Source: PaxForex Premium Analytics Portal, Fundamental Insight

General Electric CEO Larry Culp recently gave several presentations to investors, and what he said helped investors think about investment opportunities over the long term. It's no secret that GE needs to improve its earnings and free cash flow (FCF), and the good news is that the company appears to be on its way to doing so. Indeed, Culp cited a figure of $7 billion as an initial target. The question is whether that figure makes GE stock attractive. Moreover, what about GE's growth prospects once the recovery process is nearing completion?

Culp believes GE will be able to generate about $7 billion FCF by 2023 through a combination of $85 billion to $90 billion in revenues with high-digit FCF margins. Moreover, GE's implied projections are better than those outlined by Wall Street analysts, so there is a reason for optimism.

Culp discussed the issue during Bernstein's recent annual strategic decisions conference. In a nutshell, he expects about $10 billion in operating income (in 2023) to turn into about $7 billion in FCF. These are only rough numbers, so don't take them as an immutable truth, but Culp talked about $6 billion in operating profits from aviation, $3 billion to $4 billion from health care, $1 billion to $2 billion from energy, and operating profits from renewable energy will be "positive." The midpoints of the ranges give about $10 billion in operating profit in 2023 for an industrial company.

Relying on the $7 billion figure, investors can take the company's current market value of $118.8 billion and value it at 17 times FCF in 2023. Given that many investors consider a valuation of 20 times FCF a fair value for a mature industrial conglomerate, GE looks undervalued.

Looking beyond 2023 and $7 billion, the big question is whether GE is really another mature industrial conglomerate with earnings growth prospects in the low single digits.

Fortunately, there is every reason to believe that GE does have good long-term growth prospects. Starting with GE Aviation, the main thing to look at is long-term aftermarket revenue and services. In fact, GE Aviation sells aircraft engines at low or negative margins (at least initially, until production ramps up and unit costs go down) to get higher margins from aftermarket sales and services. Typically, the engine receives the first maintenance service in the first five to seven years of operation, the second in 10 years, and then two more visits in year 15 and 20.

It is a key point to consider because GE and its joint venture with Safran, CFM International, have an installed base of 38,000 engines worldwide, and more than 60 percent of them have only one maintenance visit. In other words, the existing engine fleet has great long-term growth potential, and with engines being installed on the Boeing 737 MAX, Airbus A320neo, Boeing 787, and Boeing 777X, the future looks bright for GE Aviation.

Needless to say, the pandemic has led to a decline in shop visits due to a lack of flight hours and engine disposals. However, GE expects engine maintenance shop visits to return to 2019 levels in 2023, and we can expect good service revenue growth from then on.

GE Power is likely to be self-replicating over the next few years. Gas Power (about three-quarters of revenue in 2020) is already generating positive FCF, and management is on track to improve margins in line with similar metrics. The electric power portfolio (steam power, power conversion, and nuclear power) shows roughly the same story, albeit with a delay in recovery due to GE's exit from the new coal-fired power plant business.

The fact that Culp is talking about an FCF of $1 billion to $2 billion is a positive development. Still, given the strength of the "energy transition" to renewables, it's hard to imagine GE Power's growth being more than low-single-digit when the company's margins are flat.

GE Healthcare is interesting in the sense that the market rewards healthcare companies with high valuation multiples. Not surprisingly, the company has focused its acquisition and investment activity in this segment.

As for renewable energy, grid solutions and hydropower are projected to become a break-even business between 2022 and 2023. In addition, offshore wind power sales are expected to grow from $200 million in 2020 to $3 billion by 2024. Meanwhile, management is focused on working with low-margin onshore wind power contracts and improving margins on new contracts. Looking to the longer term, GE has an opportunity to increase revenue from higher-margin services (currently only 20 percent of segment revenue) as its installed wind turbine base grows.

The growth prospects discussed above, especially in the aviation and renewable energy segments, suggest that GE does have the potential to grow earnings by more than one to two dozen percent beyond 2023. GE's health care and energy businesses will provide solid support. Thus, a price-to-FCF multiple of 17 times (assuming GE gets $7 billion FCF in 2023) makes the stock quite attractive.

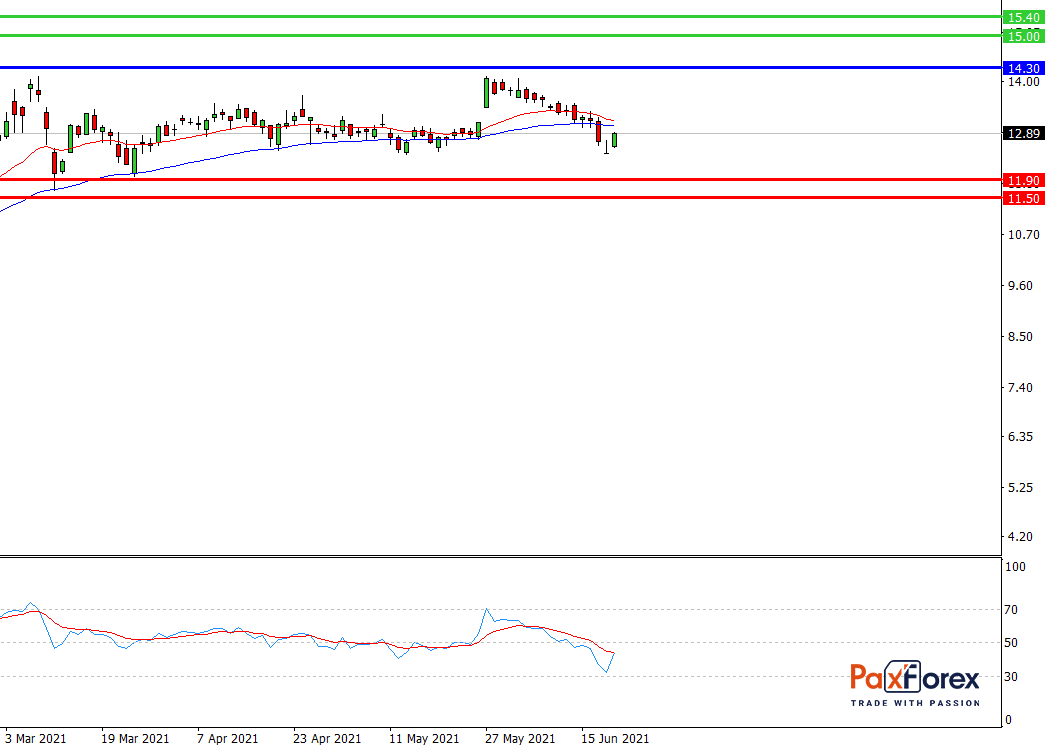

While the price is below 14.30, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 13.44

- Take Profit 1: 11.90

- Take Profit 2: 11.50

Alternative scenario:

If the level 14.30 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 14.30

- Take Profit 1: 15.00

- Take Profit 2: 15.40