Source: PaxForex Premium Analytics Portal, Fundamental Insight

General Electric has gradually received investor and analyst approval in 2021. Indeed, Andrew Kaplowitz of Citibank and Markus Mittermaier of UBS gave the stock a "buy" rating and set a $17 target. Moreover, given recent management comments and guidance, there is every reason to believe that GE stock is somewhat undervalued. Let's take a closer look at how much GE stock could be worth in several years.

The case for GE is based on comparing the sum of the parts of GE's industrial business and comparing them to what its rivals are trading at.

The key metric in all of this is enterprise value (EV), which is simply GE's market value plus its net debt. In the company's investor briefing in March, Chief Financial Officer Carolina Dybeck Happe sketched strategies to decrease GE's net debt from $51 billion at the end of 2021 to $33-37 billion in 2023. Given those numbers, you can calculate the market value of the company based on the estimated EV by stripping out net debt.

One way to compile an EV estimate is to look at each industrial business and compare it to its respective peers. It is an entertaining activity since GE has two businesses - GE Healthcare and GE Renewable Energy - in sectors that are currently highly valued.

Starting with Healthcare, GE's two main competitors in imaging and ultrasound are Siemens Healthineers and Royal Philips. Consensus analyst estimates of EV to free cash flow (FCF) for 2023 for these two companies are 23.9 times FCF and 21.1 times FCF, respectively, averaging 22.5.

As for GE Healthcare, that business generated $2.6 billion FCF in 2020, and management is targeting flat to modest growth and flat to growth over the next few years. If we conservatively assume that GE Healthcare will generate at least $2.7 billion FCF in 2023, the EV of the business will be about $61 billion in 2023.

Estimating the value of GE Renewable Energy is a bit more complicated, as that business is not expected to become an FCF generator until 2021. However, management is looking to bring the business to the level of high-digit profitability enjoyed by similar companies Siemens Gamesa and Vestas. GE management expects to achieve this by growing revenues from the offshore wind power business from $200 million in 2020 to $3 billion by 2023. At the same time, profits from the onshore wind, grid solutions, and hydropower businesses are projected to grow as the company works through unfavorable contracts.

Analysts believe Siemens Gamesa and Vestas are trading at an average EV to revenue ratio of 1.57 times earnings in 2023. Based on that figure, and the fact that GE will grow revenue at an average single-digit rate to $18.2 billion in 2023, GE Renewable Energy's EV could be $28.5 billion in 2023.

GE Power's main competitor is Siemens Energy's gas and power business. For the record, Siemens Energy is a company with a 67% stake in Siemens Gamesa and the former

Siemens gas and energy business. Based on Siemens Gamesa's market value of €17.6 billion and Siemens Energy's market value of €18.1 billion, the gas and energy segment is currently valued at €6.2 billion.

Siemens Energy aims to bring its profit margin in the gas and power segment to 6-8 percent in 2023. It is exactly the figure that GE Power is aiming for, so it is fair to compare their estimates. Based on the 2021 outlook, Siemens Energy's gas and power segment (a business with very little debt) trades at 0.33 of sales in 2021; using that ratio for GE gives an EV for GE Power of $5.6 billion.

Finally, GE Aviation is likely to begin a multi-year recovery from a pandemic-hit low point in 2020. Most experts expect commercial air travel to return to 2019 levels by 2023. If that means GE Aviation will generate FCF close to the 2019 figure of $4.4 billion, then it is reasonable to apply a factor of 20 times FCF to get an EV for GE Aviation of $89 billion.

Putting all these EV assumptions together, the target EV is $184 billion in 2023, and if you take away the midpoint of the $35 billion to $37 billion net debt forecast, the target market value is $149 billion, or a stock price of $17 per share, which is the same as the target price indicated by analysts earlier.

The target price looks reasonable, but GE will have to execute its plan to improve margins in energy and renewable energy to meet that target. At the same time, an aviation recovery is expected to occur. Fortunately, recent data suggests that the company is on the right track, and based on the numbers above and continued progress, GE's stock price looks undervalued.

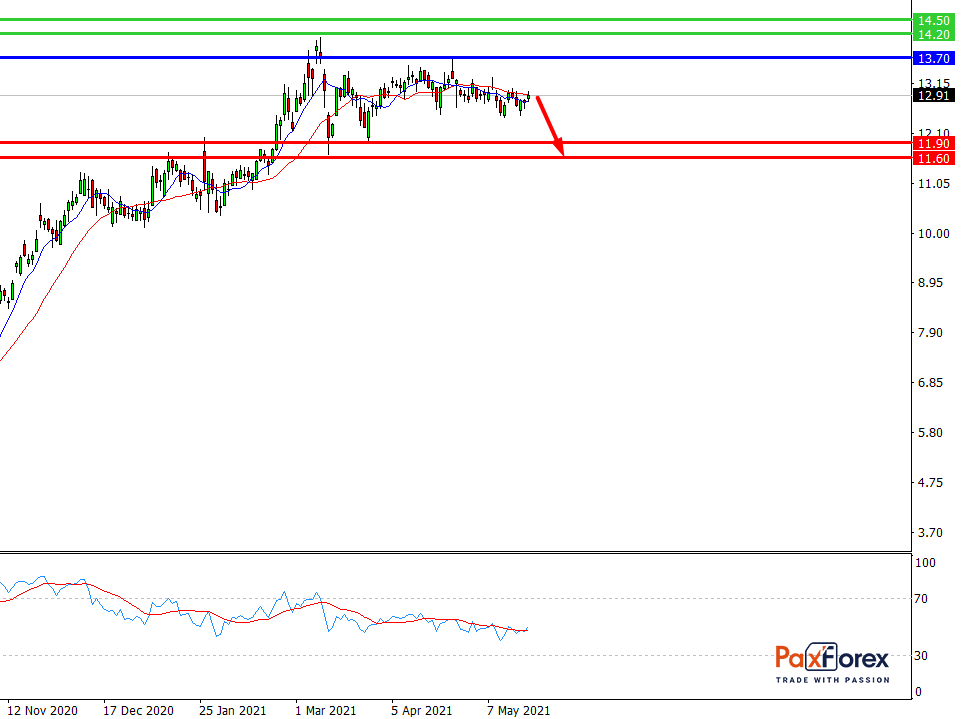

While the price is below 13.70, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 13.23

- Take Profit 1: 11.90

- Take Profit 2: 11.60

Alternative scenario:

In case of breakout of the level 13.70, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 13.70

- Take Profit 1: 14.20

- Take Profit 2: 14.50