale the way a technology business can.

In addition, the company is currently enjoying some of the best operating conditions it has ever seen, so it may maintain its momentum in the near term. However, the likelihood that Home Depot stock will generate multiple earnings over the next decade is quite low.

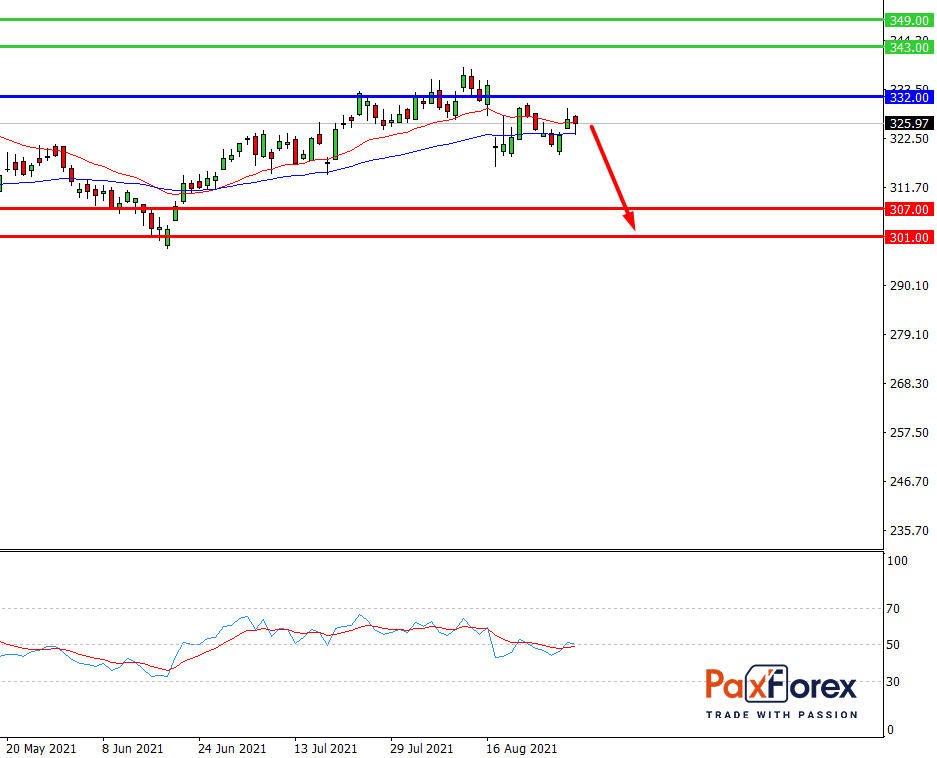

As long as the price is below 332.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 323.38

- Take Profit 1: 307.00

- Take Profit 2: 301.00

Alternative scenario:

If the level of 332.00 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 332.00

- Take Profit 1: 343.00

- Take Profit 2: 349.00