Source: PaxForex Premium Analytics Portal, Fundamental Insight

Investors had high hopes for General Electric's fourth-quarter earnings report. Three months ago, the company had projected that its industrials would generate at least $2.5 billion in free cash flow in the last quarter of the year. GE, on the other hand, lost nearly $3.8 billion in the first nine months of 2020 as a result of pandemic and seasonal factors.

GE surpassed that forecast as it continues to make plans to undervalue and outperform under the leadership of CEO Larry Culp. That sent GE stock up 2.6% on Tuesday, boosting its 80% gain, which has rebounded over the past four months.

In terms of key metrics, namely free cash flow (FCF), the midpoint of management's outlook for the year suggests that the company's performance is well ahead of the consensus on Wall Street. Add in evidence of better-than-expected business improvements, and it's clear that GE's recovery is headed in the right direction.

Larry Culp has earned a reputation as an under promising and over-performing executive during his tenure, and Q4 results have only confirmed this. Targeting an FCF of at least $2.5 billion, GE surprised the market with a whopping $4.4 billion.

Things are getting better. As for the earnings report, the consensus forecast by Wall Street analysts for FCF in 2021 was about $2.8 billion, but the range of projections offered by Culp was $2.5 billion to $4.5 billion. The midpoint of that range is $3.5 billion, $700 million higher than the analysts' consensus. And the high point is just a small fraction of their consensus FCF estimate of $4.58 billion for 2022.

No matter how you look at it, GE's FCF is improving faster than many expected. As a starting point, an FCF price multiple of 20 is often seen as a reasonable valuation for a diversified industrial conglomerate. Based on the current market cap of about $102 billion, GE would need $5.1 billion in annual FCF to reach it, a number that would probably hit it by the end of 2023.

GE's improved operating performance can also be seen by looking at its overall commercial performance by segment.

Also, investors should look at other areas in which GE has made progress during a challenging year. Five points, in particular, should be noted:

First, the conglomerate began 2020 to reduce adjusted corporate expenses to the $1.4-1.5 billion range, but the final tally was $1.33 billion.

Second, management reiterated expectations to reduce fixed energy costs for gas to $2.5 billion in 2021 from $3.5 billion in 2018 and to $2.7 billion in 2020.

Third, it's worth repeating that GE started 2020 expecting its non-aviation segments to lose $400 million to $1.9 billion in cash, but the result brought in $600 million.

Fourth, the company continues to move forward with debt reduction. Management began the year expecting industrial debt to drop to $23 billion from the $32.9 billion levels in 2019 and ended up with $23.5 billion, a credible result under the circumstances. Besides, GE Industrial paid GE Capital $1.5 billion in intercompany debt. It helped cut GE Capital's debt from $59 billion in 2019 to $52.1 billion. For reference, at the beginning of the year, management expected GE Capital's debt to shrink to $55 billion.

Fifth, GE Renewable Energy's turnaround appears to be a year ahead of schedule. The segment ended in 2020 with orders up 34% to $6.3 billion in the fourth quarter. Last quarter also saw the first order for the giant Haliade-X offshore wind turbine, which GE hopes will drive the expansion of its offshore wind energy business.

Adding it all up, GE is succeeding in cutting costs and reducing debt. Also, Culp is projecting a gradual recovery for the commercial aviation division, and GE Power and GE Renewable Energy have already begun marginal and turnaround FCF work. And all the while, the health care business is showing its strengths.

So GE's FCF will improve markedly in the coming years, and Wall Street will likely raise its forecasts for the metric after the latest report.

For 2021, GE expects low single-digit revenue growth as the business begins to recover from the pandemic. However, management's projections call for profitability to remain muted this year, with EPS adjusted to $0.15 to $0.25 because of high restructuring costs and the impact of the pandemic on GE Aviation.

Nevertheless, there is a strong likelihood that free cash flow will be at or near the top of the forecast range. And even if the aviation industry faces another setback in 2021, it won't hurt GE Aviation's long-term prospects. In fact, the segment boasts a $260 billion backlog that virtually guarantees a sharp recovery in revenue and free cash flow within a few years. It provides a solid foundation for further growth in GE stock in the coming years.

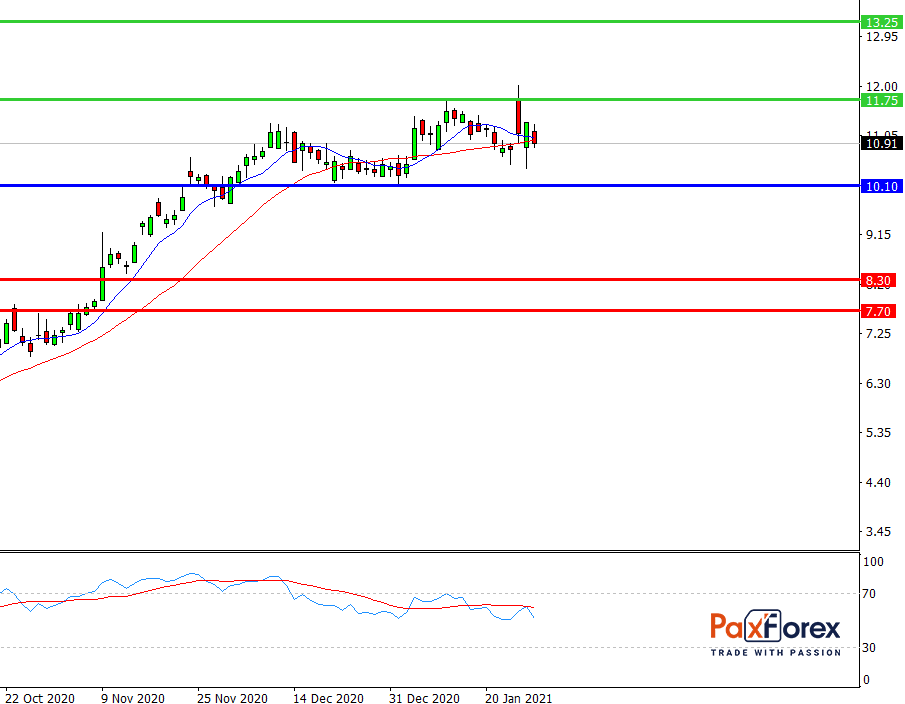

While the price is above 10.10, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 10.90

- Take Profit 1: 11.75

- Take Profit 2: 13.25

Alternative scenario:

If the level 10.10 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 10.10

- Take Profit 1: 8.30

- Take Profit 2: 7.70